BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Are accountants the last hope for the world's ecosystems?

The Guardian article by Jonathan Watts, Are accountants the last hope for the world's ecosystems?, says:

So it has come to this. The global biodiversity crisis is so severe that brilliant scientists, political leaders, eco-warriors, and religious gurus can no longer save us from ourselves. The military are powerless. But there may be one last hope for life on earth: accountants.

Wow. Eco-accounting. Well, as is said..."If you cannot measure it, you cannot control it."

The story ends with, "Accountants as agents of revolution? Now there's a thought."

Become the accountant who changed the world.

###############################

Auditchain Protocol Launches on Testnet

Auditchain has announced the release of its testnet. This is one step closer to a commercial launch and availability of Auditchain.

Auditchain Labs AG, the developer of the world’s first decentralised accounting, financial reporting, audit and analysis virtual machine for assurance and disclosure, has launched its network client “Pacioli” on the Goerli Ethereum test network.

I have mentioned Pacioli in the past, specifically the Pacioli Power User Tool. Pacioli is a specialization of PROLOG for use in financial reporting. Basically, you take the general functionality of PROLOG, add to that a global standard logical model of a business report and financial report, and then the power of PROLOG is easy for accountants to make use of.

Be sure to read up on NFT basics. Auditchain says they will be paying accountants royalties:

Accountants. reporting managers, CFOs, controllers, and financial analysts will now be able to use the Auditchain Protocol to write, validate and own logic-based accounting and disclosure control “assets” that substantially automate accounting, financial reporting, audit and analysis processes using a global standard syntax on the Auditchain Protocol.

Non-fungible tokens representing the controls are issued to the curators, and royalties are allocated between curators and validators who audit and provide assurance that the machine-readable logic works correctly. Royalties will be allocated in AUDT, the settlement and Auditchain Protocol governance token.

Want to join a process control NFT creation study group? Ping me. Here is a document I am creating to help accountants create NFTs, Process Control NFT Creation for Novices.

ACCZIOM appears to be using Auditchain already.

You will want to keep watching Auditchain. Be an accountant that changed the world.

Here are a few additional articles about Auditchain and what they are doing:

- Auditchain Will Use NFTs For Accounting And Disclosure Controls

- AuditChain pioneers a system for Accounting and Disclosure Control Development

- Can Bitcoin style validation solve financial statement fraud?

- AUDITCHAIN IS DISRUPTING A $550 BILLION A YEAR INDUSTRY

- Auditchain One Page Explanation

Keep an eye on what is going on here.

De Facto Good Practices Industry Standard Digital Financial Report Metamodel

A de facto good practices industry standard digital general purpose financial report metamodel is emerging.

By de facto I mean that while no one has actually published one specific document explaining that standard; practices that exist in reality, even though they are not officially recognized; standards do, in fact, exist.

By best practices I mean that a method or technique that has been generally accepted as superior to any other known alternatives because it produces results that are superior to those achieved by other means or because it has become a standard way of doing things. Sometimes people are offended by the term "best practices". A more politically acceptable term that means effectively the same thing is "good practices". The point is; they work better than existing known alternatives.

By industry standard I mean the normal or ordinary or typical or average manner of doing things within an industry. It is how an industry governs itself.

By digital I mean BOTH readable and understandable by machine based processes. PDF and HTML are technically readable by software applications...but they are not understood by that software. XBRL is machine readable and can be made machine understandable if the right machine readable information is provided. As a by product, digital is also readable and understandable by humans.

By general purpose financial report I mean a high-fidelity, high-resolution, high-quality information exchange mechanism used by an economic entity to report the financial position, financial performance, and liquidity of that entity. Typically general purpose financial reports are provided to parties that are external to that organization (i.e. external financial reports including policies, notes, and qualitative information).

By metamodel I mean a model that is followed by all report models. For example; Microsoft, Apple, Google, Amazon, Facebook, and Salesforce each have a report model that is used to represent their individual financial reports. But ALL of those reports follow the same common, standard SEC report metamodel. The ESMA also provides a standard report metamodel.

And so what is the basis for this de facto good practices industry standard digital financial report metamodel? Here is a list:

- US GAAP Financial Reporting Taxonomy Architecture: One of the very first general purpose financial report implementations was created by the U.S. Securities and Exchange Commission. XBRL US was charged with creating the XBRL taxonomy to support that endeavor. To achieve this, XBRL US created this architecture document. Mantenance of this taxonomy architecture was transitioned to the FASB. The original document published by XBRL US is better, but this document will do the trick.

- SEC's EDGAR Filer Manual: In support of XBRL-based filings of financial reports to the SEC, the SEC created this manual. It has some excellent information; but it also leaves a lot out. The result: quality problems. Bad practices that are allowed by the SEC are not allowed in the de facto good practices metamodel. But, we take all the good practices.

- European Single Electronic Format (ESEF) Manual: In support of XBRL-based filings of financial reports to the ESMA, the ESMA created this manual. Again, some excellent information; but it also leaves a lot out. The ESMA and SEC are more similar than they are different.

- XBRL International Open Information Model 1.0 (OIM): Useful information, but tending to be too technical in nature; the OIM helps one understand that a semantic model of a business report is necessary.

- OMG's Standard Business Report Model (SBRM): While not yet published, OMG is creating a logical conceptualization of a business report. There are drafts provided in UML.

- Logical Theory Describing Financial Report: This logical theory which provides axioms, theorems, and a world view was created by reverse engineering XBRL-based reports that have been submitted to the SEC and is the basis for the Standard Business Report Model. This is effectively the model I have implemented.

All of the above information was synthesized and implemented, generally with my assistance, by the following commercial software companies, working proof of concepts, and prototype software applications:

- XBRL Cloud: (Commercial software) Implemented about 95% of the metamodel. This can best be seen in their CleanScore Evidence Package. (Here is the evidence package, fundamental accounting concepts, and disclosure mechanics and reporting checklist validation for the 2017 Microsoft 10-K; Similar examples are provided here for Apple, Google, Amazon, Facebook, and Salesforce)

- 28msec/NTT Data: (Commercial software) Several years ago I helped 28msec implement XBRL in their database. They learned a lot, I also learned a lot and used that to help tune my model. Apparently 28msec was sold to NTT Data. 28msec implemented about 60% of the model.

- Pesseract: (working prototype) Pesseract is a working proof of concept that implements about 95% of the metamodel.

- Auditchain's Pacioli: (Commercial software) Pacioli is by far the best and most complete implementation of this metamodel. I have performed rigirous testing using multiple financial reporting schemes. The current interface is the GUI used for testing Pacioli; a new interface is scheduled to be put on and additional enhancements are planed as I understand it.

- Luca: (Pre-release commercial software) Cloud-based Luca is pre-release software for creating XBRL-based reports. The interface of Luca explains the fundamental report model very well. I don't know how to quantify how much this supports; it supports 100% of the report model but none of the supplemental validation stuff yet.

- Open source Microsoft Access Database: (prototype) This is a working prototype that I created.

- ACCIZOM: (Commercial software) I don't know a lot about ACCIZOM yet, but they say they support this metamodel and the Seattle Method. I have not yet confirmed that, but will.

- SCI: (Commercial software) SCI is building an expert system for creating financial reports and is leveraging the Seattle Method.

- Awther: (Commercial software) Awther is building an expert system for creating financial reports and is leveraging the Seattle Method.

OMG and XBRL International both call for only two implementations to support their standards. I have seven. Technically, you could say that the 30 software vendors that support XBRL-based reporting support this model because SEC filings support the model. Now, many of those SEC XBRL-based reports are inconsistent with the logic of the metamodel, but that is a problem in the creation of the reports, not the metamodel. Same can be said for ESMA reports, but I don't have any data on those yet.

It would be fantastic if a formal ISO standard for digital financial reports was created. Alternatively, be nice if XBRL International or OMG issued such a formal standard. For now, de facto is best I can do.

Try out my method, which I call the Seattle Method, for leveraging this industry standard for implementing automation within the enterprise.

Be the Accountant Who Changed the World

National Public Radio (NPR) published a story, The Accountant Who Changed the World, that discusses how Luca Pacioli ran across double-entry accounting in a math book he wrote.

Luca Pacioli was a monk, magician and lover of numbers. He discovered this special bookkeeping in Venice and was intrigued by it. In 1494, he wrote a huge math encyclopedia and included an instructional section on double-entry bookkeeping.

That article seems to be based on information from a book written by Jane Gleeson-White, Double Entry: How the Merchants of Venice Created Modern Finance.

Luca Pacioli seems to have "discovered" the special bookkeeping method in Venice, but as I understand it that method was invented in Florence by banks. But Pacioli seems to have perfected and documented the best practices used in Venice which became known as the Venetian Method. The article says he was a monk, a magician, and a lover of numbers that hung out with the likes of Leonardo da Vinci! How cool is that!!! (I have actually visited the house where Luca Pacioli lived in Venice.)

Note the subtitle of Gleeson-White's book, particularly the phrase "Created Modern Finance". Modern finance seems to have been relatively stuck at that same point in many ways. Well, we are in the midst of another big change in my opinion, "biggest in 500 years" one accountant called this. Someone else said triple-entry accounting is the most important invention in 500 years. Others call this the move to "modern accounting".

Let me tell you the story of another accountant. About 20 years ago he worked at the regional public accounting firm Knight, Vale, & Gregory based in Tacoma, Washington. (He got his initial start with Price Waterhouse.) He read a book about XML, with some help of a friend and colleague named Wayne Harding, also a CPA, reached out to the AICPA, the AICPA bought into the idea and created what became XBRL International, and now there are 180 projects in 60 countries that leverage XBRL.

This is not the end of the story. This is the beginning of the story.

We need to leverage the technologies that have been developed over the past 50 years and avoid possible pitfalls as we modernize accounting. We need to break down accounting into its essence as we think about how to build it back better. We need a good theory, principles, framework, and a method; digital financial reporting needs to work as good as or better than current financial reporting practices.

Financial reports are knowledge graphs. Financial reports have always been knowledge graphs! What changed is that we have moved from an industrial economy to an information economy. Financial accounting, reporting, auditing, and analysis need to pivot; to transition. The tools that are causing things like "information overload" and ever increasing "complexity" are also the tools that can be used to solve those problems.

Double-entry accounting enabled organizations to grow into the large multi-national organizations of today. But now; audit is broken. Reporting is a kludge. Accounting needs modernization. Financial instrtuments are unnecessarily complex.

Lost? Not sure what to do? I don't have all the answers. But, I have a lot of incredibly good questions that deserve answers. If you are not sure where to start, I recommend reading the Seattle Method. That will get you to my best information.

Be the accountant who changed the world!

Updated Luca Tutorial Documentation, Learn about Digital Financial Reports

Want to learn about XBRL-based digital general purpose financial reports? Working through the Luca tutorials that I have created might be very helpful.

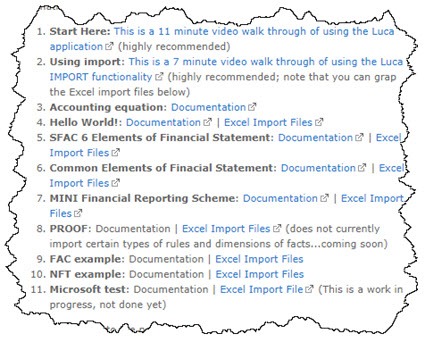

I have made significant updates to the documentation related to how to use the cloud-based version of Luca which is an XBRL-based financial report creation tool. To get to the tutorials, go to this blog post in the list you see below:

The tutorials are not yet complete; I will make updates as the Luca functionality improves. In particular, you might very well find the Accounting Equation, SFAC 6, Common Elements of Financial Statements, and MINI Financial Reporting Scheme quite useful if you want to understand XBRL-based digital general purpose financial reports.

The tutorials are not yet complete; I will make updates as the Luca functionality improves. In particular, you might very well find the Accounting Equation, SFAC 6, Common Elements of Financial Statements, and MINI Financial Reporting Scheme quite useful if you want to understand XBRL-based digital general purpose financial reports.

Digital financial reporting is here to stay. It could be looked as an "incremental innovation", just another tool accountants have available. It could be looked at as something that will revolutionize accounting, reporting, auditing, and analysis, a "disruptive innovation". Learn about the tool to figure out which. Either way you look at it, digital financial reporting is here to stay.