BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from April 26, 2020 - May 2, 2020

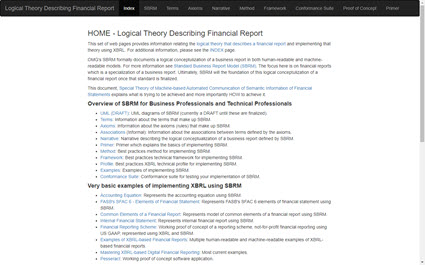

Logical Theory Describing Financial Report

A financial report is a logical system that can be described and explained using a logical theory. In this fourth industrial revolution being able to understand and explain logical systems to each other and to machine-based processes.

The Logical Theory Describing Financial Report is a consolidation and re-synthesis of multiple separate resources that I had but am pulling together and better organizing and synchronizing with the OMG Standard Business Report Model (SBRM). You can get to this logical theory here.

I am trying to simplify, simplify, simplify. If you have any requests, feedback, or other comments please don't hesitate to give me a shout. If you don't understand why this is important, I would invite you to check out this background information.

Why go through all this effort? This is what it takes to make digital financial reporting work reliably and effectively. How are you going to get something like smart regulation to work? Magic?

Best Practices Based XBRL Taxonomy that Uses Extension

A best practice is a method or technique that has been generally accepted as superior to any other known alternatives because it produces results that are superior to those achieved by other means or because it has become a standard way of doing things.

For the past 10 years I have been diligently working to perfect XBRL-based financial reporting when XBRL’s extensibility is used such as for the US GAAP and IFRS financial reporting schemes. The objective was to figure out what was causing quality problems and address those issues. What I have done was to take all the best practices that produced the desired result and avoid practices that were causing problems, and to create a working proof of concept that incorporates all of those best practices. The result is this working example XBRL taxonomy plus a repository of XBRL instances that are used to test and verify everything is working as expected. Here is that working proof of concept:

- Not-for-Profit XBRL Taxonomy (Working proof of concept)

That working proof of concept was not created in isolation. This is not the only approach to creating XBRL taxonomies that have other objectives (i.e. where extensibility is not employed). This web page has the complete set of incremental XBRL taxonomies that I have created to figure out what the end result (the URL above) should look like. This includes specific enhancements to both the US GAAP and IFRS XBRL Taxonomies that make them work exactly like the working proof of concept referenced above. Here is that supporting information:

All of this information has extensive documentation so that others can understand both the big picture and the details. Happy to answer any questions or take any feedback that would improve this working proof of concept even more.

FERC

The XBRL taxonomy for the Federal Energy Regulatory Commission (FERC) can be found here. There are about 650 companies that file reports to FERC using XBRL. There are about 11 different types of forms that could be filed.

You can look at the FERC taxonomies here.

FERC is not using extensions. Taxonomies essentially follow the structure of each form. Currently they have about 10 forms. Each form has schedules. Every schedule has a hypercube (they use the term Table). Each reported fact is associated to at least one hypercube.

Virtuous Cycle

When a system is working right, it creates a virtuous cycle.

The terms virtuous cycle and vicious cycle refer to complex chains of events that reinforce themselves through a feedback loop.

- A virtuous cycle has favorable results.

- A vicious cycle has detrimental results.

The Financial Accounting Foundation (FAF) uses the notion of a virtuous cycle and feedback loop to show the value of quality accounting standards and financial information that is clear, concise, comparable, relevant and representationally faithful:

The Financial Accounting Standards Board (FASB) uses the notion of a virtuous cycle to point out the value of technology to investors:

Here is another virtuous cycle to consider: a proper functioning financial report logical system. Here is what I mean.

I created a prototype XBRL taxonomy for financial reporting by a not-for-profit organization. My intension was to create everything that is necessary to help me make sure I created the report correctly. Rather than using a "pick list" type of approach that the US GAAP and IFRS XBRL taxonomies use; I used a model based approach. I considered all the dynamics that impact a financial report logical system.

What I found is that the system created in that manner provides a virtuous cycle, a feedback loop, that helps make defining XBRL taxonomies, creating reports, verifying reports, and extracting information from reports all work more effectively.

Rather than viewing these tasks as individual silos; if viewed as a system all this becomes quite obvious.

As authors Gerald C. Kane, Anh Nguyen Phillips, Jonathan R. Copulsky, and Garth R. Andrus point out in their book The Technology Fallacy, it is a myth that technology is behind digital transformation. People are behind such transformations. The authors define digital maturity as follows:

Digital maturity is primarily about people and the realization that effective digital transformation involves changes to organizational dynamics and how work gets done.

The technology and know-how exists to make XBRL-based digital financial reporting work effectively. The question is does the will exist. It really would not take much to turn the existing vicious cycle of quality problems related to XBRL-based financial reports submitted to the SEC into a virtuous cycle.

The question is not "if" this virtuous cycle will ever be created, it is more a matter of "when" and "who" will be the first.

This YouTube video, Virtuous Cycle, provides a bit more detail should you be interested.