BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from April 24, 2016 - April 30, 2016

Updated Digital Financial Reporting Principles Document

I have updated the document Digital Financial Reporting Principles.

Looking at individual XBRL-based financial filings is helpful. Looking across many, many XBRL-based financial filings with a focus on specific aspects of that financial report is likewise beneficial. Carefully and consciously comparing and contrasting many XBRL-based financial filings helps one build a mosaic, increasing ones understanding of digital financial reports even more. Consciously comparing and contrasting XBRL-based financial reports helps one see and understand important and insightful information about those XBRL-based financial reports.

Digital Financial Reporting Principles offers the following important information:

- Conceptual overview of an XBRL-based, structured, digital financial report

- Framework and theory for thinking about a digital financial report

- Reference implementation of XBRL-based digital financial report

- Summary of common sense digital financial reporting principles

If you believe that digital financial reporting will play a role in the future of financial reporting, then this document will help you. Whether you are a professional accountant trying to get your head around this new technology or a software vendor trying to build useful software that professional accountants; Digital Financial Reporting Principles will help you find your niche.

Machine-readable Information About Public Company Subsidiaries (Prototype)

Public companies provide information about subsidiaries to the SEC as an exhibit to their 10-K filing. Using Microsoft as an example, if you go to their SEC filing page, look for EXHIBIT 21 and you will see their list of subsidiaries.

But there is a bit of a problem. That list is not machine-readable. But what if the information were provided in a machine-readable format, such as XBRL.

I created a prototype of that machine readable list of subsidiaries.

I arbitrarily picked the comany XCEL ENERGY INC. Here is their SEC filing page. Here is their EXHIBIT 21 which shows their list of subsidiaries. Here are the pieces of the prototype:

- Define arcroles: The first thing I did was define the arcroles that I need to represent the relationships. There are TWO types of relationships. The first is the relation between a parent company and a subsidiary. The second is the state of incorporation and the company that is incorporated in that state. Here are those two arcroles defined in an XBRL taxonomy schema. (This is a prototype set of arcroles; these really belong in the XBRL International Link Role Registry.)

- List of entities: Next, I created a list of entities. I did that using an XBRL taxonomy schema. That also includes labels for each entity and documentation that explains the PURPOSE of each subsidiary which XCEL included in their EXHIBIT 21. (Now, this taxonomy schema is not properly modularized; I would have to think about exactly how to do this; but that is just an organization and maintenance issue.)

- List of states: I am going to need a list of states to indicate the state of incorporation. Here is that XBRL taxonomy schema.

- Represent the relations: Next, I represented the relations. I did that using an XBRL definition linkbase. It is in that XBRL definition linkbase that the list of subsidiaries is represented and the state of incorporation is represented by creating those relations. Basically, the XBRL definition arcroles are used to express the relations between the subsidiaries and states of incorporations expressed in the XBRL taxonomy schema and those relations are stored in an XBRL definition linkbase.

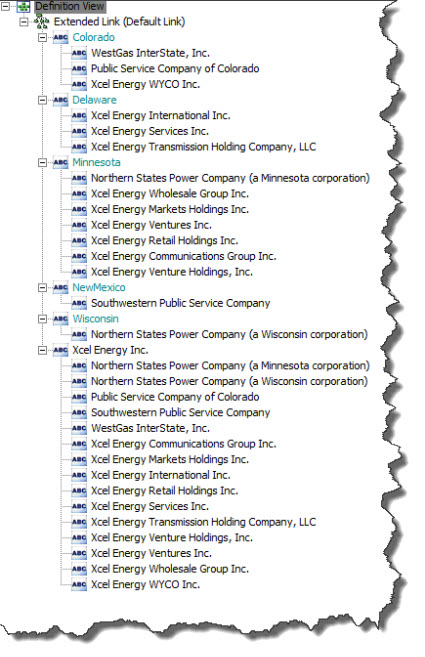

Here is what the relations look like in an off-the-shelf XBRL Taxonomy creation tool: (this does not show the arcrole that expresses the relation, that is shown as a popup.

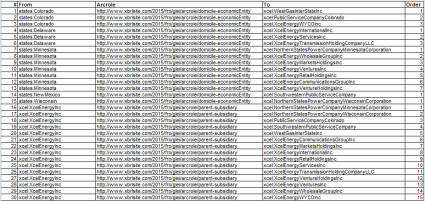

That can be a bit hard to read. Here is exactly the same information imported into an Excel spreadsheet:

So there you go; information that is both human-readable by simply rendering the information in HTML on the SEC web site, or machine-readable.

Pretty much any type of relation can be represented using this approach. Here are some other types of relations between entities or related to entities that could be represented in a similar manner.

You could do this exact same thing using RDF/OWL but those tools are harder to understand than XBRL tools. Frankly, which technical syntax is used matters less. Having the information in some machine-readable form (that is also human-readable) rather than only in human-readable HTML documents that require significantly more work to make use of the information the documents contain.

Digital!

Updated Commentary Linkbase for US GAAP XBRL Taxonomy

I have updated the commentary linkbase(s) that I have been experimenting with for the US GAAP XBRL Taxonomy. Here are three versions for the 2013, more for 2013, 2014, 2015, and 2016 US GAAP XBRL Taxonomy.

Here is a prototype references linkbase for 2013.

I will explain this more later.

Updated Reference Implementation of XBRL-based Filing to SEC

I have updated what I call my reference implementation of an XBRL-based public company financial filing to the SEC. You can get to the new reference implementation here. There you will find a high quality example of an XBRL-based digital financial report with complete human-readable and machine-readable documentation.

If you gave the exact same financial information about one economic entity to ten different professional accountants; you would expect that all ten accountants would create a fairly similar financial statement for that economic entity. Each professional accountant would represent that financial information similarly in a set of financial statements in all material respects. Each accountant would create a true and fair representation of the economic entity's financial information in the financial statement they created. That is true whether the information is formatted in HTML or PDF or Word or XBRL. Right?

Try that experiment with an XBRL-based financial report. How do you think that might turn out?

How would you define "correct" or "best modeling approach"? This is how I defined correct for my reference implementation:

- Every model structure is logical and consistent. There are no inconsistent and therefore perhaps confusing or potentially misinterpreted modeling situations. All pieces of the model structure act consistently and how they interact with other pieces is well understood and predictable.

- Every computation is expressed and proven to work correctly. Every computation must be proven to work correctly by passing one or more business rules. If a computation relation exists and it is not expressed, then there is no way to tell if the computation works correctly per the XBRL medium.

- No duplicate facts. Duplicate facts result from modeling errors and therefore should not exist.

- All reported information is consistent and does not contradict other information. If there is no specific reason for an inconsistency which can be articulated which justifies the inconsistency or contradiction; then you are being inconsistent and one of the approaches must be dropped. Each report fragment should be correct and should interact appropriately with other report fragments.

- Each property is correct. Each property of any component, fact, report element, or parenthetical explanation must be correct from a business meaning or semantics perspective.

- Meaning can be logically explained to a business professional. The meaning of each and every aspect of the digital financial report can be explained, logically, to a business professional. If the meaning cannot be explained, then it cannot be considered to be correct.

- True and fair representation of financial information. Overall, the financial report needs to work. In all other ways the information expressed is correct, complete, accurate, and consistent.

If how to create a digital financial report is not well understood, then XBRL-based digital financial reports will never be usable. A digital alternative for a general purpose financial report will not magically appear. What a digital financial report ends up being will come from deliberate effort, skillful execution, and rigorous testing.

The documentation of the reference implementation will help software vendors understand digital financial reports. All the files are there for software vendors to use for testing.

Check out the reference implementation. Understand digital financial reports by analyzing and experimenting. It is through this analysis and experimentation that professional accountants will understand how to make digital financial reports work reliably and predictably.