BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from March 13, 2016 - March 19, 2016

Introduction to the Multidimensional Model for Professional Accountants

The law of conservation of complexity states:

"Every application has an inherent amount of irreducible complexity. The only question is: Who will have to deal with it-the user, the application developer, or the platform developer?"

I put together a video and a slide deck that helps professional accountants understand the multidimensional model. Understanding the multidimensional model is important if you want to correctly understand digital financial reports. Understanding the model also helps you understand how to look at software to see if the creators of that software chose to have you deal with complexity of if they dealt with complexity for you.

Just like an electronic spreadsheet has a model (workbook, spreadsheet, row, column, cell); a digital financial report has a model. Here are the high-level pieces of a digital financial report:

- Fact: A fact defines a single, observable, reportable piece of information contained within a financial report, or fact value, contextualized for unambiguous interpretation or analysis by one or more distinguishing characteristics. Facts can be numbers, text, or prose.

- Characteristic: A characteristic describes a fact (a characteristic is a property of a fact). A characteristic provides information necessary to describe a fact and distinguish one fact from another fact. A fact may have one or many distinguishing characteristics.

- Fact Table: A fact table is a set of facts which go together for some specific reason. All the facts in a fact table share the same characteristics.

- Relation: A relation is how one thing in a business report is or can be related to some other thing in a business report. These relations are often called business rules. There are three primary types of relations (others can exist):

- Whole-part: something composed exactly of their parts and nothing else; the sum of the parts is equal to the whole (roll up).

- Is-a: descriptive and differentiates one type or class of thing from some different type or class of thing; but the things do not add up to a whole.

- Computational business rule: Other types of computational business rules can exist such as “Beginning balance + changes = Ending Balance” (roll forward) or “Net income (loss) / Weighted average shares = Earnings per share”.

- Grain: Grain is the level of depth of information or granularity. The lowest level of granularity is the actual transaction, event, circumstance, or other phenomenon represented in a financial report.

Believe it or not, but 100% of XBRL-based public company financial reports fit into that rather simple model. A handful of software vendors have implemented that model. It is very easy to create something that is complicated. It is a lot harder to create something that is simple.

I will continue to improve and otherwise tune this model. If you have feedback or suggestions, please send them along. The next step is for me to improve the document Understanding Blocks, Slots, Templates, and Examplars. That explains the next layer of the model.

Understanding Important Connection Between Global LEI, XBRL Taxonomies, Conceptual Frameworks

There is an effort to create a global legal entity identifier. There are very important connections between all of the following things and it is important to understand that interconnectedness:

- Global Legal Entity Identifier, Parts of a Legal Entity

- XBRL Financial Reporting Taxonomies

- Financial Reporting Conceptual Frameworks

I mentioned the paper, An analysis of fundamental concepts in the conceptual framework using ontology technologies, written by Marthinus Cornelius Gerber, Aurona Jacoba Gerber, Alta van der Merwe; in a prior blog post. The paper points out then when textual manuscripts are used to describe things in a conceptual framework the descriptions can be vague, inconsistent or ambiguous. Machine-readable ontologies offer better percision. The paper states the following in the conclusion:

"From the first version of the artefact construction of an ontology-based formal language for the Conceptual Framework, there is evidence that the construction of a formal language using ontology technologies could play a substantial role to enhance the quality, clarity and re-usability of the Conceptual Framework definitions. Ontology statements are explicit and precise, and consequences of assertions can be exposed using reasoning technologies."

Here is an example of where ontologies can help. In another blog post and in a document I wrote, Differentiating Alternatives from Ambiguity, I pointed out specific inconsistencies that exist in US GAAP which were pointed out by the Wiley GAAP 2011 (page 46 to 48). In that resource, the authors make the following statement:

"Since these requirements do not utilize a common taxonomy, the following explanation will be referenced throughout Wiley GAAP."

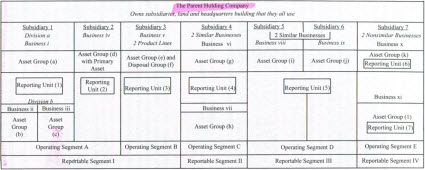

And then, they provide this graphic below that shows their resolution to the inconsistencies in US GAAP:

In today's digital world, we need this type of information in machine-readable form and we need this information to be represented correctly and precisely for machines such as computers to help us perform tasks we need them to perform.

To achieve this end, professional accountants need to learn a few things about knowledge engineering basics. This will enable professional accountants to both understand why we need this information in machine-readable form, enable them to work with knowledge engineers and information technology professionals to express this information correctly, and enable professional accountants to both maintain this information and add even more information to the base machine-readable representations.

Digital financial reporting is coming. Public companies, software vendors, and the U.S. Securities and Exchange Commission are perfecting digital financial reporting. Getting important standard identifiers like the global legal entity identifier right, getting the breakdown of entities right, and getting other such machine-readable information right is important.

(The link to LEI.INFO is https://lei.info)

Understanding the Importance of Standard Identifiers

Computers are machines. They are tools. Computers have the four basic strengths:

- Storage: Computers can store tremendous amounts of information reliably and efficiently.

- Retrieval: Computers can retrieve tremendous amounts of information reliably and efficiently.

- Repetitive processing: Computers can process stored information reliably and efficiently, mechanically repeating the same process over and over.

- Ubiquitous information distribution: Computers can make information instantly accessible to individuals and more importantly other machine-based processes anywhere on the planet in real time via the internet, simultaneously to all individuals.

To harness the power offered by these useful machines, four major obstacles need to be overcome:

- Business professional idiosyncrasies: Different business professionals use different terminologies to refer to exactly the same thing.

- Information technology idiosyncrasies: Information technology professionals use different technology options , techniques , and formats to encode information and store exactly the same information.

- Inconsistent domain understanding of and technology’s limitations in expressing interconnections: Information is not just a long list of facts, but rather these facts are logically interconnected and generally used within sets which can be dynamic and used one way by one business professional and some other way by another business professional or by the same business professional at some different point in time. These relations are many times more detailed and complex than the typical computer database can handle. Business professionals sometimes do not understand that certain relations even exist.

- Computers are dumb beasts: Computers don’t understand themselves, the programs they run, or the information that they work with. Computers are “dumb beasts”. What computers do can sometimes seem magical. But in reality, computers are only as smart as the metadata they are given to work with, the programs that humans create, and the data that exists in databases that the computers work with. (Andrew D. Spear, Ontology for the Twenty First Century: An Introduction with Recommendations)

Standard taxonomies, such as the US GAAP Financial Reporting XBRL Taxonomy, help to overcome those obstacles. Computers need to be able to grab onto a piece of information and standard taxonomies provide these "identifiers" or "handles" to grab onto or "addresses" for each specific piece of information.

In this age of "digital", business professionals need to understand how to create good taxonomies that provide these important identifiers. All too often, business professionals tend to confuse the following three distinct, different things:

- Notion, idea, phenomenon: something that exists in reality.

- Name: identifies some notion/idea/phenomenon.

- Preferred label: alternative ways used to refer to name.

The importance of quality identifies or "handles" or ways of addressing information correctly is hard to over-state. In an article they published, Barcodes of Finance, Allan D. Grody and Peter J. Hughes, explains the importance of these sorts of identifiers.

"Unique and standard identifiers, and standard data sets accessible by computer means through a tagging convention for both is the pre-requisite for financial stability objectives of the regulators. It is also a pre-requisite for fulfilling the promise of real-time straight-through-processing, significant infrastructure cost reduction and operational risk mitigation made to the industry by regulators."

In a webinar (about an hour in length) of the same name, Barcodes of Finance, Allan goes into details related to an initiative to create a global legal entity identifier scheme. The presentation helps you understand the importance of these identifiers and some of the work that is going on to create these identifiers for finance.

More information: