BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from May 1, 2016 - May 7, 2016

SEC: Disclosure in the Digital Age: Time for a New Revolution

In a speech, Disclosure in the Digital Age: Time for a New Revolution, SEC commissioner Kara M Stein says that the SEC needs to do more than ask questions in concept releases, it is time for the SEC to lead. Commissioner Stein stated, "It's time to revolutionize our disclosure paradigm. Help us in that endeavor and everyone wins."

The concept release refers to this request for comment by the Securities and Exchange Commission: BUSINESS AND FINANCIAL DISCLOSURE REQUIRED BY REGULATION S-K

SUMMARY: The Commission is publishing this concept release to seek public comment on modernizing certain business and financial disclosure requirements in Regulation S-K. These disclosure requirements serve as the foundation for the business and financial disclosure in registrants' periodic reports. This concept release is part of an initiative by the Division of Corporation Finance to review the disclosure requirements applicable to registrants to consider ways to improve the requirements for the benefit of investors and registrants.

I would encourage you to read commissioner Kara M Stein's speech. Notice her call for a 'revolution' as opposed to an 'evolution'. Commissioner Stein concludes her speech with this call to action:

We need to create a Digital Disclosure Task Force. The Digital Disclosure Task Force should include investors, analysts, academics, companies, and technology experts. Together, we can envision what disclosure should look like in the Digital Age so that we can continue to have the premier capital markets in the world.

Clearly I agree with commissioner Stein. I published my Digital Financial Reporting Manifesto months ago. My document Digital Financial Reporting Principles summarizes five years of poking and prodding XBRL-based public company financial filings to the SEC. I hopes this information can help contribute to making XBRL-based structured digital financial reporting in the US the best in the world.

Don't really understand what structured digital financial reporting is all about? Then read this Conceptual Overview of an XBRL-based, Structured, Digital Financial Report. It will help get you understand what disclosure in the digital age is all about.

Automating Accounting and Reporting Checklists

The global consultancy firm Gartner classified XBRL as a transformational technology. Gartner defines transformational as something that:

"enables new ways of doing business across industries that will result in major shifts in industry dynamics"

As I pointed out in my book, XBRL for Dummies, major shifts means lots of change and some winners and some losers.

One shift will be related to what professional accountants call the "disclosure checklist".

Accountants creating financial reports often use accounting and reporting checklists or "disclosure checklists" as memory joggers to help them get the reports right. Where can you get these disclosure checklists?

- EY has checklists for IFRS and US GAAP.

- KPMG has checklists, here is one for IFRS.

- PWC has checklists, they call them automated disclosure checklists.

- Deloitte has checklists for IFRS and model financial statements.

- BDO has checklists for IFRS and model financial statements.

- Thompson Reuters has the PPC SMART Practice Disclosure aids.

- The American Institute of Certified Public Accountants (AICPA) has numerous resources including this disclosure checklist for SMEs (small and medium size entities)

- CCH, a division of Wolters Kluwers, has AutoCheck: Automated Disclosures Checklists.

- Willy GAAP, a popular reference resource used by professional accountants, has a Disclosure Checklist for Commercial Businesses included as Appendix A of every copy.

- ICEAW has a nice summary of checklists and models for IFRS.

My point being: accountants use accounting and reporting checklists.

But, as wonderful as all these checklists, models, and examples are and as much as people say they streamline the process of creating financial reports; the checklists are memory joggers used by humans in the manual-oriented process of creating financial reports. These disclosure checklists were created in an era when financial reports were unstructured.

What if there was another way? What if the work practices of professional accountants changed. What if financial reports where machine-readable structured information? What if software used to create financial reports actually understood what a financial report is?

If you don't know what a digital financial report is or how they work, read this Conceptual Overview of an XBRL-based Structured Digital Financial Report.

OK, so you read the conceptual overview. You read the part which talked about CAD/CAM. Let me go over that again:

Architectural objects have a relationship to one another and interact with each other intelligently. For example, a window has a relationship to the wall that contains it. If you move or delete the wall, the window reacts accordingly.

In addition, intelligent architectural objects maintain dynamic links with construction documents and specifications, resulting in more accurate project deliverables. When someone deletes or modifies a door, for example, the door schedule can be automatically updated. Spaces and areas update automatically when certain elements are changed, calculations such as square footage are always up to date.

How is it possible for CAD/CAM software to understand a blueprint and that windows go into walls? Because the CAD/CAM system is an expert system. How does software actually interact with the user of the software? Well, you have two primary things: (a) a business rules engine which reads machine-readable metadata which enforces relationships of objects, and (b) you have the metadata itself which expresses the knowledge to the software.

Microsoft Word and Excel, which are used to create 85% of all financial reports, know absolutely nothing about what a financial report is. But what if you had the business rules engine and the metadata and the application you were using did understand the mechanics and dynamics of a financial report. The business rules engine works together with a finite-state machine to help the software user create financial reports correctly.

You put all this stuff together which is basic knowledge engineering and you get an expert system for creating financial reports. Now, you do have to put the pieces together correctly. That takes deliberate, conscious effort, skillful execution, and attention to detail.

Will this actually work? Will artificial intelligence have an impact on financial reporting? Well, here is a prototype of the disclosure metadata. That is piece "(b)" above. I know of at least two software vendors actively working on piece "(a)". The metadata without software won't do much; software without metadata won't do much; but put the two together the result will seem like magic. But it really is not magic, just knowledge engineering basics.

This provides an overview of the metadata (that creates the magic):

- The fact for the total inventory is reported using the concept "us-gaap:InventoryNet". (You will find that here in this information from the US GAAP Financial Reporting XBRL Taxonomy)

- If you find that concept, you would also expect a breakdown of inventory, either on the balance sheet or in a note. I gave that disclosure a name, InventoryNetRollUp. (I gave all the disclosures names)

- This shows you how to create the inventory roll up. Of course, the application will help you.

- The application knows that the disclosure is a roll up because of this metadata; so the computer will check that.

- That disclosure has mechanical qualities that can be enforced using rules. One rule is that it is a roll up. Here is that and other business rules in human-readable form; and here they are in machine-readable form.

- Here are a bunch of entities that report that disclosure. You can use that to help you figure out how to create your disclosure. (Here is another version of the same information.)

- If you have that roll up of inventory components, you also need the inventory disclosure.

- This is the stuff that needs to go in the inventory disclosure.

- Here are some examples of the inventory disclosure.

- If you have that roll up of inventory components, you also need the inventory policy. (But I don't have that metadata yet).

- Here is a comparison of the inventory disclosure information for the 10-K of 6,466 public companies, you can see the patterns in the information using this Excel spreadsheet. Here is an SECXBRL.info query which shows you how to grab information from this information repository. (XML version of same query)

That should give you a pretty good idea of how the mechanical stuff works. Of course, the computer has no judgement so a professional accountant still needs to do the hard stuff. But the routine, mechanical, repetitive, mundane tasks; the computer can handle that. No magic.

Some people call this disclosure management. Others call it structured digital reporting. I call it digital financial reporting. Digital financial reporting is the future of financial reporting for many reasons. Digital isn't software, digital is a mindset.

There is a risk to noncompliance to accounting and financial reporting rules. Automating the routine, mechanical, repetitive, mundane tasks related to accounting and reporting checklists saves time and money. Can everything be automated? Certainly not. But many of the routine, mechanical, repetitive, mundane tasks involved in accounting and financial reporting can and more importantly will be automated.

WHAT MORE DETAILS? Consider this one specific rather complex disclosure. This helps you see the business rules. This helps you understand the metadata for enforcing the business rules. This blog post walks you through the details for this one disclosure.

Prototype XBRL-based Digital Financial Report Disclosure Checklist

It is just a shell right now, but I have a prototype digital financial reoprt disclosure checklist. Here is the schema. If you look at the bottom of each disclosure, they show the list of manual disclosure checklist items. Checklist items only exist for a few disclosures: Basis of reporting, Inventory, Document information.

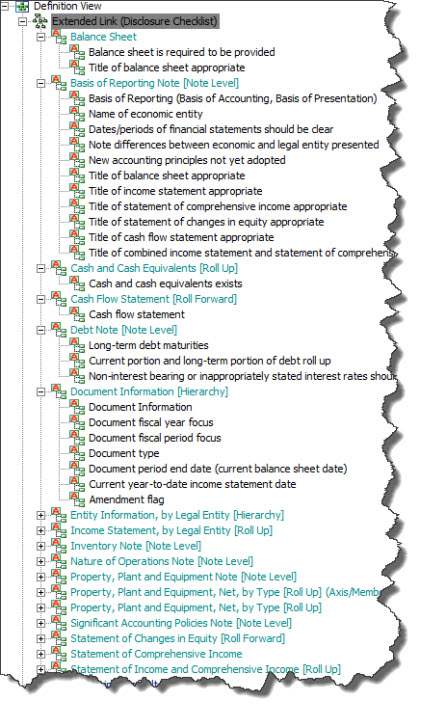

Here is a screen shot of the XBRL definition relations which represent the relations between each disclosure and the disclosure checklist items:

The next step is to connect the automated disclosure checks and the manual disclosure checks into one comprehensive set.

This disclosure viewer incorporates these manual disclosure checklist items.

The Economist: Sweet Little Lies

The Economist published a story, Sweet little lies, How to read between the lines of companies’ accounts in which they describe the corporate earnings season as:

a carnival of confusion, obfuscation and fibbing

This article is worth reading.

Similar article from the New York Times, Fantasy Math Is Helping Companies Spin Losses Into Profits.