BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from January 19, 2014 - January 25, 2014

Everybody is an SEC XBRL Financial Filing Quality Expert These Days

Everybody and their brother is holding themselves out as "the XBRL quality expert" for SEC XBRL financial filings these days. Well, here is some information you can use to get to the bottom of exactly how good someone's quality really is.

I have been analyzing SEC XBRL financial filings for years and years. Back in about November 2009, I found exactly one SEC XBRL financial filing which passed a battery of tests which I was using. By March 2010 the number that passed my battery of tests was 92. By about August of 2013 I had tuned my battery of tests and documented the things that I was looking at and the results I found in this Summary of Analysis of SEC XBRL Financial Filings document.

So, my tests were getting more tuned and harder. Tests are expanding toward accounting and financial reporting semantics or the meaning of the information. And at the same time the number of filings that passed the tests is growing. This is a very good sign.

These tests are not perfect by any means, nor are they comprehensive. But, if filers do not pass these tests, there is little hope that their SEC XBRL financial filing will be useful to anyone. However, all this said; there are thousands of additional tests which must be passed to prove that an XBRL-based financial filing is totally correct. My point is, I am not saying any SEC XBRL financial filing is totally correct.

All that said, quality is definitely improving. I have taken my tests, tuned them again, and ran them against the most current 10-K filings. My new set contains 5262 filings currently. The submission analyzed were 10-K SEC XBRL financial filing submissions between March 1, 2013 and December 31, 2013. This will be updated for 10-K filings submitted between January 1 and February 28, 2014.

This is my battery of tests: (All Stars pass all of these tests)

- XBRL technical syntax validation: ZERO XBRL technical syntax errors are allowed.

- Automated EFM validation: ZERO EDGAR Filer Manual (EFM) errors are allowed.

- US GAAP Taxonomy Architecture rules: ZERO US GAAP Taxonomy Architecture model structure errors are allowed. (For more information see this blog post.)

- Core financial statement roll ups: ZERO missing core financial statement roll ups (assets, liabilities and equity, net income, net cash flow) are allowed. (For more information, see this blog post.)

- Fundamental accounting concepts validation: ZERO failed fundamental accounting concept business rules. (For more information, see this blog post.) Note that this is pretty aggressive but this is necessary for unambiguous use of the financial information.

Below are the complete results thus far. I will be adding additional semantic tests relating to identification of the root reporting entity and correct reporting period information over the coming months. In the very near future I will also be adding additional accounting/financial reporting semantic rules. But as of right now, this is what the data says:

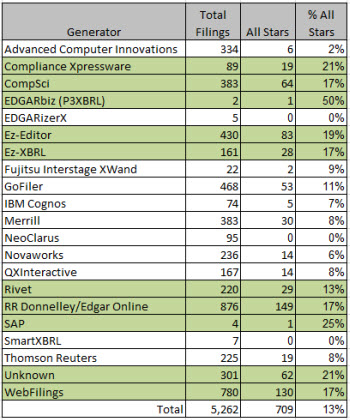

For the total set of 5,262 SEC XBRL financial filings, all of which are 10-Ks; I found 709 which passed all the tests in my battery of tests. That is an average of 13% of all SEC XBRL financial filings. In the list of generators, all generators who were average or better than average are highlighted in green.

I will update this information and make all my data available after the 10-K season which ends March 1, 2014. I will recompile the results, further tune my tests, and see what shows up.

If any software vendor, filing agent, SEC filer, or anyone else has any input as to what else might be included in my battery of tests please contact me.

Again, I am not saying that I am defining what quality is. You can decide for yourself what the definition of quality is. However, you should be able to justify your definition of quality. So should your software vendor or filing agent.

Decomposing SEC XBRL Financial Filing Report Components

In a prior blog post I provided a general idea of why some SEC XBRL financial filing disclosures were hard to understand.

In this document, Decomposing SEC XBRL Financial Filing Report Components, I get more specific and show precisely why these renderings are hard to decipher and alternatives used by other SEC XBRL financial filers which made exactly the same disclosures but represented the information in ways where it was easy to understand.

What causes something to be hard to read? Here is the bottom line: (a) As a rule of thumb, don't put things together when the combined representation is worse than the separate representations, and (b) use [Abstract] report elements to separate things where it makes sense.

Understanding Financial Disclosures

This blog post summarizes information related to understanding the big picture of disclosures contained in a financial report. This information is not detailed information about individual disclosures, but rather a framework for understanding disclosures in general in the age of digital financial reporting.

The very first thing which one needs to understand is that there is a conceptual framework for financial reporting. That conceptual framework is created by the FASB (Financial Accounting Standards Board) for US GAAP. (The IASB, or International Accounting Standards Board, creates the conceptual framework for International Financial Reporting Standards.)

Concept statements make up the conceptual framework of US GAAP based financial reporting. Reading through all that stuff can be mind numbing. There lots of presentations which explain the conceptual framework and even compare the IFRS and US GAAP conceptual frameworks which the FASB and IASB have been working to make more consistent.

Why have a conceptual framework? Well, this is explained by the FASB in their publication, FASB Special Report, The Framework of Financial Accounting Concepts and Standards (1998):

- Providing a set of common premises as a basis for discussion

- Provide precise terminology

- Helping to ask the right questions

- Limiting areas of judgment and discretion and excluding from consideration potential solutions that are in conflict with it

- Imposing intellectual discipline on what traditionally has been a subjective and ad hoc reasoning process

All good reasons for understanding the conceptual framework. While the FASB documents can be hard to understand, the framework is explained in easier to understand terms in two places that I have found. First, in the very popular intermediate accounting text, Intermediate Accounting Seventh Edition by Spiceland, Sepe and Nelson. Another very good resource is the 2014 Wiley GAAP Guide. Both of these have chapters which explains the big picture of financial reporting.

A financial report is comprised of two main parts:

- Financial statements (or primary financial statements)

- Notes (or disclosure notes)

A disclosure can be made in the following three ways as summarized very nicely by the Spiceland et. al. intermediate accounting text mentioned above:

- Parenthetical comments or modifying comments placed on the face of the financial statements

- Disclosure note conveying additional insights about company operations, accounting principles, contractual agreements, pending litigation

- Supplemental schedules and tables that report more detailed information than is shown in the primary financial statements

A couple of things are worth mentioning here. First, you can look at the primary financial statements as disclosures. Sometimes things are required to be presented on the face of the financial statements, other times it is an option which one may use, meaning the accountant could put the information within a disclosure note. Second, many times information in the disclosure notes ties directly to the primary financial statements; but other times the information does not tie because the information may not even exist within the statements. So some of the disclosures supplement information provided by the primary financial statements, other disclosures provide more details of what is in the financial statement line items.

One thing which is often misunderstood is the difference between a "disclosure" and a "note" or "footnote" or "disclosure note". A disclosure is information or data which is required to be disclosed. A note or footnote or disclosure note is an organization or presentation of the disclosure.

What needs to be disclosed? Is there a list of disclosures? Well, there is now: here is that list. That list is still a work in progress, but it will be all of the disclosures which are requried by commercial and industrial companies eventually.

Another way to say this is that companies which provide financial statements can sometimes be grouped into special industries or activities which require special accounting rules. Commercial and industrial companies are just "general" and have no such industry/activity specific accounting rules which they need to follow. So say a bank has special accounting rules. An insurance company has special rules. Here is a list of some of the special industry/activity accounting guides. My focus is reporting entities which don't have a specific industry accounting/audit guide.

So that list is long. Currently it has 943 disclosures on it. That number might go up or it might go down as I tune my list of disclosures. One way to break the list into smaller pieces is to break the disclosures down into topics. This is a list of topics. That flat list of topics can be organized into a hierarchy to make the list of topics easier to read. Here is that hierarchical list of topics. That list is inspired by the Accounting Standards Codification (ASC) topics published by the FASB.

In fact, the topic list is mapped to the ASC topics. For example, if you click here, you will be taken to the ASC topic for operating leases. (You have to have a subscription to use the ASC, but a basic subscription is free.)

What if you wanted to create your own organization of disclosures? Can you do that? Of course you can. Most of the organizations are very similar, but they are different in the intermediate text book I mentioned, the Wiley GAAP Guide I mentioned, disclosure lists I have seen, etc. Is any one organization best? No, each has its pros and cons. I actually don't like some things about the ASC organization and so I changed it to meet my needs. I said is was inspired by the ASC list, I did not use it verbatim. Everyone should be able to create their own list and organize disclosures as they see fit.

In the past it was very hard to create your own organization of disclosures for two reasons. First, all the lists were published in books and you could not reorganize the list provided by the book very easily. Second, there really was no real list of disclosures at all. There were only sentences which described a disclosure. I gave the disclosures names. Why?

Computers need names to be able to relate to things. How would you ask a computer to give you the long-term debt maturities disclosure of a financial report if that disclosure did not have a name? You could not do it.

In the digital age, these names are important. So are the lists. But computers cannot read lists from books, then need lists that they can understand. Another term for that is metadata.

I did not just create a human readable list. In fact, I did not create a human readable list at all. I created a computer readable list and then I used my computer and a software program that I wrote to generate the human readable list from the same metadata. That is why metadata is important and why articulating all this information in books is problematic in the digital age. This information belongs in a computer readable knowledge base.

Here is my list of topics in computer readable form and also the list of disclosures in computer readable form.

I used my computer readable list of disclosures which has the names of each disclosure in another set of metadata which I created. You can find this list here in the form of an RSS feed. The RSS feed points to two other computer readable files. I don't have human readable versions of those files.

What those two files do is map specific report components of SEC XBRL financial filings to specific examples. Basically, the SEC XBRL financial filings provide examples of specific disclosures. I then read the metadata and the SEC XBRL financial filings, pulling all the information together within a financial disclosure tool that I created. The tool helps me figure out how to create financial disclosures. Take a good look at that tool that I created and see if you think it is useful.

So how did I put all of these pieces together? Manually? Sure, for a while I did in order to figure out the moving pieces that I need to deal with. But I eventually created yet another tool which leverages something called prototype theory to find disclosures in SEC XBRL financial filings for me. You can take a look at my financial disclosure query tool in this video.

If you stop and think about it you can begin to understand why I needed to create a list of disclosures. If you were going to tell a software application to go get the long term debt maturities disclosure from a financial report; exactly how are you going to do that if you don't have something to tell the software exactly what you want it to get? How are you going to identify a specific disclosure and distinguish that disclosure from other disclosures if the different disclosures don't have specific names?

Do disclosures have names? Well, they didn't in the past. That is because people related to a disclosure, say in a disclosure checklist, buy reading a paragraph of text which described the disclosure. You cannot really use those paragraphs of text to describe disclosures because each paragraph is different. And that is why these names are not only helpful, but critical.

There is one other thing which accountants should understand. All this metadata is a new way to transfer knowledge that you have to others and in many cases get paid for that information. If you have specific industry knowledge or other specific expertise which others find useful, metadata is a way to transfer that knowledge and make money doing it. Don't know how to create metadata or even what metadata means. Well, stay tuned to my blog. I will help you figure that out.

In fact, if there are other accountants out there who want to create metadata for say IFRS or other US GAAP industries or activities, I would be happy to help you understand how to do that. (Please keep in mind that what I am showing is only the tip of a much bigger iceberg.)