BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Sensemaking

It always seemed that I have some sort of superpower when it comes to accounting information systems. Well, it seems that superpower has a name, "sensemaking".

The following are three definitions of sensemaking that I have run across:

"Sensemaking is the ability to determine the deeper meaning or significance of what is being expressed."

"Sensemaking is the process by which people give meaning to experience."

"Sensemaking or sense-making is the process by which people give meaning to their collective experiences."

Article, Making Sense of Sensemaking

"Sensemaking is literally the act of making sense of an environment, achieved by organizing sense data until the environment “becomes sensible” or is understood well enough to enable reasonable decisions."

Here is my composite definition based on what I am seeing and a synthesis of the definitions from above:

Sensemaking is the process of determining the deeper meaning or significance or essence of the collective experience for those within an area of knowledge.

Sensemaking is a tool. You can use sensemaking to construct a map you can share with others. Sensemaking is the art of analysing, understanding, clarifying, untangling, organizing, and synthesizing. As explained in this video, Introducing SenseMaking, the process of sensemaking involves:

- Looking for patterns in information.

- Making connections among different things.

- Synthesizing lots of information and categorizing it into small chunks.

- Think about the big picture.

- Think about the "why" of a situation.

- Organizing and untangling things.

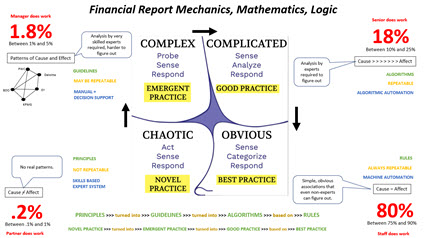

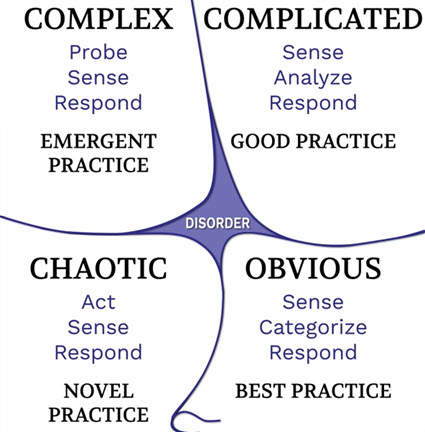

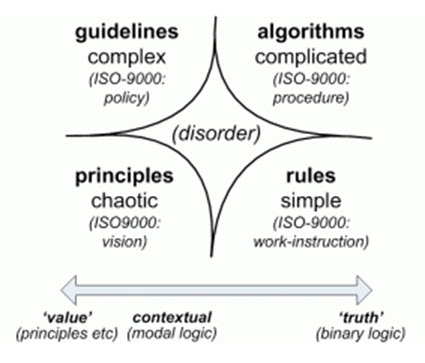

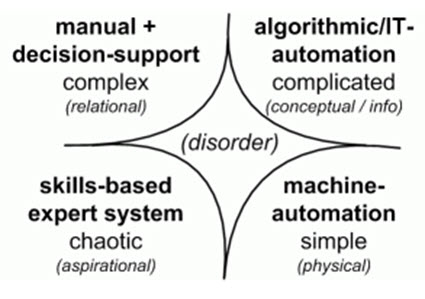

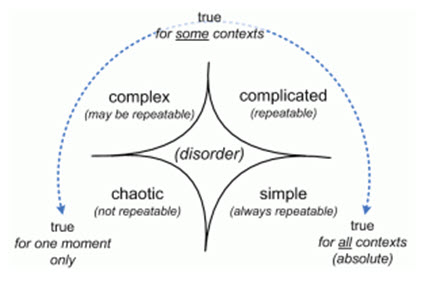

The Cynefin Framework is a sensemaking model. There are other types of sensemaking models. And even more types of sensemaking models. Here are the Cnyefin and other sensemaking models shown graphically:

Cynefin Framework:

ISO 9000 Quality Model:

Skill Level Model: (think CPA firm here; staff=trainee, senior=apprentice, manager=journeyman, partner=master)

Automation/Manual Model:

Repeatability and Truth Model:

What is interesting is the descriptions of each of the five parts of each graphic above. "Disorder" is always in the center, you have the LOWER RIGHT=simple/obvious, UPPER RIGHT=complicated, UPPER LEFT=complex, and LOWER LEFT=chaotic. Look at the patterns and look at the subtexts.

Information for an area of knowledge can be broken down by those groups. Information in each of those groupings can be processed. The effort involved to process the information in the different groups varies, but all the information can be processed using automation. That processing needs to be controlled.

So now, take all of the above and think Six Sigma, Lean, and Lean Six Sigma. Those tools are a match made in heaven in terms of automation of tasks and processes. Have a quick look at Six Sigma and Lean Six Sigma:

Six Sigma in 9 Minutes: (tools for process improvement, tools for removing defects from a process)

Lean Six Sigma in 8 Minutes: (methodology providing value to customer, eliminating waste, continuous imporovement, reducing cycle time)

I have tried to synthesize all the important details into one graphic which I have provided below: (click on the image for a larger view)

If you put all of these pieces together and then think Financial Report Knowledge Graph and the Seattle Method; then you will better understand the future of accounting, reporting, auditing, and analysis.

What is happening is a foundational change: it is highly useful, highly novel, and highly complex. A disruptive innovation is about to occur.

Folks, software engineers are going to be able to automate the heck out of financial report creation tasks and processes. Those tasks and processes will leverage Lean Six Sigma techniques, principles, and practices. Accounting, auditing, and analysis will soon follow.

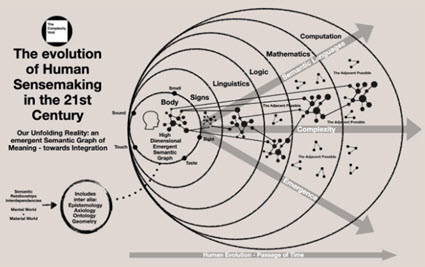

Graphic of the evolution of sensemaking:

##########################

The Hidden Brain: Rebel with a Cause (role of experience, skill, and experimentation in innovation)

Financial Disclosures are Not Novel Art Projects

As pointed out by Mike Willis when with PriceWaterhouseCoopers, financial disclosures are not novel art projects akin to how highly skilled craftsmen assembled cars by hand prior to Henry Ford’s innovations that include the assembly line and standardization of parts.

This might come as a big surprise to most accountants, perhaps even shock. The term "generally accepted accounting principles" (GAAP) is used for a reason. Using the terminology of the Cynefin Framework, I would suspect that 80% of external financial disclosures follow "best practices", about 18% follow "good practices", perhaps 1.8% are "emergent practices" and maybe .2% are "novel practices".

Further, the average accountant is, well, average. My 10 years of creating XBRL taxonomies for financial reporting using US GAAP and IFRS included meeting many, many accountants who provided input as to what should be in those XBRL taxonomies. The discussions which took place were enlightening. Accountants, just like everyone else, make mistakes.

What I predict the future will bring is heavy use of templates and exemplars for creating financial disclosures. Here is a prototype of a template gallery that I created. Here is another prototype. Works similar to how templates work for, say, Microsoft PowerPoint or Word. This just makes a lot of sense.

What I predict the future will bring is heavy use of templates and exemplars for creating financial disclosures. Here is a prototype of a template gallery that I created. Here is another prototype. Works similar to how templates work for, say, Microsoft PowerPoint or Word. This just makes a lot of sense.

Financial reports are far more consistent than you might think. Don't take my word for it, have a look at all those reports in the EDGAR system. The AICPA publishes a book, Best Practices in Presentation and Disclosure. PPC's Guide to Preparing Financial Statements which is published by Thompson Reuters is a similar guide.

Besides, forget about public companies for a moment. Think about the smaller accounting firms and the millions of companies creating financial reports. Think of that bell shaped curve. Mistakes are made. Templates and best practices guides help avoid mistakes.

Today, these guides are readable only by humans. Soon, this best practices and good practices guidance will also be readable by machines. That information will be used to gulde expert systems for creating financial reports.

Seattle Method

In the past I have referred to "my method". I have re-branded "my method" to be the Seattle Method.

The Seattle Method is inspired by and builds on the Venetian Method which is a good practices approach to double entry bookkeeping created and documented by Luca Pacioli. The Seattle Method is:

Proven, good practices, standards-based pragmatic approach to creating provably high quality XBRL-based general purpose financial reports that builds on the Venetian Method of double entry bookkeeping and adapting it for the information age

The Venetian Method has adapted to serve society many times over its 500 year history serving commerce. The Seattle Method supplements the Venetian Method, better tuning it to serve the need for "digital" as we transition from the industrial age to the information age. Welcome to the Fourth Industrial Revolution!

The focus of the Seattle Method is financial reporting using financial reporting schemes such as US GAAP, IFRS, UK GAAP, and other schemes where the preparer of a financial report is permitted to modify the report model. Because modification of the report model is allowed, those modifications must be controlled to keep the modifications within permitted boundaries.

New name, but nothing about the method has changed. Join the increasing number of software vendors that are using the Seattle Method to create effective XBRL-based digital financial reporting.

Here are resources for helping you understand the Seattle Method:

################################

If you are interested in the history of all this, check out XBRLS from 2008, the Financial Report Semantics and Dynamics Theory, the original submission to OMG, and my blog archive. Before all that there was "the patterns document".

Are DAOs the future of DeFi?

This article, Are DAOs the future of DeFi?, by Mikhail Goryunov is worth reading. Here is the conclusion of the article: (emphasis is mine)

At this point, decentralized virtual communities and groups are essentially a big experiment in applying a new concept of interaction and governance. DAOs can offer innovative approaches to doing business, project development, collaboration, and coordination. The development of affordable ways to create DAOs and incorporate them into decentralized protocols is essential to reach widespread adoption. As this type of organization becomes more popular and accepted, communities will grow, forming both micro-economies and billion-dollar projects.

Worth considering.

A DAO is a great way to build a product and bring it to market.

######################################

What is a DAO and What is it Used for?

Decentralized Autonomous Organizations (DAO)

Accounting: Our First Communications Technology

Chapter 1 of her book, Double Entry: How the Merchants of Venice Created Modern Finance, Jane Gleeson-White titled Accounting: Our First Communications Technology.

In that first chapter, which you can read online, Gleeson-White discusses the research of French archeologist Denise Schmandt-Bessersat who discovered that the origin of writing was the farmers of Mesopotamia (now Iraq) keeping track of their crops and animals.

There seems to be three primary aspects of the communications technology of accounting:

- Medium used to represent information.

- Number system used to represent information itself.

- Accounting method used to maintain quality of information.

Based on Gleeson-White's book and some other sources I put together this timeline that combines those three aspects: (click on image to see timeline)

The medium is in GREEN; the number system is in BLUE; and the accounting method is YELLOWISH. Accounting always seems to adapt for the times. While specific technologies used to implement the "institution" of accounting change, the institution itself presses on.

It is time for accounting as practiced in the industrial age to transition into the information age.

* * * *

Accounting, auditing, and reporting has been out paced by financial innovation. Auditing is broken. Old school financial report creation processes are very inefficient. Processes are inefficient from end-to-end. There is far too much rekeying of information.

As LibraTax put it in a presentation on the future of accounting, "Accountants and auditors are financial doctors." They go on to say, "We just gave them penicillin."

This is what I believe LibraTax means...

Accountants and auditors use tools to perform the tasks and processes that they need to perform to get their work done. Those tools evolve. In the past the tools have been things like clay tablets as the media, Roman numerals, the invention of the 0, Hindu-Arabic numerals, paper as the media, the double-entry bookkeeping model, the calculator, the electronic spreadsheet, the computerized accounting system.

Innovations occur and new tools are invented such as artificial intelligence, immutable digital distributed ledgers, knowledge graphs and other structured information, rules/reasoning/logic/knowledge/insights engines, triple-entry accounting (bookkeeping), cryptocurrency, NFTs, smart contracts, decentralized autonomous organization (DAOs) and such. Add to this the process and quality control techniques of Lean Six Sigma and things are even more reliable.

These new tools, technologies, and other innovation will have an impact on accounting, reporting, auditing, and analysis that will be similar in nature to the impact the invention of penicillin had on the practice of medicine.

The change will be disruptive, transformational, perhaps even considered foundational. With any such transformation there will be winners and there will be losers.

################################################

History of Hindu-Aribic Numerals

Timeline of Numerals and Arithmetic