Analysis of Fortune 100, See Controversial Issues and How to Resolve Them

The following helps professional accountants understand how to understand and resolve potentially controversial issues related to creating XBRL-based digital financial reports for public companies that are submitted to the SEC.

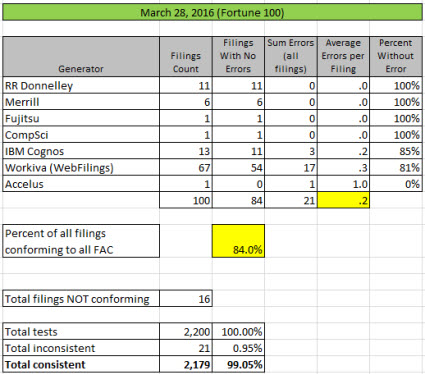

The following is a summary of issues related to representing Fortune 100 company financial reports in the XBRL format. This analysis measures the latest financial report as of March 28 for each of the Fortune 100 public companies against the set of basic, fundamental accounting concept relations that I have been using.

First, here is a summary of all issues by generator (filing agent/software vendor):

On average, the Fortune 100 is 2.6% better in terms of overall quality than the entire population of approximately 6,700 public companies.

Of the total of 21 inconsistencies identified, 9 of those are uncontroversial filer errors. For example, someone entered a value in as a positive that should be negative or they selected an obviously incorrect concept to report a fact.

That leaves 12 issues. Those 12 issues tend to be more controversial in nature, perhaps not as straight-forward to resolve or there is a lack of consensus as to how to resolve the issues.

I want to point out 3 of these issues to make a specific point. Here are the three issues, I will explain the point after I explain the issues.

Potentially controversial issues:

- Possible Missing US GAAP XBRLTaxonomy Concept "Operating and Nonoperating Revenues": Exxon and Marathon Petroleumboth create an extension concept for what amounts to the line item "Operating and Nonoperating Revenues". That concept is not represented within the US GAAP XBRL Taxonomy. About 157 other public companies report relatively similarly to Exxon and Marathon. Some create extension concepts, others use existing US GAAP XBRL Taxonomy concepts. One of two things must be true because an extension concept should not be necessary at this high level:

- #1: Exxon and Marathon have created an inappropriate extension concept and should use some existing US GAAP XBRL Taxonomy concept.

- #2: The US GAAP XBRL Taxonomy is missing the concept Exxon and Marathon felt compelled to extend, "Operating and Nonoperating Revenue".

- Computation of Gross Profit: Philip Morris International does something that is inconsistent with what most public companies do. Most public companies that report gross profit have the following computation: Revenues - Cost of Revenue = Gross Profit. Philip Morris uses this computation: Revenues - Cost of Revenue - Excise Tax = Gross Profit. There are at least four other companies that report that relation in the same manner as Phillip Morris: ALTRIA GROUP, BROWN FORMAN, CONSTELLATION BRANDS (created extension concept for exise tax), MOLSON COORS. One of the following must be true:

- #1: This relation is allowed: Revenues - Cost of Revenue - Excise Tax = Gross Profit

- #2: This relation s NOT allowed, it is always the case that: Revenues - Cost of Revenue = Gross Profit

- Extension of Income (Loss) from Equity Method Investments when Moved: PRUDENTIAL FINANCIAL reports the line item "Income (Loss) from Equity Method Investments" as part of the reconciliation of before and after tax income from continuing operations. They do so using an extension concept. There are 129 public companies that report that line item in exactly that same manner and use the existing US GAAP XBRL Taxonomy concept "us-gaap:IncomeLossFromEquityMethodInvestments". Only one of the following should be true:

- #1: If income (loss) from equity method investments is reported as part of the reconciliation of income from continuing operations before and after tax, DO NOT extend the concept; use the existing US GAAP XBRL Taxonomy concept.

- #2: If income (loss) from equity method investments is reported as part of the reconciliation of income from continuing operations before and after tax, EXTEND the concept. (i.e. DO NOT use the existing US GAAP XBRL Taxonomy concept)

My point is that each of these issues can be resolved by getting clarity on which of the possible alternative resolutions is the appropriate resolution to the specific issue. If I missed an alternative, all one needs to do is simply add that alternative to the list of alternatives being considered. Examining the evidence of how public companies actually report can help resolve these and other issues.

Looking at the issues/inconsistencies related to these 100 companies is very helpful because many of the same sorts of issues/inconsistencies impact the full population of 6,700 public company XBRL-based financial reports.

Further, analyzing issues is not limited to these three specific issues. Other issues exist. I know, I have lists of these issues. Today, I work with filing agents and software vendors to figure out as best as we can how to resolve each specific issue. That works when each filing agent/software vendors arrives at the same decision as to which is the appropriate alternative. When consensus cannot be reached, then different software vendors/filing agents address the specific reporting situations in a different way, causing an inconsistency. Who is right? Who knows. But where consensus is reached, consistency exists. Where consistency exists, what is right is rather obvious.

That will leave the controversial issues unresolved. How many controversial issues are there? I am compiling an inventory of those issues. Stay tuned!

Reader Comments