BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from July 15, 2018 - July 21, 2018

Easing Into the Next Layer of Validation

Reporting styles break financial reports into patterns of reporting styles. I have reporting styles for US GAAP and IFRS. Reporting styles organize fundamental accounting concepts into different allowed relations that appear in financial reports. I don't make the reporting styles up, I simply identify the patterns of reporting styles within US GAAP and IFRS reports that have been submitted to the SEC.

I verify the fundamental accounting concept relations per each reporting style each quarter for both US GAAP and IFRS as of last quarter.

I am now going one layer deeper within reports, what concepts are used within roll ups to the fundamental accounting concepts.

So, consider this reporting style: COMID-BSC-CF1-ISM-IEMIB-OILY-SPEC6. This same style is used in US GAAP and in IFRS. The model structure is essentially identical. There are some minor differences but for all practical purposes, they are the same.

Here are the mappings of the fundamental accounting concepts to the US GAAP and IFRS XBRL Taxonomy concepts: US GAAP | IFRS.

If you notice those mappings there is a link for all the XBRL concepts, US GAAP or IFRS. For example, us-gaap:Assets and ifrs-full:Assets have links. Click on the link and you will be taken to a web page that shows you how SEC filers are using those concepts relative to other concepts.

So, for example, if you click on us-gaap:Assetsyou see the 532 different concepts that public compainies used as line items that contribute to the total "us-gaap:Assets" in SEC filings. Note that this list includes 100% of the companies that use the COMID-BSC-CF1-ISM-IEMIB-OILY-SPEC6 reporting style. Here is the same information for ifrs-full:Assets. There are 270 different concepts that are used within roll ups of "ifrs-full:Assets". Now, for IFRS I am using all 339 filings. Currently I am experimenting to see what gives me the based information. It seems like doing the breakdowns by reporting style is best.

I also created a web service that provides this information for US GAAP and IFRS. That can be useful to those creating reports. I am not going to go into detail on this.

So, I am finding some interesting things. Consider the roll up of the components of concept Gross Profit. Here that is for US GAAP and for IFRS. If you look at either of those breakdowns of concepts you see the same thing for US GAAP and for IFRS. You see that most reports contain "Revenues" and "Cost of Revenues", which you would expect, and then you see pretty much odds-and-ends being reported.

Now, I have to do some additional analysis to figure out exactly what I am seeing. I think I am seeing some reporting inconsistencies, some missing taxonomy concepts, and errors filers are making creating extension concept which they really should be be creating.

Here are some clear errors. The US GAAP XBRL Taxonomy has a concept us-gaap:NoncurrentAssets. It also has the concept us-gaap:AssetsNoncurrent. Those concepts mean two different things. I think what is going on is that a few filers are providing detailed breakdowns of us-gaap:NoncurrentAssets in their geographic area disclosure.

Here are some clear errors:

- Cost of revenue included in operating expenses: If you look at the total us-gaap:OperatingExpensesyou will see the concepts "us-gaap:CostOfRevenue" and "us-gaap:CostOfServicesDirectLabor" and "us-gaap:CostOfServicesDepreciationAndAmortization" among other DIRECT operating expenses included in the total "us-gaap:OperatingExpenses" which represents INDIRECT operating expenses. That is clearly an error. If a filer is reporting DIRECT and INDIRECT expenses together, the concept "us-gaap:CostsAndExpenses" should be used which includes both direct and indirect expenses.

- Inappropriate extension concepts: If you search on us-gaap:AssetsCurrentand you look at the list you see "none:Inventory", "mpaa:NetInventory", "smp:FIFOInventoryNet", "emkr:InventoryCurrent", "dpm:OtherCurrentAssets"; all of these are clearly inappropriate extension concepts.

- Inappropriate use of commitments and contingencies: As I understand it, the line item "Comitments and contingencies" is a US GAAP line item and never used in IFRS. Yet, if you search the total ifrs-full:EquityAndLiabilitiesyou see filers using concepts "bce:CommitmentsAndContingencies1", "emitf:CommitmentsContingenciesLiensAndCollaterals", "forty:CommitmentAndContingencies", "iag:CommitmentsAndContingencies1", "abx:CommitmentandContingencies1", "nept:CommitmentsAndContingentLiabilities", "oncyf:CommitmentsAndContingencies1", "qbmi:IfrsCommitmentsAndContingencies", "umc:CommitmentsAndContingencies1"; either (a) these are all errors or (b) the IFRS XBRL Taxonomy is wrong and needs to include this concept and some accountants that think that this is NOT allowed are mistaken and this line item is allowed on the balance sheet.

If you find some interesting errors when you fiddle with this tool please let me or the SEC or ESMA or FASB or IASB know.

This PDF walks you through a presentation of this information.

Leveraging Poka-yoke to Build Better Software

Poka-yoke (not to be confused with the Hawaiian raw fish salad, poke) is a technique used to prevent mistakes through smarter design. Poka-yoke is a Japanese term that means "mistake-proofing". A poka-yoke is any mechanism consciously added to a process that helps an equipment operator avoid mistakes. Its purpose is to eliminate defects by preventing, correcting, or drawing attention to human errors as the errors occur.

For example, consider the graphic below. You want someone to plug the plug into the receptacle such that positive and negative of the plug and receptacle match up. Inadvertently reversing this would have catastrophic consequences. In the top part of the graphic notice that it is possible to make a mistake but in the bottom part of the graphic a mistake would be impossible because of the size differences in the positive and negative receptacle and plug.

(Image from Process Exam, Six Sigma Tools - Poka-yoke)

(Image from Process Exam, Six Sigma Tools - Poka-yoke)

Poka-yoke is a Lean Six Sigma technique. You can use techniques such as this to build better software. My MBA is in these sorts of quality control techniques. At the time these were called "World Class Manufacturing Techniques". Today people call these techniques "Lean" or "Six Sigma" or "Lean Six Sigma". While Lean Six Sigma was developed by the manufacturing sector, these techniques are applicable to literally any system.

In the document Putting the Expertise into XBRL-based Knowledge Based Systems for Creating Financial Reports, Hamed Mousavi and I explain how we are leveraging things like poka-yoke, patterns, compound objects, and other techniques to create an expert system for creating financial reports. That software we are creating is part of the modern finance platform which, we believe, will replace the old school approaches for creating financial reports.

If you read the document Computer Empathy you will recognize how dumb computers are but also what it takes to get computers to reliably perform work for you.

An expert system for creating financial reports is a pretty novel idea, I believe. Time will tell if we can make this work. There is a tremendous amount of complexity that is required to be coordinated to pull this off appropriately. We believe that the modern finance platform will not only disrupt, but will significantly transform accounting, reporting, auditing, and analysis. Time will tell whether we are right or whether we are wrong.

Some people (ok...well, at least one person) call accounting "history's sexiest subject". I don't really know if it is sexy, but it is certainly interesting. Digital distributed ledgers, triple-entry accounting, artificial intelligence, digital financial reports; what a great time to be an accountant if you understand what is going on.

Don't quite understand? Well, start by reading Computer Empathy. Don't be sold a bill of goods by the snake oil salesmen!

The Modern Finance Platform

I mentioned that old school financial report creation processes can be inefficient and error prone and that these processes should be change. But how should these processes be changed?

BlackLine has one of the best explanations of what the modern finance platform will look like. BlackLine uses the term "smart close". Their smart close appears to be SAP specific. Here is BlackLine's description:

The Modern Finance Platform

BlackLine builds solutions that modernize the finance and accounting function to empower greater productivity and detect accounting errors before they become problems. BlackLine products work in unison to eliminate manual spreadsheet-dependent processes prone to human error. BlackLine Account Reconciliations automates and standardizes the reconciliation process, and natively integrates with other BlackLine products to help manage every element of reconciliations and the financial close. Streamlining account reconciliations helps ensure accurate and efficient accounting activities, free from manual, error-prone practices. BlackLine is the only provider that offers a unified cloud platform supporting the entire close-to-disclose process and the leader in Enhanced Finance Controls and Automation software. BlackLine enables clients to move away from out-of-date practices and help finance and accounting professionals work smarter, more efficiently, and accurately. Clients around the world use BlackLine. BlackLine’s cloud platform unifies the experience of more than 196,000+ people around the world as they accurately, securely, and efficiently execute critical accounting tasks from reconciliations and journals to intercompany settlement and the financial close.

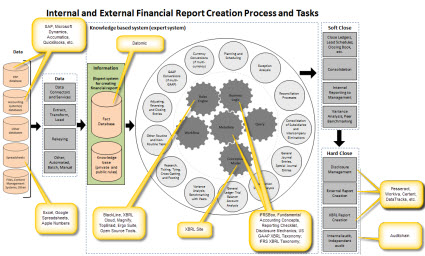

As I menstioned in the document Computer Empathy, more tasks of both the internal and external financial report creation processes will be automated. Rather than humans doing all the work, teams of humans assisted by machines (i.e. software) will collaborate to create financial reports. Humans will focus on the sorts of things they do best; machines will focus on the sorts of things they do best.

So, what is the process? What are the tasks that need to be performed? What software is available? I have been nuturing this graphic along for about six months which tries to explain the tasks within the process of creating a financial report. Here is that graphic (click image for a larger view):

If you think about how you might implement accounting process automation one of the first things you will realize is that you have to use some sort of technical syntax in these processes. XBRL is an excellent choice. I show you how you can do this in my Guide to Implementing Robotic Finance. Now, XBRL is not the only choice. The semantic web stack is a viable alternative. You do need some sort of a logic framework.

To be honest, I do not clearly understand the pros and cons of the semantic web stack as contrast to the XBRL stack. Frankly, I really don't think it matters which technical stack you choose. The power of the logic framework does matter. The more powerful the logic, the more work that can be automated.

Don't understand all of this? You are not alone. Many business professionals need to enhance their digital skills. What the heck is a digital mirror world? And what is triple-entry accounting? Or, digital distributed ledgers? What are the risks of artificial intelligence? It does not seem that artificial intelligence is working for self-driving cars; why should we believe it will work for finanancial reporting?

These are all excellent questions. And all of these questions have answers.

Accounting, reporting, auditing, and analysis in a digital environment will be here sooner than you might think! Don't be an information barbarian. The quality standards of financial reporting are extremely high. Software vendors that cannot maintain quality will not succeed. Low quality is simply a non-starter.

How do you build a modern finance platform? This document General Ledger Trial Balance to External Financial Report helps you understand the pieces of that puzzle.

Stay tuned for more information.