Global Master Plan for XBRL-based Digital Financial Reporting

We are in the midst of a great upheaval. As Levine and van Pelt point out in their book, "we are in a time of profound, unrelenting, and accelerating change of a magnitude and scope unequaled since the Industrial Revolution." We are transitioning from an analog, industrial economy to a digital, knowledge economy. We are transitioning from a national focus to a global focus.

As part of this transition from analog to digital, leaders within the institution of accountancy along with others have created the global standard XBRL technical syntax.

The next step is to create a global master plan for XBRL-based digital general purpose financial reports. Auditors should participate in the creation of this plan.

Today, there is pretty much a literal free-for-all when it comes to creating XBRL taxonomies for financial reporting and how to best create such XBRL taxonomies is blurred and confused for most. Regulators are taking different approaches. There is consensus that the quality of XBRL-based reports submitted to the SEC and ESMA are not of the quality that they need to be.

This free-for-all and the quality issues causes confusion and increases risk for pretty much everyone including software vendors, auditors, regulators, and economic entities that report. Making the confusion go away would help pretty much everyone.

And what if non-regulated private companies want to move from analog to digital; what are they to do? There is no global standard formal approach that they can adopt that is proven to work so well that they could implement digital reporting within their organization.

The Seattle Method and the Standard Business Report Model (SBRM) could end up as de facto best practices or good practices based approaches to implementing XBRL-based digital financial reporting. There are already over eight groups implementing or publically experimenting with these ideas that I can make you aware of at this point. Others I know of are experimenting in private.

XBRL-based digital general financial reports may never replace all paper-based or e-paper based general purpose financial reports. But they are a good tool if they work reliably and predictably. If there is not agreement as to what information is being conveyed by the reports and the quality of that information, there is no way such reports can ever be audited.

Optimally, there would be one set of standard XBRL-based digital financial report approaches. Not sure that will ever happen, but it is worth trying for and seeing what happens. In the United States, I see these use cases and markets (best information that I have):

- Public company financial reporting, about 6,000 companies.

- Private company financial reporting, about 85,000 larger companies with over 500 employees and up to 25,000,000 medium, small, and micro companies.

- State and local governmental financial reporting, about 110,000 states, towns, villages, cities, school districts, public utility districts, transit authorities, and so forth.

- Not-for-profit financial reporting, about 350,000 not-for-profits that report to the Federal Government in support of federal grants.

- ERISA pension plans financial reports, about 850,000 plans.

- DEFI financial reporting, about 7,000 crypto currencies and growing.

- Personal financial statements, about 1,000,000 individuals

But if XBRL-based digital financial reporting does not work (i.e. not "Better"), takes more time (i.e. is not "Faster", costs more money (i.e. is not "Cheaper"), or is too hard to use; then XBRL-based reporting by those groups above is a non-starter.

If the SEC or ESMA lifted their XBRL reporting mandates today, how many companies would continue to use XBRL? Probably 100%. Why? Because current approaches don't provide enough value, they are not BETTER, they are not FASTER, and they are not CHEAPER.

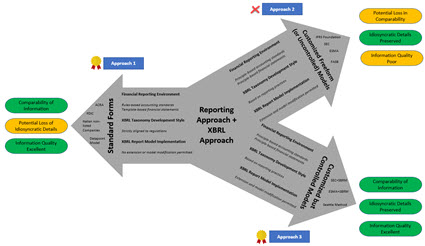

From what I can see, there are THREE current approaches:

- Standard Forms: Comparability is good, information quality is good, but there is a loss of idiosyncratic detailed information. This is useful in some cases even if detailed information is lost.

- Customized Free Form (or uncontrolled) Models: Idiosyncratic details are preserved; but information comparability is bad and information quality is poor.

- Customized but Controlled Models: Comparability is good, information quality is good, and idiosyncratic details of economic entities is preserved. Most regulators that use approach #1 will change to this approach when it works effectivly I predict.

This graphic below provides a comparison of the three approaches that was inspired by an academic paper that I referenced in another blog post:

I hold the Seattle Method out as an example of what can be achieved. Whether the leadership in the institution of accounting can put something better together, time will tell. Whether the market will accept XBRL-based digital financial reporting is an unknown.

If you want to understand how change unfolds, I would encourage you to read the book The Great Upheaval. If you want to understand the environment in which all this will be operating, read New Rules for the New Economy. If you want to understand the details of the Seattle Method, I would point you to these resources.

Should you want to master XBRL-based digital financial reporting, here you go.

It will be interesting to see how all this unfolds.

Reader Comments