BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from August 28, 2016 - September 3, 2016

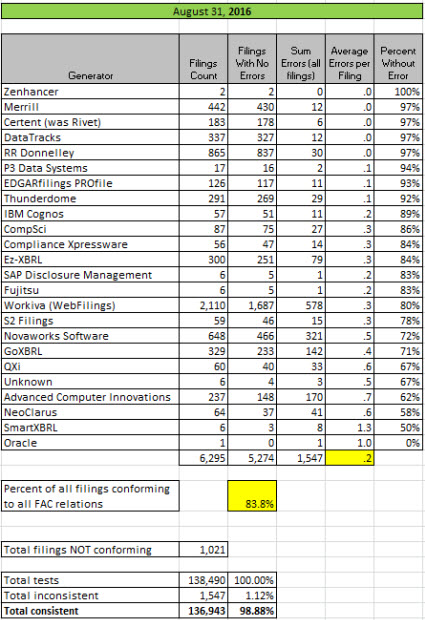

Public Company Quality Continues to Improve, 8 Generators above 90%

The quality of XBRL-based public company financial filings continues to improve steadily. Now, 8 software vendors/filing agents are in the range where 90% of more of their reports are consistent with all of the fundamental accounting concept relations.

EDGARfilers PROfile was the most recent filing agent to reach the 90% level of quality. They were at 76% back in March 31, 2016, moved to 82% at June 30, 2016; and climbed to 93% consistency as of the end of August 2016.

As I pointed out in another blog post, consistency with the XBRL US Data Quality Committee validation criteria averages about 81.7%.

* * * PRIOR RESULTS * * *

Previous fundamental accounting concept relations consistency results reported: June 30, 2016; March 31, 2016; February 29, 2016; January 31, 2016; December 31, 3015; November 30, 2015; October 31, 2015; September 30, 2015; August 31, 2015; July 31, 2015; June 30, 2015; May 29, 2015; April 1, 2015; November 29, 2014.

Framework for Understanding Digital Financial Report Mechanics

A framework is a set of principles, assumptions, ideas, concepts, values, rules, laws, agreements, and practices that establishes the way something operates. A theory is a tool for understanding, explaining, and making predictions about a system. What is conspicuously missing from the minds of most professional accountants and auditors are a framework and a theory relating to how to think about digital financial reports.

The Financial Report Semantics and Dynamics Theory is what Rene van Egmond and I created to provide this framework and theory. We created the first version in early 2012. We have tuned the framework and theory over the past several years.

A CFA Institute paper calls for broader and deeper use of structured data (page 5). In the paper the point out that the currently inefficient system of creating financial reports (page 5) is focused on human consumption of the information, not machine-readable information (page 1). In the paper they call for increased education of professional accountants and auditors (page 16). The CFA Institute calls for structured data to be applied earlier in the financial report creation process to achieve the promised benefits of such machine-readable information (page 3).

Overall, the CFA Institute paper is excellent and provides a good vision for the future. One thing the paper does not provide is an explanation of exactly what a machine-readable structured data report is. I provide that explanation here, Conceptual Overview of an XBRL-based, Structured Digital Financial Report.

One mistake people tend to make is to look at a structured digital financial report from the perspective of what they know today and how financial reporting works today. Another approach is to learn a few new things which allows a better perspective. The document Comprehensive Introduction to Knowledge Engineering for Professional Accountants is a synthesis of all the things I have learned which I found helpful in getting my head around XBRL and how to use it properly. This involved a lot of poking and prodding of what others have done to see what works, what does not work, and figure out how to put all the pieces together and create something that is useful. This document helps professional accountants and auditors understand the increased education they need. Don't fall for the "Learn to code" hysteria.

There are three pieces that are so critical to gaining a proper understanding that I went into additional detail in these three areas.

The first area is business rules. The document Comprehensive Introduction to Business Rules for Professional Accountants summarizes this information. This is important because it shows the vital role business rules play in making machine-readable information usable.

The second area is artificial intelligence and intelligent software agents. The document Comprehensive Introduction to Intelligent Software Agents for Professional Accountants summarizes that information. This is important because it helps you see the true potential of artificial intelligence. Overly optimistic or overly pessimistic views both problematic.

The third area is expert systems. The document Comprehensive Introduction to Expert Systems for Professional Accountants summarizes that information. This is important because it help you see the true potential of artificial intelligence. Again, overly optimistic or pessimistic views are both problematic.

Understanding what a problem solving logic helps you understand what you need a computer to do for you. The document Comprehensive Introduction to the Notion of Problem Solving Logic for Professional Accountants summarizes this information. XBRL and XBRL Formula processors should use common, standard problem solving logic. Also, XBRL Formula processors need to support common problem solving logic.

If you want to understand the fundamental difference between structured and unstructured information, watch the five minute video, How XBRL Works.

I will add one final piece for those that want to dig in a little deeper. If you want to understand the XBRL technical syntax, a very good overview of that is provided in Chapter 4, An XBRL Primer in XBRL for Dummies.

I thank all of those who helped me accumulate this information. What is next? As Henry David Thoreau says: "Simplify, Simplify". Per the Law of Conservation of Complexity, complexity cannot be removed from a system; but it can be moved. Good software will hide the complexity of XBRL-based structured data.

If you know of a better framework for understanding XBRL-based digital financial reporting mechanics, please send the information my way. I am always trying to improve.