BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from February 7, 2016 - February 13, 2016

Describing Systems Formally

Professional accountants need to understand the following information related to how to engineer systems so that they can better understand how to get the system of digital financial reporting to work correctly and as they desire it to work:

Aristotle is said to be the father of formal logic. Logic is a discipline of philosophy. Logic is the study of correct reasoning.

The notation of what we call elementary school arithmetic took centuries to develop. But today we take mathematics for granted.

Formal logic is the basis for mathematics. Mathematics is a formal system.

A formal system is defined as any well-defined system of abstract thought based on the model of mathematics. Of particular importance in describing systems is set theory. Basically, formal systems can be explained and proven to work or show system flaws and inconsistencies using the language of mathematics. Every formal system has some sort of formal language that explains that system. Every formal system can be tested to see if it works using a formal proof.

A theory is a tool for understanding, explaining, and making predictions about a system. A theory describes absolutes. A theory describes the principles by which a system operates. A theory can be right or a theory can be wrong; but a theory has one intent: to discover the essence of some system.

A theory is consistent if its theorems will never contradict each other. Inconsistent theories cannot have any model, as the same statement cannot be true and false on the same system. But a consistent theory forms a conceptual model which one can use to understand or describe the system. A conceptual model or framework helps to make conceptual distinctions and organize ideas.

Formal logic was consciously broken into two groups: first-order logic and higher-order logic. There is a reason for this. Systems based on first-order logic can be proven to be sound (all provable theory statements are true in all models) and complete (all theory statements which are true in all models are provable using proof theory).

Basically, higher-order logics are less well-behaved than those of first-order logic. They are less predictable and therefore less reliable and they are significantly harder to implement using computers.

That is why computer systems are generally based on first-order logic.

This is all well understood by good software engineers. A finite-state machine is a model for designing computer systems that should never break. Finite-state machines are Turing machines. These machines tend to not "freeze" or "fail" or fail to return an answer. The Chomsky Hierarchy categories languages into groups that provide different levels of reliability. Type-0, type-1, type-2, and type-3 languages all are Turing machines.

How does all this relate to professional accountants?

First, bear in mind that you don't need to be a nuclear engineer to plug an appliance which uses electricity. You don't need to be an automotive engineer to understand how to start and drive a car. You don't need to be a hydraulics engineer to take a drink of water from a faucet. But you do want good engineers to build those systems so the systems don't break.

A digital financial report is a formal system. A system such as the digital financial report needs to be described precisely so that professional accountants understand how the system works so that the system can be used effectively and so the system works how the system was intended to work. This blog post related to Z Notation, which is used to describe systems precisely, helps one understand that systems need to be described precisely and that tools exist to achieve that end.

Deliberate, rigorous, conscious, skillful execution is preferable to haphazard, negligent, unconscious, inept execution if you want to be sure something works.

Another way to describe a system is to create a theory and then prove the theory. Financial Report Semantics and Dynamics Theory is such a theory and proof. Digital financial reports can be tested for consistency against a documented theory. Consistencies with the theory help prove the theory. Inconsistencies with the theory can be detected in the system and the reason for the inconsistency determined.

If you understand how formal logic works all this makes sense. If you don't understand formal logic, please watch this video which is a crash course in formal logic. If you don't understand knowledge engineering and want more detailed information, please read Knowledge Engineering Basics for Accounting Professionals. It lays out important ideas that need to be considered when thinking about digital financial reports.

Systems need to work properly to be useful. That is what engineering is all about, making things work properly so that they are useful. Luck and magic have nothing to do with making systems work. Conscious, deliberate, and skillful attention to the details of a system contribute to making a system work.

It would be very hard to argue that XBRL-based financial reports to the SEC are a resounding failure. Likewise, it would be hard to argue that XBRL-based financial reports to the SEC are an overwhelming success given the quality problems that exist with those digital financial reports today. What one can do given the right tools is to gather empirical evidence about how the system is working and compare that evidence to how one thinks the system should work.

This sort of testing helps improve systems.

Two Interesting Phenomenon Related to XBRL-Based Public Company Filings

There are two interesting phenomenon related to XBRL-based public company financial filings submitted to the SEC. Here is a summary of the two phenomenon which I will explain in further detail and show examples of below and what the phenomenon means as I see it:

- XBRL-based filings can go from correct, to incorrect, and then back to correct from period to period per some unknown random pattern.

- Basic, fundamental accounting concept relations appears to be dependent on the creation software used to create a financial report.

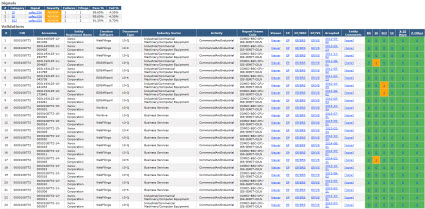

So let us dig into these phenomenon. To start off, click on the image below which shows a summary of all the XBRL-based financial filings submitted to the SEC by Microsoft and a summary of the consistency of each financial report to a set of basic, fundamental accounting concept relations.

As you look at that summary, first be aware that this summary and all of the other summaries are not in order by date. So, you need to look at the column "Accepted" and consider the date to see the precise ordering of the submitted reports.

The order does not really matter for what I want to point out about the Microsoft filings. Notice how the vast, vast majority of the columns are GREEN and you have a few cells that are ORANGE. The GREEN indicates consistency with the set of fundamental accounting concept relations and the ORANGE indicates inconsistencies exist. The exact same fundamental accounting concept relations consistency checks were applied to all the filings.

So ask yourself a question: Why would the XBRL-based financial report of Microsoft be consistent in one period but NOT be consistent in the two periods in that list where their the color ORANGE indicates and inconsistency?

Well, the answer to the question is: Errors creep into the filing. Someone perhaps changed a concept they should not have changed or entered a number incorrectly. But the bottom line is that some sort of inconsistency was induced.

Errors creeping into filings is not unique to Microsoft. Here is another filer, Xerox:

Pretty much the same story as Microsoft except that they have a few more inconsistencies in their set of 23 filings to the SEC. But there is one additional difference. Go back and look at Microsoft and notice that the creation software lists "Edgar Online" and "RR Donnelley". RR Donnelley purchased Edgar Online, so the creator is the same really. But now have another look at Xerox and notice they did change the creation software they were using. (Also note that WebFilings changed their name to Workiva, so that really is not a change in creation software.)

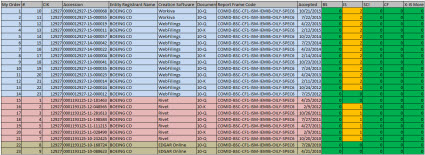

OK, so now look at this set of XBRL-based financial filings submitted to the SEC by Boeing. Again, please take note that the DATES of the submission are NOT IN THE CORRECT ORDER! I will walk you through the list below.

Boeing submitted their first two filings using EDGAR Online and those filings (#9, #8) were 100% consistent with a set of fundamental accounting concept relations. They switched to Rivet and one inconsistency was introduced (#7). That same one inconsistency existed for the next five filing periods (#6 through #2), and then the inconsistency was corrected (#1) and the Boeing XBRL-based financial filing again had no inconsistencies. Then, Boeing switched to WebFilings/Workiva which consistent with the last Rivet created filing was 100% consistent with the same set of fundamental accounting concept relations (#23). But then one inconsistency was introduced (#22) and then two inconsistencies were introduced and persisted (#21 through #10).

To help you see this better, I took the report above and reorganized it by the Accepted date. I also colorized the report by creation software used:

So basically, inconsistencies appear and disappear and there seems to be some correlation between the creation software used and the inconsistencies detected. The Boeing report started out correct, Rivet introduced one inconsistency. Rivet ultimately fixed that inconsistency. WebFiling/Workiva submitted the report with no inconsistencies after the handoff from Rivet. Then Boeing introduced one inconsistency and then a second inconsistency, and that is where they stand as of today.

(FOOTNOTE: Boeing filed their 2015 10-K on February 10, 2016 and corrected one of the two inconsistencies in their financial filing. Also, I got XBRL CLoud to adjsut their report and now it sorts things better. See the updated comparison of Boeing's filings here.)

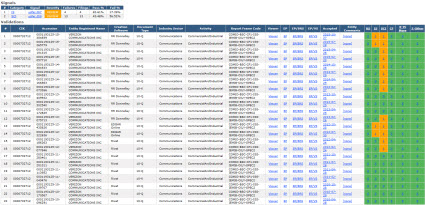

This phenomenon is not unique to Boeing. Lots of filers have this pattern. Here is Verizon:

I did not point out the periods or creation software, you can figure that out for Verizon.

And there are plenty of other examples of this phenomenon.

Clearly, which creation software is being used should have no impact what-so-ever of the accounting concepts selected and used within a financial report. Clearly, it should not be the case that different creation software products use different sets of rules for verifying the correctness of the reports. Clearly, consistency checks are not a one-time thing and rather need to be performed each time an XBRL-based financial report is submitted to the SEC.

Well, at least that is my view. What do you think?

If you look through the screen shots above you will also notice that the industry sector changes (driven by the SIC code used) and that even the company name used changes.

Conceptulizing Digital Financial Reporting

I creating a web page that helps people conceptualize digital financial reporting. I don't have this exactly where I want yet, but I am getting closer and closer. If anyone has any ideas as to how to improve this please sent them my way.

What I am trying to accomplish is to lay out the pieces of XBRL-based digital financial reporting so that the average professional accountant or auditor can get their heads around why a digital alternative to a general purpose financial report is a useful thing.

Ultimately I want to turn this into a video. People seem to find the video How XBRL Works helpful as there are nearly 40,000 views of that video.