BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from November 29, 2015 - December 5, 2015

Understanding Digital Distributed Ledgers

In a post a few days ago, I mentioned that someone was creating a "triple-entry accounting system". They point out three key pieces to that system:

- InterPlanetary File System (IPFS)

- Ethereum

- XBRL

Those three things might be "technologies" or "implementations of technologies". But I don't think that those are the pieces of the puzzle. Or, there may be more than three pieces. For example, Ethereum is one of many blockchain and other supporting technology implementations.

One of the fundamental pieces though is the idea of a digital mutual distributed ledger. (I have heard "distributed ledger" and "mutual distributed ledger" and "digital ledger" used interchangeably. I will use the term digital distributed ledger.)

So what is a digital distributed ledger? A digital distributed ledger is an indestructible and uneditable decentralized computer record, or ledger. It provides a full and complete history of transactions in that ledger. Ledgers can be as public and open or private and limited as the use case demands. Ledgers can be permissioned or permission-less in determining who can add new transactions. Different approaches can be used to determine how new transactions are authorized (proof-of-stake, proof-of-work, consensus, identity mechanisms) before they can update the ledger. Ledgers can be interlinked with one or more other ledgers.

The key innovation that enables computerized digital distributed ledgers is the blockchain technology. Blockchain technology is used to maintain what amounts to a continuously growing list of translational data records hardened against tampering and revision, even by operators, using advanced cryptography (basically, cryptographic mathematics). As Gabriel Tumlos of KPMG put it in his paper Blockchains, Distributed Ledgers in Finance and Accounting, "Blockchains introduced a trust-minimizing transactional platform that all but eliminates the need for a vulnerable third party and allows accounting systems to take their logical next step."

What can digital distributed ledgers be used for? This video mentions the following use cases:

- Regulatory records

- Delivery records

- Chain of custody

- Property titles

- Know your customer

- Digital rights management

- Loyalty management

- Motor insurance

- Proof of authenticity

- Account portability

- Anti-money laundering

- Peer-to-peer lending

- Personal insurance

- Corporate credit

- Trading records

Don't limit yourself by thinking that a "transaction" is an accounting transaction such as an invoice. While transactions can be recorded, so can events, circumstances, and other phenomenon that affect, say, a business during a period. That sounds a lot like the sort of information from a financial report. A report is a transaction. The "payload" of the transaction is the information in the report itself. XBRL-based digital general purpose financial reports, say to a regulator like the Securities and Exchange Commission, are really transactions that hold complex information structures about the financial condition and financial position of an economic entity.

What XBRL brings to the table is an ability to agree on and document the relations between the reported facts in the complex transactions we refer to as financial reports. But XBRL can also be used to make sure that smaller transactions that go into these ledgers adhere to agreed upon business rules. This keeps information within those digital distributed ledgers correct.

If digital distributed ledgers are used to their full potential, it could enable a fundamental shift in the way economic entities transact business with one another. How will this impact the role of accountants and auditors? Time will tell.

Here are some additional resources useful in understanding computerized digital distributed ledgers:

- How does the blockchain work?

- Demystifying Blockchain and Distributed Ledger Technology – Hype or Hero?

- Mutual distributed ledgers

- Unblock the shared economy - Growing trust in mutual distributed ledgers – such as the Blockchain technology underlying Bitcoin – will change financial services for the better: Three page concise overview of what mutual distributed ledgers do.

- The Digital ledger landscape: This is a 70 slide presentation that provides a lot of details about distributed ledgers.

- InterChainZ: Sharing Ledgers for Sharing Economies: This is a 5 minute video that explains distributed ledgers.

- Crash Course on Mutual Distributed Ledgers (BlockChains):

- Rubix, and initiative by Deloitte: Part of Rubix appears to be "blockchain as a service".

- How to Implement Block Chain and Distributed Insfrastructure in Financial Services: Blockchain’s and distributed ledger technology’s potential to make ledgers more transparent, trustworthy and efficient leads to suggestions that it can possibly revolutionize financial services. But applying the blockchain within each firm’s context is complicated, and it is as yet unclear what business needs, if any, the blockchain will truly resolve. Ernst & Young explains the blockchain’s potential to change financial services, explores possible applications and describes the issues worth considering when applying the technology.

- Distributed Ledger Technologies

- EY, Blockchain reaction: Tech Plans for Critical Mass

- Deloitte, Blockchain technology. A game changer in accounting?

- A brief history of blockchain

- Hyperledger, an enterprise blockchain

- Multichain, Open source private blockchain

- How bitcoin will disrupt accounting and auditing

- The Truth about Blockchain, Harvard Business Review

- Journal of Accountancy, Why CPAs need to get a grip on blockchain

- World Economic Forum, 5 key concepts for blockchain newbies

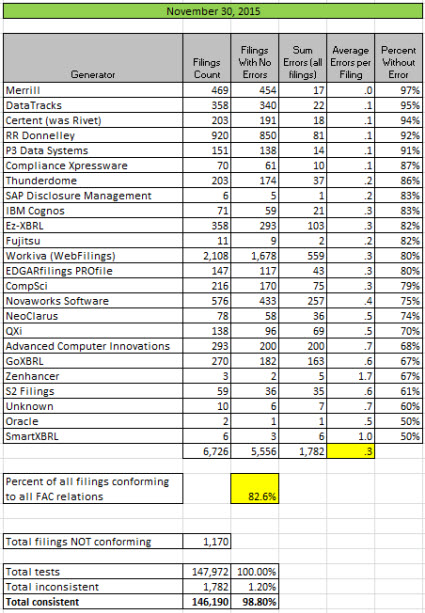

Public Company Quality Continues to Improve, 13 Generators above 80%

The quality of XBRL-based public company digital financial filings to the SEC continued to improve and some important milestones have been reached. As a reminder, this measure compares XBRL-based reports submitted to the SEC with approximately 22 basic, common sense fundamental accounting concept relations using an automated machine-based process. It is expected that 100% of all XBRL-based financial filings to the SEC would be consistent with all 22 basic, common sense accounting relations. Certain specific categories of filers have been removed such as "Funds and trusts" which have unique reporting practices and are not expected to follow these basic relations. The purpose of these tests is to determine the basic abilty of an automated machine-based process to make use of information in XBRL-based public company financial reports. These basic accounting relations consider 100% of the reporting styles of public companies.

There are three possible reasons for an inconsistency with one of the basic, common sense fundamental accounting concept relations:

- Filer error, where the filer represents a relation which is inconsistent with US GAAP. For example, one common error is to use the concept "us-gaap:IncomeLossFromContinuingOperations" to represent the line item "Operating Income (Loss)" in a financial report. The proper concept is "us-gaap:OperatingIncomeLoss".

- US GAAP XBRL Taxonomy error, where a filer cannot possibly represent information consistently because a concept is missing from the taxonomy. For example, the US GAAP XBRL Taxonomy does not have a concept to represent "Operating and nonoperating revenues". Therefore, filers must create an extension concept or use some inappropriate concept and automated processes may misinterpret reported information.

- Test metadata error, where the mapping rules or impute rules used to obtain information and test the relations between reported facts are inconsistent with US GAAP. For example, if a test disallows a relation that is allowed under US GAAP, this is a metadata error.

The column "Percent Without Error" in the table below indicates the percentage of a generaor's (software vendor or filing agent) filings which are completely consistent with expectations represented by the set of approximately 22 relations. For example, the first generator in the list "Merrill" created 469 XBRL-based financial filings which were submitted to the SEC, 454 of those contained no inconsistencies, and therefore 97% of the filings they created were completely consistent with what is expected by the 22 consistency tests.

Other important milestones include:

- 5 software vendors/filing agents have achieved 90% "Percent Without Error" or better.

- 13 software vendors/filing agents have achieved 80% "Percent Without Error" or better.

- 82.6% of all 6,726 XBRL-based financial filings to the SEC were completely consistent with all 22 basic common sense accounting relations.

- Total inconsistencies has dropped below 2,000 for the first time and now stands at 1,782 inconsistencies.

Summary of results by generator (software vendor/filing agent):

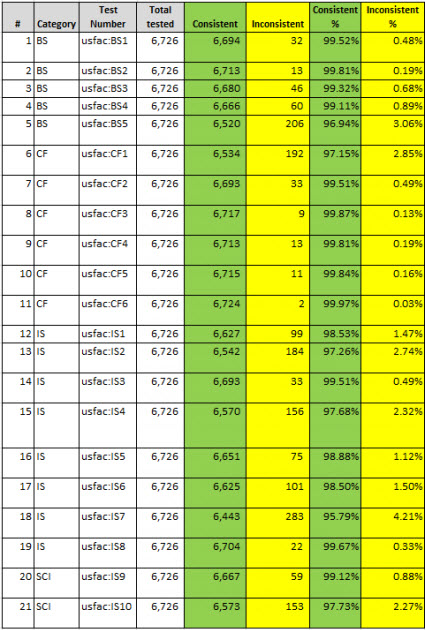

Summary of results by test:

(Click image for larger view which includes narrative describing each relation)

(Click image for larger view which includes narrative describing each relation)

Average consistency with each basic, common sense fundamental accounting concept relation and comparison of software vendor/filing agent with average: (Shows Merrill as compared to average)

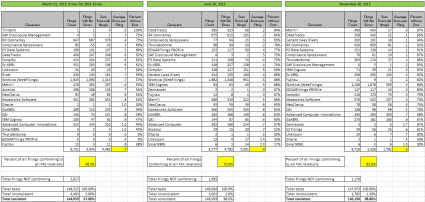

Comparison of information for March 31, 2015 (10-K for 2014), June 30, 2015 and November 30, 2015:

For more information or to obtain a complete set of test results, please contact me. The documents Arriving at 2014 Digital Financial Reporting All Stars: Summary and Understanding Minimum Processing Steps for Effective Use Of SEC XBRL Financial Filing Information, provides helpful information if you want to better understand the tests and testing process.

Again, great work to the software vendors, filing agents, and public companies who are blazing the digital financial reporting trail!

Previous results reported: October 31, 2015; September 30, 2015; August 31, 2015; July 31, 2015; June 30, 2015; May 29, 2015; April 1, 2015; November 29, 2014.

Triple-Entry Accounting System

This is interesting, triple-entry accounting system. That is part of ConsenSys' vision. Not sure what they mean by "triple-entry". Double-entry relates to balancing debits and credits.

Ethereum is hard to explain. ConsenSys explains the four pillers of etherium here. Ethereum uses the same sort of technology as bitcoin, blockchain. Wikipedia provides this explanation of ethereum:

Ethereum is a cryptocurrency platform and Turing-complete programming framework intended to allow a network of peers to administer their own stateful user-created smart contracts in the absence of central authority.

Read this blog post and you will understand why "Turing-complete" is important.

InterPlanetary File System is basically a distributed file system. Watch the demo here.

XBRL, well, read this blog if you want more information. Clearly XBRL Global Ledger will be a part of the "XBRL" piece of the puzzle. What they don't mention is the US GAAP and IFRS Financial Reporting XBRL taxonomies. Other taxonomies will likely be important, such as other reporting schemes, tax basis information, etc. And, of course, when information goes into the digital triple-entry accounting system, you will want to get some of the information out in the form of a structured digital financial report, not old fashioned unstructured reports.

Here is another paper on triple-entry accounting.

Is Digital Financial Reporting About to Cross the Chasm?

Crossing the Chasm, the book by Geoffrey Moore, points out that there is a chasm between the early adopters and the early majority customers when dealing with disruptive innovations like XBRL-enabled structured or digital financial reporting.

One of the big challenges a new technology has relates to having a complete product solution that will serve the market appropriately. There are different approaches to providing the essential functionality markets demand.

Strategies exist for crossing the chasm, for example here is a blog post by Product Strategy, What is the Chasm and How do I Cross It?, which outlines these essential strategies:

- Reduction in Scope (Niche Marketing) - focus resources on one target market and provide a complete solution to that niche.

- Quickly Capture the Lead Market Share - Be pragmatic, work with market leaders, choose technologies and approaches that will likely become industry standards.

- Alliances - Don't necessarily build the entire solution yourself but rather partner with others and create alliances to bring a complete solution to the market.

- Marketing Support - Creating the appropriate marketing materials that will support moving the pragmatists/early majority customers forward.

Is digital financial reporting about to cross the chasm? Perhaps it is, perhaps not. The actions of the pragmatists, that early majority, will dictate whether digital financial reporting is or is not crossing the chasm. But one thing is certain. Digital financial reporting will never cross the chasm if the products provided by software vendors do not work or do not provide functionality demanded by the market.

The Digital Financial Reporting Manifesto summarizes my views of where digital financial reporting is going and important information related to building software for serving the potential market.

Software vendors don't get to define what a complete solution looks like. The market defines that. Miss the mark and your product offering will fall short. A product offering that has missing pieces will not be useful to the market. If you don't understand these dynamics, go back and read Understanding the Law of Conservation of Complexity.

Digital financial reporting and a mandate to provide XBRL-based financial reports to a regulator like the SEC are not the same thing. They are related. But they are not the same.

Blind optimism will not cause digital financial reporting to cross the chasm. Arrogant ignorance will not keep digital financial reporting from crossing the chasm. Well-functioning software which provides the necessary and complete set of features will cause digital financial reporting to cross the chasm. The Digital Financial Reporting Manifesto provides many, many clues as to what that software must be able to do.

Ultimately, digital financial reporting will cross the chasm. That just makes sense. The question is which software vendors benefit most as this disruptive change unfolds.