BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from July 8, 2018 - July 14, 2018

Updated List of IFRS Filings

I have updated my set of IFRS-based financial reports that have been submitted to the SEC. I am using these filings to create IFRS metadata including the reporting styles. Here is a list of what I have:

- Human readable list of the now 406 IFRS filings.

- Machine readable RSS feed of those same 406 IFRS filings.

- IFRS Reporting Styles Analysis.

- ZIP archive containing Excel spreadsheets that prove the reporting styles.

- List of the current reporting styles. (Details)

- IFRS Reporting Styles Summary. (Overview)

- List of manually organized and classified statements and disclosures.

- ZIP archive with XBRL taxonomy model structure and roll up relations.

- ZIP archive of XBRL instances.

- Roll up query tool. (New, work in progress)

- Roll up query tool linked to reporting style mappings. (New, work in progress)

- Analysis of errors in one reporting style

Basically, I added about 90 form 40-F filings that use IFRS of Canadian companies. Stay tuned! More to come.

Here are some updates to the reporting styles:

- This summary and detailed information is the most current.

- Those reporting style rules (#1) are 100% synchronized between XBRL Cloud, Pesseract, and the Excel versions and tested to be sure they are consistent.

- This set of Excel spreadsheets in the ZIP file have the rules for the classified balance sheet (BSC), typical cash flow statement (CF1), and the most common income statement (SPEC6).

- I made most of the adjustments requested by others:

- Commitments and contingencies was REMOVED from all balance sheets.

- Temporary equity was REMOVED from all balance sheets.

- Many of the codes such as BSC, BSU, SPEC6, CF1 are now included in the XBRL taxonomy and related documentation.

- I removed the network and rules related to Preferred Stock Dividends and Other Adjustments, and Net Income (Loss) available to Common that are not applicable to IFRS.

- I removed other stuff associated with US GAAP that is not applicable to IFRS

- I fixed the issue related to the Revenues concepts being in the wrong order.

- I fixed the issue related to "ifrs-full:OperatingExpense".

- I added the 2018 IFRS taxonomy.

- I had two separate creation tools for the "controlled natural language" format and the "XBRL Formula" XPath 2.0 rules format. Now this is ONE tool. (i.e. doing things now takes half the time).

- Here are all the rules I currently have in both XBRL Formula (XPath 2.0) format and the Controlled Natural Language (i.e. Excel-ish type) format: (note the LINKS to the actual XBRL Formulas)

- Here are all the networks.

- Here are all the fundamental accounting concepts.

- Here are the mappings.

- Here are the fundamental accounting concept relations in presentation form.

- And here is the PROOF that all this works (I will update this empirical evidence of actual filings as I add new reporting styles)

Like I said, stay tuned. If you don't understand why I am doing all this, you may want to consider reading this document.

Enhancing your Digital Skills

Professional accountants and other business leaders will need to enhance their "digital skills" in order to be efficient at accounting, reporting, auditing, and analysis in a digital environment.

Allan Grody, in his article, Banking could use more leaders with STEM skills, points out the importance for those in leadership positions to become conversant in the important details about the technologies they will inevitably employ:

"It's important that those at the front end of this information - legislators, regulators and financial executives - become conversant in these skills, lest the back-end stumbles over meaning and intent and, in some cases, declares it impossible to be implemented."

While those in leadership positions don't need to have a deep understanding of math or computer programming; they do need to have the capacity to ask good probing questions and be able to have a meaningful conversation about the digital construction materials those that they lead are working with. Leaders should be able to question and challenge how their direct reports are overseeing the implementation digital tools that will be used to perform work using algorithms, metadata, conceptual models, and other tools, techniques, and processes.

Don't be an information barbarian. Leaders have a responsibility to acquire these "digital skills" that allow them to understand how accounting, reporting, auditing, and analysis work in the digital age; ultimately your industry or your customers hold leaders to a higher standard.

But what skills do you need?

STEM (science, technology, engineering, and math) is a very general description. "Learn to code" is a hysteria, which likewise is a very general description and it is simply misguided to think that everyone should be a programmer. Simply understanding "technology" is too broad and general to be helpful.

Understanding the specifics of how computers work will help you understand how to employ these very useful tools for your work. The document Computer Empathy strives to provide you with very specific details of what you need to learn with enough information to help you understand why you should learn it. That document should provide you with a good theory, framework , and principles to help you not only survive, but to thrive in a digital environment.

ESMA Field Test Information, Great Information for Testing

I mentioned in another postthe field test of the ESEF (European Single Electronic Format). Here is some additional information.

This is the set of 22 companies that participated in the ESEF field test. I created an RSS feed for these 22 companies. Not sure why the ESMA did not do that, it is kind of standard practice to provide a machine-readable version of the set of filings.

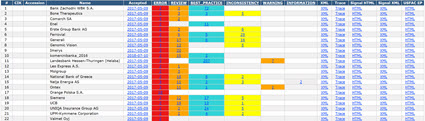

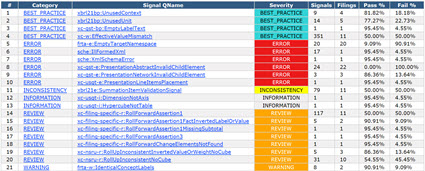

I ran all 22 of these filings through validation using XBRL Cloud and the following are the validation results:

By ESMA filer:

By Error/Inconsistency message:

There are a lot of errors, but the vast majority of errors fall into one category which is called "InvalidXhtmlBodyContent". Basically, the filer is not representing their [Text Block]s correctly, violating the Inline XBRL specification. One of the filings would not even load, I am pretty sure that filing was violating the Taxonomy Package Specification which dictates how the ZIP archive is formatted. Could be wrong about that, still trying to figure that out but that is what I speculate is going on.

So, these 22 filings add to my set of IFRS filings that I am testing. I am creating the fundamental accounting concept relations continuity cross check validation for IFRS with the help of a handful of other accountants. I am also working on validating the disclosures. I have the framework all up and running, I just need to create more metadata to match what I have for US GAAP.

If you are still trying to understand why I am going through all this effort, read this document.

Just for the heck of it I tried to create an XBRL instance using the Taxonomy Package ZIP format. Here it is. It worked!

Recalibration of Expectations as to AI Capabilities can be Painful and Costly

It is really, really hard to figure out if the claims people make about artificial intelligence (AI) will come to pass. This article, Self-driving cars are headed toward an AI roadblock, highlights 2015 predictions about when self-driving cars would be on the road. Per those predictions, we should be seeing more driverless cars than we are seeing.

So, what is the problem? In a word: quality. Consider the following excerpt from the above article:

But the dream of a fully autonomous car may be further than we realize. There’s growing concern among AI experts that it may be years, if not decades, before self-driving systems can reliably avoid accidents. As self-trained systems grapple with the chaos of the real world, experts like NYU’s Gary Marcus are bracing for a painful recalibration in expectations, a correction sometimes called “AI winter.” That delay could have disastrous consequences for companies banking on self-driving technology, putting full autonomy out of reach for an entire generation.

How do you evaluate the claims and predictions people pushing technology make? The answer is understanding the details. That is why documents such as Computer Empathy are important. Today the world is full of people making predicts and claims but there are fewer that are actually delivering the goods. If you really want to evaluate the predictions and claims of the snake oil salesmen trying to separate you from your money; then pay attention to the details.

It really is that simple. It may not be easy if you have not been paying attention, you might have some catching up to do.

Don't get me wrong. AI will work. The question is what are the true capabilities. Me, I am focusing on the easy end of the spectrum of AI functionallity, expert systems. Expert systems is already a proven technology.