US GAAP XBRL Taxonomy Missing Approximately 50% of Level 3 Text Blocks

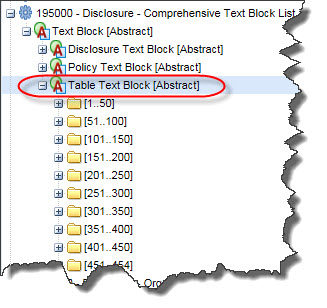

The US GAAP XBRL Taxonomy provides 454 Level 3 Text Blocks. In the taxonomy these are called [Table Text Block]s. These Text Blocks are used to provide human readable HTML for a specific disclosure. You can find a list of these Level 3 Text Blocks in the Comprehensive Text Block List in the US GAAP XBRL Taxonomy.

(Click on image to go to US GAAP XBRL Taxonomy)

(Click on image to go to US GAAP XBRL Taxonomy)

The US GAAP XBRL Taxonomy and SEC EFM use inconsistent terminology, so it is worth making sure we are on the same page here. What the US GAAP XBRL Taxonomy calls a "Disclosure Text Block", the SEC calls a "Level 1 Text Block" or a "Footnote as a Text Block". Level 2 Text Blocks are policies. Level 3 Text Blocks provide human readable HTML at the level of an individual disclosure. And finally, Level 4 Detail provides individual detailed facts for an individual disclosure. All this is explained in the SEC Edgar Filer Manual (EFM) section 6.7.12.

And so, the US GAAP XBRL Taxonomy says that there are 454 possible disclosures because they provide 454 Level 3 Text blocks ([Table Text Block]s).

Well, I went through the US GAAP XBRL Taxonomy and tried to identify each individual disclosure and I came up with about 957 total disclosures. That number includes a handful of statements, 129 Level 1 Text Blocks (Note Level), a handful of Level 2 Text Blocks (Policy Level), and a few odds-and-ends which really are not individual disclosures. As such, I will adjust the total number of true disclosures down to this approximate number: 807.

I will also point out that my list includes only disclosures for commercial and industrial companies. I am not including disclosures for banks, insurance companies, broker-dealers, and so on.

And so the US GAAP XBRL Taxonomy indicates that there are 454 disclosures, I can point out about 807. It is my guess that my list of 807 disclosures is off by between 50% and 100%. That is just an educated guess, hard to come up with an exact number without going through every public company filing and trying to identify every disclosure (which I am working on now). But my guess is based on work trying to determine all the different types of primary financial statements (what I call report frames, this document helps you understand report frames).

There is a relationship between the Level 3 Text Block and Level 4 Detail disclosures. Look at three examples which I created for fairly common disclosures:

- Inventory, Net: Roll up of the components of inventory.

- Property, plant and equipment components: Roll up of the components of PPE.

- Long-term debt maturities: Roll up of the maturities schedule of long-term debt.

Looking at rather uncommon disclosures also points out that text blocks are missing from the US GAAP XBRL Taxonomy. Here is an example:

- Capitalized Computer Software Roll Forward: Roll forward of capitalized computer software.

Looking at both the Level 3 Text Blocks and the Level 4 Detail for disclosures helps you understand if pieces are missing from the US GAAP XBRL Taxonomy.

Reader Comments