BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from April 22, 2018 - April 28, 2018

Understanding Accounting Process Automation

The terms "accounting process automation" and "robotic process automation" and "machine intelligence" and "artificial intelligence" seem to have very different meanings to different people.

Here is a list of vendors that seem to provide process automation:

- Blackline - Accounting Process Automation

- Blackline - Finance Controls Automation

- Docuphase - Accounting Automation, Robotic Accounting Information

- Kofax - Robotic Process Automation, Finance and Accounting

- Winpro- Robotics and Congitive Automation

- IBM - Robotic Process Automation

- IBM - Automation of Month End Closing

- Blueprism - Robotic Process Automation

- Oracle - XBRL stack

- SAP - XBRL stack (uses Fujitsu)

- IBM - XBRL stack

- Altova - XBRL stack

- Arelle - XBRL stack (open source)

- XBRLQuery - XBRL stack (open source)

This video showsa really good example of what most people seem to be calling "RPA" or robotic process automation. What RPA seems to be is a "bot" performing specific detailed tasks by "scraping" or "reading" information from a web page and then "copying and pasting" fields from a web site or application to another. It is like "recording" a macro of a routine task which is then repeated over and over by the robot/macro rather than performed by a human.

So, what RPA seems to be is similar to what a business rules management system does plus some sort of user interface to "scrap" or "read" information from one system and put it into another. Neither business rules management systems nor RPA seem to have an over-arching conceptual model which can be leveaged.

These seem software vendors seem to provide similar capabilities, but they take a different approach. Each of these uses the semantic web approach and does provide the ability to create a conceptual model which can be leveraged by business rules:

- TopQuadrant- TopBraid, Data Governance

- Coherent Knowledge - Egro Suite

- Cognitum - Fluent Editor

Basically, RPA is a computer performing a specific set of routine tasks in order, replacing a human that performed these mundane routine tasks.

So, I can see the benefit of RPA. I have a different vision for automation. I am taking the expert systems approach. I would not consider RPA an expert system, it is just stringing tasks together. And I am not using "deep learning" or "machine learning" commonly associated with artificial intelligence.

These different approaches each have different capabilities. The pros and cons of each approach are not currently clear to me. What is clear is that different companies are trying to figue out the best way to make automation work.

##########

Risks of Artificial Intelligence

This TedX video, The Real Reason to be Afraid of Artificial Intelligence, by Peter Haas helps you understand some things you want to keep in mind when thinking about artificial intelligence. The problem is not the artificial intelligence software. The problem is people's ignorance of how these tools actually work.

If you want to understand, I would invite you to read the document Computer Empathy that I put together. Tools such as artificial intelligence are great, but they deserve to be evaluated with a healthy skepticism. Be a leader, not a follower.

########################

- Elon Musk on the Risks of AI (July 2017)

- But then, the problem with over-automation (April 2018)

Pretty High Quality XBRL-based Financial Reports of Public Companies

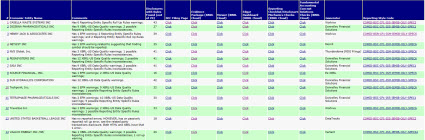

Below is a link to a web page that provides a list of 14 pretty high quality XBRL-based financial reports of public companies. (Or you can click here.)

Each of the 14 XBRL-based financial reports were evaluated using techniques summarized in the document Blueprint for Creating Zero-Defect XBRL-based Digital Financial Reports.

I am comparing the validation results obtained from different software validation tools, this is a work in progress.

For each of these 14 XBRL-based financial filings of public companies, the following is provided: (the links are all for the FIRST filing)

- Link to the XBRL instance

- Link to the SEC filing page (where you can get the HTML, XBRL, or whatever else was submitted to the SEC)

- Link to the XBRL Cloud Evidence Package (human readable information about the report)

- Link to the XBRL Cloud Viewer

- Link to the XBRL Cloud Edgar Dashboard (which shows inconsistencies for submitted filings)

- Link to the Reporting Checklist/Disclosure Mechanics results (shows validation results)

- Link to the Fundamental Accounting Concept Relations results (shows validation results)

- Link to information about the Reporting Style of the company

Also, links to all the machine-readable rules that were used to validate the reporting checklist, disclosure mechanics, and fundamental accounting concept relations rules are provided on the summary document. These rules have been implemented in two different software applications, XBRL Cloud which is commercially available software and Pesseract which is a working proof of concept used to test the feasibility of some ideas.

If I can find other publicly available information about these filings, then I will link to that information to this web page.

More information coming soon.