Perfected Financial Report Disclosure Viewer Prototype

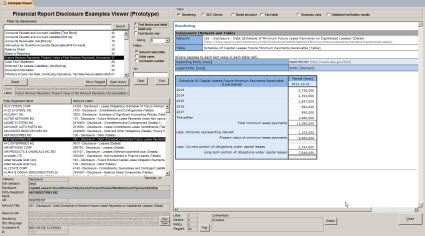

I have perfected my financial report disclosure viewer. Here is a screen shot of the primary interface of the application; it helps to understand the application:

Click image to view larger version

Click image to view larger version

This video will walk you through the basics of the prototype.

Let me explain the prototype and the idea. The first thing to understand is that this is the tip of a much bigger iceberg. There are so many ways that this can be expanded. I will not go into those. I will only cover the basics.

So today, when an accountant creates an external financial report (primary financial statements and all the disclosures) they use reference materials in the forms of books like the best selling AICPA Best Practices in Presentation and Disclosure, the Wiley US GAAP Guide, the PPC Guide to Preparing Financial Statements, the accounting standards codification (ASC) web site maybe, disclosure checklists, existing financial statements as examples, and other resources.

These resources are very typically separate resources, information silos. The information silos are not centered on the users of these resources. Rather they tend to be centered on the creator of the resource. Some organizations such as Big 4 CPA firms have internal proprietary resources which may fit together better and they are centered around the CPA firm.

Keep in the back of your mind that I am not talking about public companies, of which there are about 10,000 who create and submit financial statements to the SEC. There are millions and millions of private companies who also create US GAAP based financial statements. There are hundreds of thousands of licensed CPAs and non-licensed accountants who create those financial statements. Disclosures of SEC filers are examples for those private companies also.

What if you could pull all these resources together and center them around the accountant creating a financial statement?

Well, that is the fundamental idea of what I have done.

First off I have a collection of extremely high quality financial statements. Why are they of such high quality? Because some company filed their financial report with the US Securities and Exchange Commission. Now, these financial statements are not perfect but there is no better set of financial statements in existence than these and they are all available free for the taking complements of the SEC via their EDGAR system.

In the past the only way to get at the information is to manually go through the filings one-by-one. That has now changed. You can query those financial statements because the information is structured using XBRL as opposed to unstructured information which is not queriable at all. If you don't understand this, watch this video How XBRL Works. This video, Querying Disclosures of SEC Financial Filings, helps you understand how the querying actually works via another working prototype application that I have created to do just that.

Second, in order to work with the individual disclosures of SEC XBRL financial filings, you have to give each disclosure a name and be able to refer to the disclosure. Basically, go ask a computer to go get something you have to tell the computer what to get. Here is an older list of those disclosures so you can see what I am talking about. I have similar metadata for the topics to help organize the long list of disclosures.

Finally, you need to be able to "glue" the disclosures to actual SEC XBRL financial filings. That is what this metadata does: http://www.xbrlsite.com/2014/US-GAAP/rss.xml.

And so the viewer application uses the list of disclosures, the report components of SEC XBRL financial filings which contain disclosures and the map between the two to provide the functionality which you see in the screen shot and the video above.

The hardest part of all this is getting the high-quality renderings. To get those I simply use the XBRL Cloud Edgar Report Information web service. This blog post explains that and how to use the web service.

And so what does all this mean? Paradigm shift. If you are trying to understand all this in the context of how external financial reporting is achieved today, you will likely miss the point. But if you look at what external financial report could be like, you will realize that:

- It is possible to weave the supply chain together in ways never achievable before.

- Accountants with expertise can make money in new ways by expressing that expertise in forms readable by software applications.

- Software used to create financial reports can leverage this metadata and help other accountants create financial reports. Think about how much Microsoft Word helps you create a financial report. It knows nothing about financial reports or financial reporting.

- It is possible to query across financial reports and work with the individual pieces of a report, not the entire report. But, you can always get to the complete context of any individual disclosure.

- Querying for specific disclosures is not only possible, but actually quite easy. For example, "give me a list of every company that reported extraordinary items of income or expense" can be achieved in seconds.

In essence the "supply chain" or the "network of those creating financial reports" can communicate using this metadata and these structured SEC XBRL financial filings. If you have not read it yet, it might be a good idea to check out the Disclosure Management article published by PWC.

All this will help make it less costly to create external financial reports (whether you generate XBRL or not), the quality of the financial reports will be higher, and it will take less time to create the reports. Once accountants experience these efficiencies they will start to realize that the same ideas can be applied to internal financial reporting.

By the way; any accountants or software developers who want to understand how to use this metadata please contact me. I can point you in the right direction.

Reader Comments