BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from March 7, 2021 - March 13, 2021

Accounting Evolved from Physical Objects to Digital

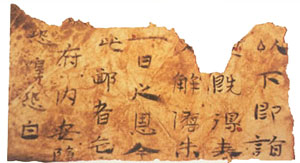

Paper has had a good run, some 1,900 years. Paper was invented in China around 100 AD. The rudimentary technology was constantly improved over its life span. But that long life span has created a "paper mentality" that accountants need to set aside. We need to escape from the imaginary boundaries created by 1,900 years of working with paper. We need to create new habits.

But paper was not the first media for representing financial information. Accounting has changed before and accounting, and will, surly change again. Accounting existed in well before writing, having been invented somewhere between 5,000 and 10,000 years ago. Before writing was invented, accounting was performed using physical objects (tokens).

Writing was first developed around 3200 B.C. by Sumerian scribes in the ancient city-state of Uruk, in present-day Iraq, as a means of recording accounting transactions. The form of writing was called cuneiform. Cuneiform writing was created by using a reed stylus to make wedge-shaped indentations in clay tablets. Stone was also used if you wanted a more permanent record I guess.

Clay tablets did not last long as an accounting media. Clay was bulky, heavy, and had a tendency to break. Papyrus was used as a writing material as early as 3,000 B.C. in ancient Egypt. Papyrus was produced exclusively in Egypt where the papyrus plant grew; but papyrus was exported throughout the classical world, and was the most popular writing material for the ancient Greeks and Romans.

Papyrus continued to be used for commercial purposes to some extent until around 1100 A.D. It continues to be used today by artisans.

Paper was used as the primary media of accounting, reporting, auditing, and analysis until about 1970 or 1980 A.D. Getting a copy of a financial statement in the 1930s, 1940s, and 1950s involved physical technologies such as carbon paper (remember that!).

In those early days, public company financial reports submitted to the U.S. Securities and Exchange Commission were submitted on paper and were available only by paper copy. In the 1970's, the SEC contracted with a company to create and distribute microfiche copies to designated SEC "public reference rooms" in specific locations in the US. (They seemed to have these rooms in Chicago and New York.)

Obtaining copies of these documents was cumbersome and expensive. An individual had to either make hard copies one page at a time in the public reference rooms or order copies from service bureaus whom in turn had to make and sell hard copies as requested.

Immediate access to reported financial information was virtually impossible except at extremely high cost.

In 1984 (before the internet even existed), the SEC started the EDGAR (Electronic Data Gathering Analysis and Retrieval) pilot program. The purpose of the pilot was to create an electronically accessible database providing a more efficient and less costly method whereby the investing public could get the information it needed. (Lessons learned from the SEC EDGAR pilot project.)

Since 1996, all reporting companies have been required to file electronically. This new method of filing has enormous implications for the investment community because once a document is filed, the information is immediately available to anyone.

In 2008, the SEC Chairman Christopher Cox unveiled the successor to the agency’s 1980s-era EDGAR database. The new system, IDEA (Interactive Data Electronic Applications) was based on a completely new architecture being built from the ground up. The idea behind IDEA was for the SEC to transition from collecting "forms" and "documents" to collecting information. That information would be freely available to investors and analysts. EDGAR was moving from "electronic" to "digital".

The U.S. SEC was not the first to transition to digital and it will not be the last either. Today there are 180 projects around the world in 60 different companies.

Today, there is an opportunity to create a Universal Digital Financial Reporting Framework. Not only will the report itself be digital, the infrastructure of financial accounting, reporting, auditing, and analysis will also transition to digital. Accounting will become more modern.

The general purpose financial report itself and the media used to represent that general purpose financial report are two different things.

How absurd is it to put accounting information (transactions) into a database, print a report from that database, send that report to someone else, and then they rekey the information back into another database that is used for financial analysis? We have the technology to improve this process.

Accountants need to adapt to changes created by the Fourth Industrial Revolution. Not adapting has consequences.

Configure Models, Skip Coding

These guys have it right. Configure models, skip coding. Here is a list of advantages. Here is another company that seems to get it.

Data Fabric

Learned something new: Data fabric. Comes from this article, Data Fabrics: The Killer Use Case for Knowledge Graphs. That article defines data fabric as:

"A Data Fabric is (a data management architecture that) orchestrates disparate data sources intelligently and securely in a self-service and automated manner, leveraging data platforms such as data lakes, Hadoop, Spark, in-memory, data warehouse, and NoSQL to deliver a unified, trusted, and comprehensive real-time view of customer and business data across the enterprise."

Seems like that might work for financial accounting, reporting, and audit information also although that might already be included in the "business data".

So, why limit this to "the enterprise". The definitions the article has for knowledge graph does the same thing. Why can't a data fabric be for an entire supply chain???

For example, it seems that all the XBRL-based reports plus their supporting XBRL taxonomies (models) submitted to the U.S. Securities and Exchange Commission constitute a data fabric.

Personally, seems like this should be called an "information fabric" or a "knowledge fabric".

2020 Was The “Year of the Knowledge Graph”

2020 was the "year of the Knowledge Graph". As I have pointed out, XBRL is a knowledge graph devised in 1999, long before Google came up with the term "knowledge graph" in 2012. Prolog, RDF, SQL, GQL are also all declarative approaches to representing knowledge graphs.

The take away from the article above is:

For knowledge graph technologies to have a broader impact, we shouldn’t be dogmatic about a term that was invented by Google’s product marketing department. We shouldn’t insist on adoption of standardized markup schemes or the creation of a centralized graph database because that didn’t work for the Semantic Web, and it won’t work for the corporate web.

If we instead listen to the problems information workers have, spend a day shadowing them in their jobs, and design solutions that integrate knowledge-tech in a lightweight way to automate tedium, then we have a shot at solving a larger set of problems, to benefit more of society.

Linked to the article above is this excellent article by some folks from Deloitte in Germany: Wisdom of Enterprise Knowledge Graphs. If you read nothing else, read the CONCLUSION of that document. But the entire document is worth reading.

Have a look at what you can do with a knowledge graph in this 3 minute YouTube video. They are using KgBase. Accountants (and others) can learn about knowledge graphs for free.

Remember, an XBRL-based digital financial report is a knowledge graph.

####################################

What is Small Data (YouTube Video)

Generating Small Data can Solve Big Problems (TedTalk)

The New York Times: The Robots Are Coming for Phil in Accounting

A The New York Times article, The Robots Are Coming for Phil in Accounting, makes the following statement:

“With R.P.A., you can build a bot that costs $10,000 a year and take out two to four humans.”

Accounting bots are no joking matter. An EY survey says 53% of accounting tasks can be handled by robots in the next three years. Another article puts accounting and booking in the top 5 of jobs to be replaced. An Oxford University study finds that 47% of all jobs in the United States are at risk. That same study (page 69) says that there is a 94% probability that accountants and auditors will lose their jobs.

But the bots are only the beginning. Big, big changes are in store for the entire global financial reporting platform. That includes accounting, reporting, auditing, and analysis. The move to modern accounting is already happening.

Makes one wonder about the value of a degree in accounting in its current instantiation. Accounting education really needs to change ASAP. Perhaps it is time for new leadership in the accounting profession; the current leadership appears to be asleep at the wheel. "Objects in mirror are closer than they appear."