BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from March 16, 2014 - March 22, 2014

TED: How Data Will Transform Business

Very interesting TED Talk. Philip Evans: How data will transform business.

Notice the number of times he uses the term "patterns".

Digital Financial Reporting Will Change Accounting Work Practices

You can probably imagine that CAD (computer added design) changed the work practices of architects, engineers, and builders. Likewise, digital financial reporting will change the work practices of accountants and financial analysts over the coming years. Accounting education will likewise change.

Think about the parallels. Architects used to create blueprints using pencil and paper. Now they use CAD software. CAD software is not something where you draw lines, squares, and circles. You work with architectural objects in CAD software. Consider this description from the AutoCAD Wikipedia page:

Architectural objects have a relationship to one another and interact with each other intelligently. For example, a window has a relationship to the wall that contains it. If you move or delete the wall, the window reacts accordingly.

In addition, intelligent architectural objects maintain dynamic links with construction documents and specifications, resulting in more accurate project deliverables. When someone deletes or modifies a door, for example, the door schedule can be automatically updated. Spaces and areas update automatically when certain elements are changed, calculations such as square footage are always up to date.

A CAD application understands architectural objects. It deals with windows, walls, doors, light fixtures, etc. Consider a digital financial reporting application. Now, that is not how the current "version 1.0" generation digital financial reporting software works today. And that is exactly why there are errors in SEC XBRL financial filings. CAD applications don't let you build things that won't work. That is one of the value propositions of CAD.

The same will be true of digital financial reporting tools. Unlike Microsoft Word which is used to create 85% of external financial reports today but knows nothing about a financial report; a digital financial reporting to will understand that:

- external financial reports have balance sheets (like 100% of SEC XBRL financial filings)

- balance sheets have assets and balance sheets have liabilities and equity (like 100% of SEC XBRL financial filings, see the fundamental accounting concepts)

- assets = liabilities and equity (like on the balance sheets of 100% of SEC XBRL financial filings)

- the financial reporting conceptual framework

- the Financial Report Semantics and Dynamics Theory

- US GAAP disclosure topics (and maybe IFRS also)

- US GAAP disclosures

- the financial report ontology

- financial disclosure algorithms

- the model structure of a business report

- accounting concept arrangement patterns

- member arrangement patterns or whole-part breakdowns

- business rules

- reporting templates which embody the stuff mentioned above

- and much more...

Paper-based and even electronic PDF or HTML financial reports are readable by humans. Digital financial reports are readable by both humans and machines.

Machines can therefore do things to help humans create or use digital financial reports that they could not help with before. This help from machines will reduce costs and increase quality.

If you are a software vendor and you don't understand these things, you are likely building the wrong software. A good way to learn is to understand the seven minimum criteria for evaluating SEC XBRL financial filings. It is somewhat of a digital financial reporting starter kit.

If you are an accountant and you don't understand these things you will become increasingly out of touch with financial reporting over the coming years. How many years? That is hard to tell.

Digital is not software, it is a mindset. Thinking digital is the paradigm that is winning. Not changing has costs associated with it. Ask Kodak.

The Innovators Dilemma classified technologies into two buckets:

- Sustaining technologies which foster improved product performance

- Disruptive technologies which result in worse product performance in the short term, but then over the long term they bring to a market a very different value proposition than had been available previously

Digital financial reporting is a disruptive technology which will bring a very different value proposition than has been available previously.

Watch out for Robocop.

Updated Minimum Criteria for Evaluating SEC XBRL Financial Filings

This blog post updates a prior post, Minimum Criteria for Evaluating SEC XBRL Financial Filings. The core premise did not change, only the supporting data and therefore the summary totals. This post updates the data for the complete set of 10-K filings submitted to the SEC between March 1, 2013 and February 28, 2014.

To repeat the core premise: "Prudence dictates that using financial information in SEC XBRL financial filings should not be a guessing game. Rather; safe, reliable, predictable, automated reuse of reported financial information seems preferable."

To realize that goal, fundamental things about an SEC XBRL financial filing must always be correct. These are the minimum criteria for using the information; and therefore they should be the minimum criteria for evaluating the appropriateness of SEC XBRL financial filings.

Not meeting these minimum criteria cause the information contained in SEC XBRL financial filings to be ambiguous, to not be decipherable by automated computer processes, to yield "red flags" which indicate the information may not be trustworthy to automated computer processes, or to be unusable by such automated processes. Further, any human readable renderings derived from this information will not be usable.

In addition, violations of these criteria cause very specific issues, most are very easy to see and understand, and generally issues are very easy to fix.

The following is a summary of the minimum criteria which are necessary for an SEC XBRL financial filing in order to make use of any financial information within that digital financial report. Also provided is the percentage of situations within SEC XBRL financial filings which already meet this criteria.

- 99.9% meet the criteria of consistent XBRL technical syntax rules and are therefore fundamentally readable documents (More information | Examples)

- 97.9% meet the criteria of specified by automatable SEC EDGAR Filer Manual (EFM) rules (More information | Examples)

- 99.9% meet the criteria of consistent and unambiguous report level model structure relations (More information | Examples)

- 99.2% provide a detectable "root of reporting entity" so that information can be properly discovered using automated processes (More information | Examples)

- 99.3% provide a detectable and unambiguous current balance sheet date (More information | Examples)

- 97.8% consistenty report or provide enough information to impute 51 fundamental accounting concepts and those concepts consistently adhere to 21 basic accounting relationships (More information | Examples)

- 90.1% provide detectable roll up rules for balance sheet, income statement, cash flow statement (More information | Examples)

How do I know that these criteria are correct? Because 1,281 SEC XBRL financial filings satisfy all seven of these criteria and the foundational information in their digital financial reports is proven to be usable by automated computer processes. These 1,281 public companies are digital financial reporting all stars.

What is even more interesting than the 1,281 examples where you can use these digital financial reports is the fact that the gap between the others which do not meet these criteria and those public companies also becoming digital financial reporting all stars because they meet this required minimum criteria is so small. Consider the following:

- 1,281 have 0 errors/issues/anomalies (these are the current all stars)

- 2,293 have only 1 error/issue/anomaly

- 1,382 have 2 errors/issue/anomaly

- 700 have 3 errors/issue/anomaly

- 433 have 4 errors/issue/anomaly

- 255 have 5 errors/issue/anomaly

Add all those numbers up and you get 6,344 or 95% of all SEC XBRL financial filings which are 5 or less errors from meeting that minimum criteria. That is 10,164 errors!

Something is worth repeating here. I am not saying that I have 100% of my criteria exactly correct. What I can say is that given my interpretation, if my interpretation were employed the system would work. However, the goal is system equilibrium, for the system to be in balance. There are three things which impact the system:

- The SEC XBRL financial filing.

- The business rules.

- The software algorithm which reads the SEC XBRL financial filing.

So basically if someone has a better interpretation of the business rules or of someone can create a better software algorithm to effectively and safely use these digital financial reports, cool. But we do need to have one agreed system, not 6674 different systems one for each of the 6674 different filers.

There is one other thing worth mentioning. I don't have this totally dialed in yet, but this is what I currently see. My perspective on these tests was the filing, the submission, the report. If you pass all the tests then "you are an all star".

But that perspective might not be correct or the best way to look at what is really going on with SEC XBRL financial filings. Perhaps a better and certainly a different perspective is looking at all the possible errors which COULD exist as compared to all the errors which DO exist.

Consider the following. In my set of 6,674 SEC XBRL financial filings I am testing there are 6,442,922 relations between the report elements contained in those filings. Of those 6,442,922 relations there are only 344 total relations which are potentially ambiguous. If I am getting my decimal points correct, that is .0054% of the total relations. The vast, vast majority of those relations are correct. This is not to minimize the errors, those errors must be fixed. But considering that very few systems adequately manage these model structure relations correctly (proof of that is ANY errors), those who are creating these reports are doing a very good job of getting these model structure relations correct.

These SEC XBRL financial filings are made up of many, many, many little pieces. All these many, many little pieces have to fit together correctly. Most of these pieces do fit together correctly.

What if we were to flip this around? The tests that I am looking at has the focus on what is wrong in the SEC XBRL financial filing. What if one were to look at what is RIGHT! Again, the point here is not to minimize the errors. Again, those must be fixed. But what I am noticing is that there are also a lot of things which are right with these digital financial reports; particularly considering that there are not nearly enough automated processes watching over the creation of the information.

To give you a perspective, there are an average of 1278 reported facts in a report. Each reported fact has a context. Each reported fact has taxonomy schema pieces, linkbase relations, lots and lots of stuff. The XBRL 2.1 and XBRL Dimensions conformance suites have probably around a thousand tests. Considering all the possible things which could be wrong and for 6674 SEC XBRL financial filings, there are 3 errors. That is really pretty amazing.

Again, don't get me wrong. In an article, XBRL Mistakes Really Hurt: Why Accuracy is Crucial for Your Company’s Communications with Financial Markets, Professor Dhananjay (Dan) Gode, a Clinical Associate Professor of Accounting at New York University’s Stern School of Business, makes the following statement:

"95% accuracy is not good enough – even 98% is not good enough"

The only way digital financial reports will work is if they are 100% accurate. The truth is that digital financial reports can be more accurate than the current financial reports created using Microsoft Word. Why? Because computers can read and therefore help accountants creating digital financial reports. Word knows nothing about financial reporting.

As you can see from my minimum criteria, digital financial reporting tools do understand financial reports. Digital financial reporting tools know that "assets = liabilities and equity". They know that assets foot. They understand the notion of the balance sheet date and can help you keep it that information consistent. Word can do none of this! And I would point out the phrase "minimum criteria". My seven criteria is only the tip of a much larger iceberg. While humans are crucial to the process of creating and even using financial information, computers can help humans if financial reports are digital.

So are SEC XBRL financial filings "half correct" or "half wrong"? SEC XBRL financial filings are far, far more than "half correct". I don't know if you can extrapolate my data onto the entire filing. My lowest category is 90.1%.

Primary Financial Statement Roll Up Computation Update, Insights Observed

Every accountant knows that assets should foot. So should liabilities and equity. Net income (loss) on the income statement foots. Net cash flow on the cash flow statement foots. Further, SEC Edger Filer Manual (EFM) rules, 6.15.2, requires that these computations be provided with SEC XBRL financial filings in the form of XBRL calculation relations.

90.1% of SEC XBRL financial filings provide these XBRL calcuations for these primary financial statement roll up computations. Pretty straight forward. This document Understanding Why Roll Ups are Missing provides what helps you understand how to see if required XBRL calculation relations are missing from SEC XBRL financial filings which support the validation/verification of these primary financial roll ups which always exist in financial statements.

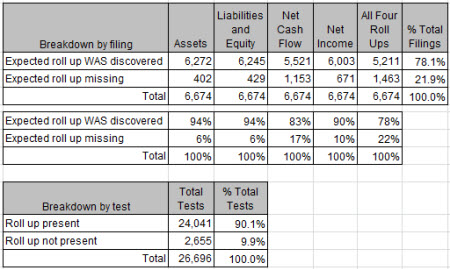

There is something which is important to understand. I will point this out for the roll up computations but this relates to all these tests. Consider this graphic which will help explain the point:

There are two ways you can view these tests: by filing and by test. If you look at this by filing, then if you don't have any one of the four roll ups, then you fail the test. If you look at this by test, each individual roll up is considered and if you have three of the four, you get "credit" for three.

I point this out so you can use this information to look at this information. There is no real right or wrong answer, you just need to understand what the information means.

This is my summary of key insights:

Insight #1: Balance sheets report assets, liabilities and equity; assets foot; liabilities and equity foots. Income statements report net income (loss); that foots as well. Cash flow statement report net cash flow; and that foots as well.

Insight #2: If you are looking at this basic financial information and you can verify that these roll up computations work as expected, your trust of the information when you send it to some automated process, which might do a comparison or something, can be much higher because everything seems to work as you expect.

Insight #3: Each of these roll up computations is required by SEC EFM rules.

Insight #4: There is no "technical" reason that these XBRL calculations cannot be expressed and verified to be consistent. If someone thinks there is some reason they cannot express these correctly and therefore they leave them out, they make a mistake in their representation of the information in XBRL. If the representation mistake is corrected, then the XBRL calculations can work correctly.

Digital Isn't Software, it is a Mindset

Thinking digital is the paradigm that is winning.

Aaron Dignan's presentation insightful presentation Digital Isn't Software, It's a Mindset helps grasp your future.

The most dominant companies, no matter the industry, are digital-first. Think Netflix over Blockbuster or iTunes over Tower Records. So how can we take advantage of this trend in our work and with our own projects?

Aaron Dignan walks us through how we can have the right mindset to thrive in the future: We need a purpose, a process to support it, the right people, and (most importantly) these need to combine to make products that serve a community larger than any employee or organization. Dignan shows off plenty of examples and tells us what to adopt for our own work. “When we look at the companies that are really dominating, this is what they are doing.”

How do you do what you do? What is your operating model? PURPOSE that applies PROCESS to support PEOPLE who make PRODUCTS that grow into PLATFORMS that serve a community larger than any employee, department, or organization.