Identifying Conflicting Facts in XBRL-based Public Company Financial Reports

Tools for working with XBRL-based financial reports are improving significantly. This makes seeing mistakes that are made easier. This blog post points out a type of issue which was hard for many people to see and understand in the past; but now with better tools, understanding the problem is very easy.

Reported information clearly needs to be correct; but reported information should also not contradict other information that was reported. Provision for loan losses will be used to explain what I mean.

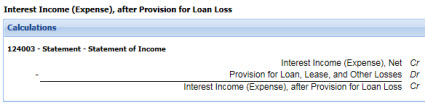

Financial institutions that report using interest-based reporting have the following relationship that you can see in the US GAAP XBRL Taxonomy:

(Click impage to go to the US GAAP XBRL Taxonomy)

(Click impage to go to the US GAAP XBRL Taxonomy)

Interest income (expense), net less the provision for loan, lease, and other losses equals interest income (expense), after the provision for loan losses.

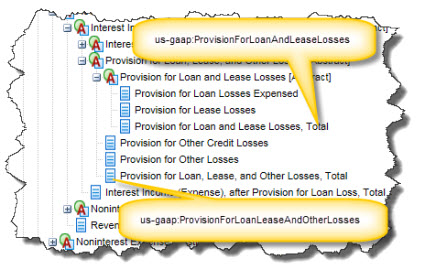

The total or "whole" provision for loan losses total can be broken down into "parts" to provide more detailed information.

(Click image to go to US GAAP XBRL Taxonomy)

(Click image to go to US GAAP XBRL Taxonomy)

While you can see the relationships between the concepts in the presentation view of the US GAAP XBRL Taxonomy; the calculation view provides more explicit information. See this calculation relation and this calculation relation to see more clearly how the provision concepts relate to one another.

In the case of these detailed provision concepts the relationships are very straight forward. The WHOLE provision "us-gaap:ProvisionForLoanLeaseAndOtherLosses" has several PARTS one of which is "us-gaap:ProvisionForLoanAndLeaseLosses" and another of which is "us-gaap:ProvisionForLoanLossesExpensed". There are other parts, but 90% of financial institutions use one of those three concepts to report the provision on their income statement.

Four banks make mistakes that causes contradictory information to be reported in their XBRL-based financial report.

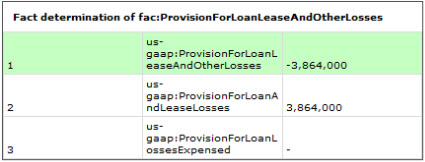

First Guaranty Bancshares, Inc.

They reported the grand total concept as a negative number, then the PART of that grand total using one of the PARTS but using the exact same value but as a POSITIVE number. If you look deeper, what you find out is that the POSITIVE number was used on the income statement and the NEGATIVE was used in the cash flow statement. So this is a bad error; the filer is really using two different concepts to represent the exact same information used in two different places.

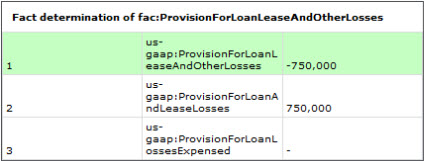

CITIZENS FINANCIAL SERVICES INC

These guys make EXACTLY the same mistake as the first entity. Again, going to the income statement and looking at the provision line item and then going to the cash flow statement and looking at the provision line items shows this rather obvious error.

Again, exactly the same mistake as the first two above. Go look at their income statement and cash flow statement provision line items; you see the obvious mistake.

This bank has an error, but the pattern is different. Again, two different facts are provided but they are both positive and in addition the values are different. If you go to the income statement and the cash flow statement you see the SAME FACT, the second concept, being used for both which is what the others above should have done.

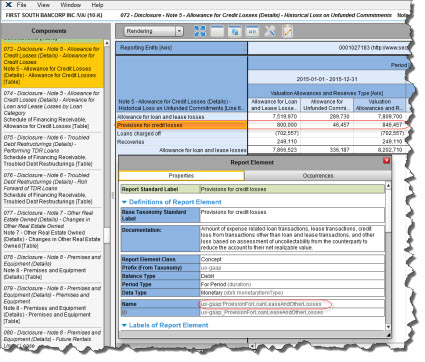

But, if you go to the disclosures (click here to view this using the XBRL Cloud viewer), specifically Note 5 - Allowance for Credit Losses (Details); you see that the FIRST concept was used along with dimensional information to represent the roll forward of the allowance for loan and lease losses:

So that is a mistake also because now you see that TWO DIFFERENT FACTS exist for that income statement and cash flow statement line items. The information is also contradictory to how other banks report and contradictory to the US GAAP XBRL Taxonomy that says the GRAND TOTAL is what goes on the income statement per that relationship I point out above.

While the analysis I provide only has about 60 banks; I am actually looking at all 529 economic entities that report using the interest-based style. Of that total, there are only 31 that have an issue with the provision for loan losses and most of those follow the first three examples that I showed.

As tools improve, it will be easier for professional accountants to see and understand these sorts of contradictions reported in XBRL-based financial reports.

Reader Comments