BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from January 31, 2016 - February 6, 2016

The European Union Officially Recognizes XBRL as a Standard

Understanding Where Digital Financial Reporting Can Go

I put together another handful of queriesusing 28msec's SECXBRL.info web service. These are not perfect, but you can get a really good idea where digital financial reporting is headed.

As you look at the queries, think about what it takes to get this information from an XBRL-based public company financial report. If you need some guidance understanding that, read this blog post which walks you through exactly that. As Mike Starr, head of the XBRL US Data Quality Committee puts it, the ultimate determination of quality comes from the ability to actually make use of information.

I think this stuff is getting pretty good. What do you think?

A Digital Financial Report is a Formal System That Needs to Work Reliably to be Useful

Aristotle is said to be the father of formal logic. Logic is a discipline of philosophy. Logic is the study of correct reasoning.

The notation of what we call elementary school arithmetic took centuries to develop. But today we take mathematics for granted.

Formal logic is the basis for mathematics. Mathematics is a formal system.

A formal system is defined as any well-defined system of abstract thought based on the model of mathematics. Basically, formal systems can be explained and proven using the language of mathematics. Every formal system has some sort of formal language that explains that system. Every formal system can be tested to see if it works using a formal proof.

A theory is a tool for understanding, explaining, and making predictions about a system. A theory describes absolutes. A theory describes the principles by which a system operates. A theory can be right or a theory can be wrong; but a theory has one intent: to discover the essence of some system.

A theory is consistent if its theorems will never contradict each other. Inconsistent theories cannot have any model, as the same statement cannot be true and false on the same system. But a consistent theory forms a conceptual model which one can use to understand or describe the system.

Formal logic was consciously broken into two groups: first-order logic and higher-order logic. There is a reason for this.

Systems based on first-order logic can be proven to be sound (all provable theory statements are true in all models) and complete (all theory statements which are true in all models are provable using proof theory).

Basically, higher-order logics are less well-behaved than those of first-order logic. They are less predictable and therefore less reliable and they are significantly harder to implement using computers.

That is why computer systems are generally based on first-order logic.

This is all well understood by good software engineers. A Turing machine never "freezes" or fails. The Chomsky Hierarchy categories languages into groups that provide different levels of reliability. Type-0, type-1, type-2, and type-3 languages all are Turing machines.

How does all this relate to professional accountants?

A digital financial report is a formal system. A system such as the digital financial report needs to be described precisely so that professional accountants understand how the system works so that the system can be used effectively. This blog post related to Z Notation helps one understand that systems need to be described precisely and that tools exist to achieve that end.

Another way to describe a system is to create a theory and then prove the theory. Financial Report Semantics and Dynamics Theory is such a theory and proof. Digital financial reports can be tested for consistency against a documented theory. Consistencies with the theory help prove the theory. Inconsistencies with the theory can be detected in the system and the reason for the inconsistency determined.

If you understand how formal logic works all this makes sense. If you don't understand formal logic, please watch this video which is a crash course in formal logic. If you don't understand knowledge engineering and want more detailed information, please read Knowledge Engineering Basics for Accounting Professionals. It lays out important ideas that need to be considered when thinking about digital financial reports.

Systems need to work properly to be useful. That is what engineering is all about, making things work properly so that they are useful. Luck and magic have nothing to do with making systems work. Conscious, deliberate, and skillful attention to the details of a system contribute to making a system work.

It would be very hard to argue that XBRL-based financial reports to the SEC are a resounding failure. Likewise, it would be hard to argue that XBRL-based financial reports to the SEC are an overwhelming success given the quality problems that exist with those digital financial reports today. What one can do given the right tools is to gather empirical evidence about how the system is working and compare that evidence to how one thinks the system should work. This sort of testing helps improve systems.

Public Company XBRL-based Digital Financial Report Quality Inches Forward

Not a lot of movement in the quality of public company XBRL-based financial reports, but quality did improve slightly. See the information below:

Because there is not a lot going on I want to introduce a handful of additional quality measures. In order to read any information from an XBRL-based digital financial report, you have to be able to locate the reporting economic entity of the report, the current balance sheet, and the current year-to-date income statement. Further, you want to know that the information is trustworthy and if you cannot be sure the balance sheet, income statement, and cash flow statement to not roll up correctly it raises a red flag in your mind as to the reliability of the information.

Here are six additional quality measure which are part of what I call the "minimum criteria" for making use of information reported in an XBRL-based digital financial report. You can see page 2 of this document for a three year comparison of this information. Here is where things stand now:

- Ambigous root economic entity: Only 14 out of 6,683 entities, or about .21%, get this wrong.

- Ambigous current balance sheet date: Only 29 out of 6,683 entities, or about .5%, get this wrong.

- Ambigous current income statement year-to-date period: Only 41 out of 6,683 entities, or about .7%, get this wrong.

- No balance sheet calculation relations provided: Only 44 out of 6,683 entities, or about .66%, don't provide these calculation relations.

- No income statement calculation relations provided: Only 176 out of 6,683 entities, or about 2.63%, don't provide these calculation relations.

- No cash flow statement calculation relations provided: Only 202 out of 6,683 entities, or about 3.02%, don't provide these calculation relations.

It appears that about 98% of public companies provide XBRL calculation relations for the primary financial statements. Note that for 2014, 2013, and 2012 the percentage of public companies that provided calculations relations for the primary financial statements was 92.0%, 90.5%, and 84.9%; respectively. So, that is improving. Below is a summary for all the minimum criteria for the past three years:

The SEC seems to be putting additional pressure on public companies to provide the required XBRL calculation relations. I look forward to the 2015 analysis of 10-Ks to see how much improvement occurred over the past year.

* * *

Previous fundamental accounting concept relations consistency results reported: December 31, 3015; November 30, 2015; October 31, 2015; September 30, 2015; August 31, 2015; July 31, 2015; June 30, 2015; May 29, 2015; April 1, 2015; November 29, 2014.

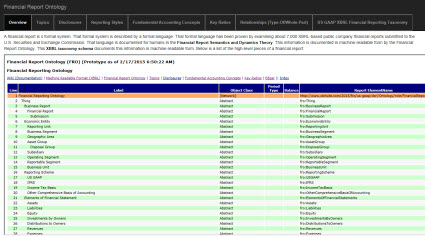

Updated Financial Report Ontology Landing Page

I keep tweaking with the Financial Report Ontology, making incremental improvements. Here is a new landing page that I have created:

None of the metadata changed, just the presentation of the pieces. It is getting closer and closer to what I want.

Don't understand what this is or why it is important? Read this and this.