Positive Trend: Public Companies Fixing Long Standing XBRL Issues

There is a very positive trend that is happening. Big and small public companies are correcting long standing issues in their XBRL-based financial reports related to the basic, fundamental accounting concept relations within their financial reports.

One example of this postive trend is General Mills. I will walk you through this issue, how it was fixed, and what it means.

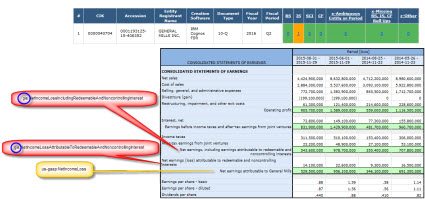

In the screen shot below (click on the image for a larger view) you can see that General Mills used two extension concepts to represent line items of their income statement for Q2 of 2016. The fundamental accounting concept relations consistency checks identifies this issue. On the top of the screen shot you can see the automated validation results with one issue on the income statement (IS) shown in orange. Note the extension concepts shown in red:

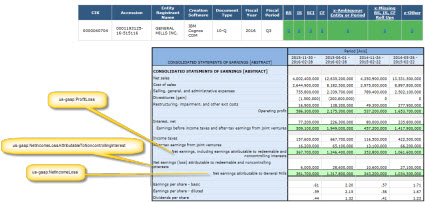

In the very next report for Q3 of 2016, General Mills switches to existing US GAAP Financial Reporting XBRL Taxonomy concepts. You can see that on the top of the screen shot, the validation messages (the ORANGE) went away and the fundamental accounting concept shows General Mills 100% consistent with all of those basic accounting relations:

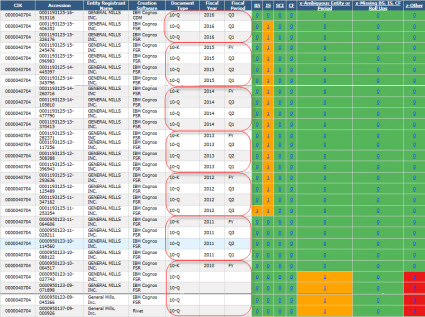

This next screen shot shows a summary of all General Mills XBRL-based financial filings to the SEC. After 18 reporting periods using inappropriate extension concepts, in the latest period (Q3 of 2016) the issue is resolved. In this analysis every General Mills report is evaluated using exactly the same set of rules. In fact, every public company that uses this reporting style uses the same rules.

Thus, General Mills is now consistent with all of the basic, fundamental accounting concept relations just as is approximately 80% of public companies.

Here is a handful of other public companies that have this same positive trend, fixing long standing inconsistencies with the basic, fundamental accounting concept relations:

- General Mills: Discontinued using two inappropriate extension concepts.

- Alaska Airlines: I emailed investor relations, pointed out the inappropriate use of the concept "us-gaap:LiabilitiesNoncurrent", and they fixed the issue. See this balance sheet comparison.

- Boeing: I emailed investor relations. Fixed one of two long standing issues where they were using an inappropriate concept in the statement of comprehensive income. The remaining issue is being worked on. It relates to a unique situation where net income from noncontrolling interest is considered immaterial for the income statement but not for the statement of changes in equity.

- Verizon: Fixed a polarity issue (reversed the value of a number) related to comprehensive income attributable to noncontrolling interest.

- Travelers Companies: Fixed inconsistency between facts reported for net income (loss) and net income available to common shareholders, basic.

- Guess

- Wings & Things

- Jones Financial Companies

- Real Industry

- Tessco Technologies

- Alexandria Real Estate Equities

- Oneok Partners

- Providence Worchester Railroad

- Franklin Resources

- Total System Services

There were more than these fixes, I am only providing supporting evidence for this very positive trend.

Reader Comments