BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from October 1, 2014 - October 31, 2014

Understanding How to Make Digital Financial Reporting Work

I don't know, perhaps I am missing something. But, how long do you think that public companies are going to tolerate spending millions of dollars going through an exercise to structure information using XBRL and the information is not of a quality that makes it generally useful?

What do you think the probability is of expanding the market for digital financial reports beyond the 10,000 or so US public companies who are required to use it to the some 30 million private companies in the US and as I understand it 100 million private companies globally if digital financial reports don't work? That probability would be ZERO.

Now, I really don't blame anyone for not believing me that the market for digital financial reporting could be ever be in the realm of 30 million to 100 million entities. Given the fact that pretty much zero SEC filers like their software for creating XBRL and given the poor quality of reported financial information available, why would you believe me? Who would ever think that digital financial reporting could provide benefits?

But what if I am right? What if the quality of public company XBRL-based financial filings does improve? What if using structured information actually did provide value? What if XBRL-based digital financial reporting could be made to work?

If you don't think a market of 30 to 100 million businesses is achievable, stop reading this, I am sure there are some good cat videos on YouTube that you can watch. If you are inspired enough to want to know how to make digital financial reporting work and maybe provide software which is useful, works, and provides value to those creating and consuming financial information, here is some good information for you.

On the page of my blog Understanding SEC XBRL Financial Filings I have summarized issues which cause each of the fundamental accounting concept conformance rules to fail. I have also provided information about why filings do conform to those rules. With the information I am providing, you can basically walk through the entire process of making use of the reported information of XBRL-based financial filings and see for yourself what works, what does not work, and why it does or does not work.

Probably the most useful thing is the overview document which helps you interpret what you are looking at.

I pointed out that the quality of SEC XBRL financial filings in terms of conformance to the fundamental accounting concepts has moved from 25.6% to 53.1%. I predict that by March 1, 2015 (after the year end 10-K filings are in) the conformance rate will be 75% or higher. The rate of conformance will continue to gradually but consistently and with an increasing pace improve. These are not pie in the sky guesses. These predictions are based on good information about things that are already happening.

While this improvement is only one small battle in terms of getting the total quality where it needs to be, it is an important battle. The reason is that everyone and anyone will be able to see exactly what impacts the quality of XBRL-based financial filings in positive ways and what impacts the quality XBRL-based financial filings in negative ways.

And this is not just SEC XBRL-based financial filings. Those are only a means to an end. Because all of this information is available publically everything about this discussion is transparent. The truth is easy to understand, all you need to know is where to look.

Remember, XBRL is a means to an end. None of this is about XBRL really, it is about the benefits of structured information. It is about taking what can only be human-based manual processes today and making some of those processes that can be performed by machines. It is about increasing compliance. It is about reducing risk of noncompliance. It is about making something complicated just a little less complicated. And, should someone want to press the "Save as XBRL..." button in their software, fine. There are zero mandates necessary to expand the market of digital financial reporting. But what is necessary is software that provides real value and that really works.

What really baffles me is why the members of XBRL International and others don't understand that it is in their interest to collaborate to create the necessary inroads into the financial reporting market. Step 1: collaborate and create an XBRL-based structured approach to creating a digital financial report and MAKE SURE IT WORKS CORRECTLY. Step 2: compete. The enemy right now is not each other. The enemy is the status quo.

Conformance to Fundamental Accounting Concept Relations Doubles

(Note that information on discovering and correcting issues found by using the fundamental accounting concept tests can be found here.)

Two incredibly positive things have happened with regard to SEC XBRL-based financial filing quality. First, as part of my minimum criteria testing for fiscal year 2013, my data shows that 1,711 of 6,674 or 25.6% of all filers passed all of the fundamental accounting concept relations tests.

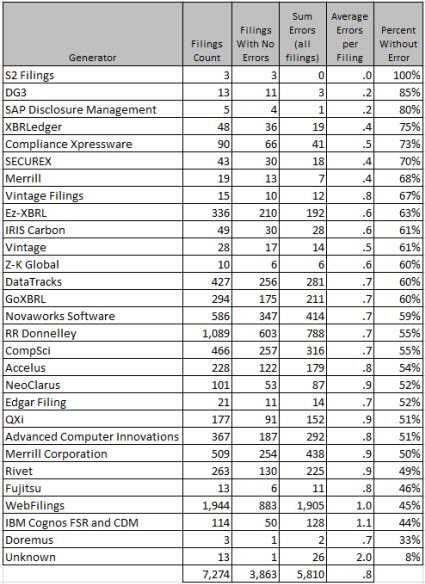

I just ran that same test and the rate is 53.1%! A total of 3,863 filings from the complete set of 7,274 SEC filers who filed a 10-Q for fiscal year 2014/2015 pass 100% of the fundamental accounting concept relations tests.

This is the breakdown by generator that my data shows: (note that this is approximatly that same breakdown as of March 2014; it is an approximation because it shows all of the minimum criteria)

The second positive thing is that XBRL Cloud has implemented my fundamental accounting concepts relations tests within their EDGAR Dashboard. Currently, only XBRL Cloud customers have access to the validation results as it is in BETA, from what I understand the fundamental accounting concept validation will make its way to the publicly available dashboard page eventually.

Now, these fundamental accounting concept relations validation results have only been avaiable for less than a week or so. That is important to know because that means most of the filers have not had their filings corrected as of the time my testing was done. What that means, it seems to me, is that there will be yet another significant increase in conformance to the fundamental accounting concept relations as XBRL Cloud customers make use of these new tests. I would assume that XBRL Cloud has a lot of customers, therefore there should be a lot more filings which conform to the fundamental accounting concept relations rules.

That means three things:

- There will be even more pressure on the half that don't follow these basic relations which no one really disputes.

- Data quality will rise as a result.

- Less human effort will be required to fix broken data thus doing the necessary expensive manual work to correct the bad data will cost significantly less.

Not sure if you are following me. But fundamentally it means this: the business model of data aggregators is about to shift. It will cheaper to fix the broken XBRL-based data than it will be to continue with the legacy approaches to making this data available.

I really don't know what caused the conformance to the fundamental accounting concept relations to increase so dramatically. I would like to think that my pestering software vendors and filing agents had something to do with it. SECXBRL.info publishing the same data probably helped. A few other software vendors implemented these also. Nothing that the FASB or SEC has done would explain this dramatic increase.

What do you think explains the dramatic quality increase?