BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from April 5, 2015 - April 11, 2015

Nonsense-in-Nonsense-out: Representing Business Problem Domains Digitally

"This problem can be summed up by saying that computers are dumb beasts. Computers do not understand themselves, their programming or the intended interpretations of the representations that they manipulate. This fact has a number of implications."

As Andrew D. Spear points out in his paper Ontology for the Twenty First Century: An Introduction with Recommendations, we are awash in a sea of information. This sea of information will only get bigger, and bigger, and bigger.

If business problem domains such as financial reporting express the information about that business domain in terms that are vague, ambiguous, contradictory and unclear; then the dumb beasts (computers) will not be very helpful to us humans.

Overcoming the quality problems within this sea of information is not unique to XBRL-based financial information provided to the SEC by public companies.

The NPR story Sharing Patient Records Is Still A Digital Dilemma For Doctors points out a similar issue for electronic medical records. Mr. Spear's paper implies that the same problems exist in other domains in the sciences. Other problem domains, both business and science, likely have similar issues.

Business professionals need to understand knowledge engineering enough to be part of teams which create rigorous, clear, logical, coherent representations of business problem domains in machine-readable form. Such representations are perhaps new to business professionals. For example, the US GAAP XBRL Taxonomy which expresses parts of US GAAP used within a financial report are on the leading edge of business domains going digital.

But today many business professionals, such as accounting professionals, are having the wrong sorts of discussions. Many accountants are so wed to the past 100 years of paper-based and electronic paper (i.e. HTML, PDF) based financial reporting which is document-centric and presentation oriented that they cannot see the real opportunities offered by thinking more data-centric and information-centric thoughts.

Don't be part of the herd making the mistake of bringing too much baggage from the past into the new digital oriented future. Take a more balanced approach. Take the time to understand what the technology can and cannot achieve. Learn to employ new tools like a craftsman.

If you were around when electronic spreadsheetsreplaced paper-based spreadsheets, you had a glimpse of what is in store for financial reporting. Per that NPR story about spreadsheets 400,000 accountants lost their jobs because of the switch to electronic spreadsheets. On the other hand, 600,000 new jobs were created. Better jobs.

The same thing will happen as we transition to digital financial reporting. Remain relevant. Take the time to learn about knowledge engineering because the best way to predict the future is to help create it. Learn to create quality digital financial reports. Learn to ask good questions of software vendors.

Tame the dumb beast, avoid the nonsense. Stay afloat on the sea of information.

Imagine: Analytical Review at a Whole New Level

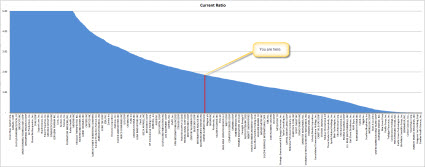

Imagine being able to do analytical review or benchmarking or analysis at a completely new level. Below is a protype I created in Excel of a chart which shows the current ratio (current assets / current liabilities) for every public company that reports a classified balance sheet:

One day analysis will be less about rekeying information into a spreadsheet and more about the analysis. Imagine being able to then click on any public company name and the balance sheet pops up. Imagine this for the hundreds if not thousands of data points, key ratios, etc.

Imagine having an analysis using information from this paper, A Data Mining Framework for Prevention and Detection of Financial Statement Fraud. In Table 1, they have 62 financial items or ratios. Heck, I have the information to compute 35 of those in my fundamental accounting concepts.

Think accounting quality model; Robocop.

Understanding Public Company XBRL-based Financial Report Quality

In a prior post I pointed out that the quality of public company XBRL-based financial filings doubled with respect to consistency with a set of fundamental accounting concept relations. Measurement is key attaining quality.

"Quality is never an accident; it is always the result of high intention, sincere effort, intelligent direction and skillful execution…."

- Will A. Foster, Business Executive

Arriving at 2014 Digital Financial Reporting All Stars: Summary walks you through how that quality is measured. This resource helps you understand what is necessary for a machine to read reported financial information and successfully make use of that information. The resource also helps to understand how to correct these quality issues.

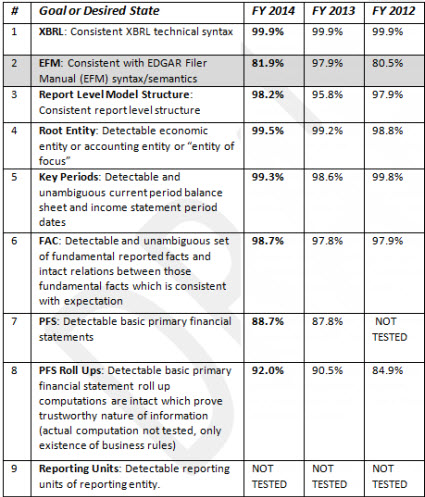

I call these steps the minimum criteria necessary to make use of XBRL-based reported financial information. This is a summary of those minimum criteria (also included in the document):

The document walks you through how consistent XBRL-based public company financial filings to the SEC are with these criteria and information which helps you better understand the details of each criteria.

The good news is that the quality of public company XBRL-based financial filings continue to increase. Overall, 3,356 or 50% of all such digital financial reports are consistent with these basic minimum criteria. What is even better is that another 1,729 are only 1 issue away from consistency with all these criteria. That would bring 75% of all filings consistent with all of these minimum criteria. Only 5 issues or less per stand between public company financial filing and 98.77% consistency with all of these minimum criteria.

As is said, if you cannot measure it you cannot control it.

While these minimum criteria are far from what is sufficient to make 100% of the information within public company XBRL-based digital financial reports; they are necessary. The minimum criteria is both a start and helps one understand the path to quality XBRL-based financial information and successful information reuse.

For more information useful in understanding and correcting these issues, please see this resouce.