BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries in Creating Investor Friendly SEC XBRL Filings (222)

US GAAP XBRL Taxonomy Missing Approximately 50% of Level 3 Text Blocks

The US GAAP XBRL Taxonomy provides 454 Level 3 Text Blocks. In the taxonomy these are called [Table Text Block]s. These Text Blocks are used to provide human readable HTML for a specific disclosure. You can find a list of these Level 3 Text Blocks in the Comprehensive Text Block List in the US GAAP XBRL Taxonomy.

(Click on image to go to US GAAP XBRL Taxonomy)

(Click on image to go to US GAAP XBRL Taxonomy)

The US GAAP XBRL Taxonomy and SEC EFM use inconsistent terminology, so it is worth making sure we are on the same page here. What the US GAAP XBRL Taxonomy calls a "Disclosure Text Block", the SEC calls a "Level 1 Text Block" or a "Footnote as a Text Block". Level 2 Text Blocks are policies. Level 3 Text Blocks provide human readable HTML at the level of an individual disclosure. And finally, Level 4 Detail provides individual detailed facts for an individual disclosure. All this is explained in the SEC Edgar Filer Manual (EFM) section 6.7.12.

And so, the US GAAP XBRL Taxonomy says that there are 454 possible disclosures because they provide 454 Level 3 Text blocks ([Table Text Block]s).

Well, I went through the US GAAP XBRL Taxonomy and tried to identify each individual disclosure and I came up with about 957 total disclosures. That number includes a handful of statements, 129 Level 1 Text Blocks (Note Level), a handful of Level 2 Text Blocks (Policy Level), and a few odds-and-ends which really are not individual disclosures. As such, I will adjust the total number of true disclosures down to this approximate number: 807.

I will also point out that my list includes only disclosures for commercial and industrial companies. I am not including disclosures for banks, insurance companies, broker-dealers, and so on.

And so the US GAAP XBRL Taxonomy indicates that there are 454 disclosures, I can point out about 807. It is my guess that my list of 807 disclosures is off by between 50% and 100%. That is just an educated guess, hard to come up with an exact number without going through every public company filing and trying to identify every disclosure (which I am working on now). But my guess is based on work trying to determine all the different types of primary financial statements (what I call report frames, this document helps you understand report frames).

There is a relationship between the Level 3 Text Block and Level 4 Detail disclosures. Look at three examples which I created for fairly common disclosures:

- Inventory, Net: Roll up of the components of inventory.

- Property, plant and equipment components: Roll up of the components of PPE.

- Long-term debt maturities: Roll up of the maturities schedule of long-term debt.

Looking at rather uncommon disclosures also points out that text blocks are missing from the US GAAP XBRL Taxonomy. Here is an example:

- Capitalized Computer Software Roll Forward: Roll forward of capitalized computer software.

Looking at both the Level 3 Text Blocks and the Level 4 Detail for disclosures helps you understand if pieces are missing from the US GAAP XBRL Taxonomy.

Mastering Digital Financial Report Disclosures

While comparing and contrasting the fundamental accounting concepts reporting entities use helps you understand and verify basic relationships which are generally reported on the primary financial statements; the same ideas apply to disclosures. This blog post will help you understand how to understand disclosures within a digital financial report such as an SEC XBRL financial filing.

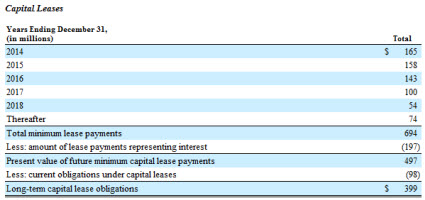

Take the disclosure future minimum payments under capital leases. (Here is documentation which provides details of this information provided below; here is an Excel spreadsheet with the summary.)

In order to understand this disclosure I looked at the Fortune 100 companies which provided the disclosure future minimum payments under capital leases. There were 35 entities in the Fortune 100 which provided that disclosure. (The other 65 don't have this disclosure because they don't have capital leases.)

Of those 35 entities which have this disclosure I will use Delta Air Linesbecause they were one of 21 entities which I believe created a logical, rational, sensible representation of this information. So 60% of those 35 entities represented this information consistently in all aspects and also consistent with what US GAAP says as I understand it.

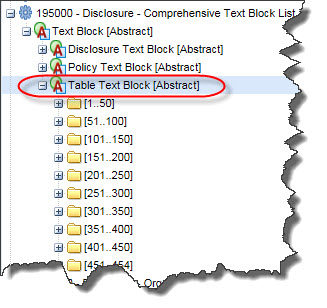

First, they will provide a Level 3 text block with this disclosure as required by the SEC. They will also provide a Level 1 text block, but I am not analyzing that, only the Level 3 text block and the Level 4 detailed disclosure. Here is that Level 3 text block for Delta: (us-gaap:ScheduleOfFutureMinimumLeasePaymentsForCapitalLeasesTableTextBlock)

From the analysis you will note that only 6 other entities which reported this disclosure used that concept. There were 24 entities which created an extension concept. Why? Well, because (a) they combined the presentation of the capital lease and operating lease future minimum payments disclosure and (b) there is no text block concept for that combined disclosure. That seems to indicate, perhaps, that there is a concept missing from the US GAAP XBRL Taxonomy.

So, here is what the combined disclosure looks like (using American Airlines):

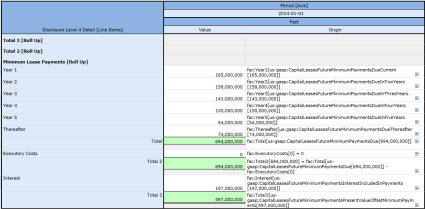

OK, back to Delta. They also need to provide a Level 4 detailed disclosure. Here is that information:

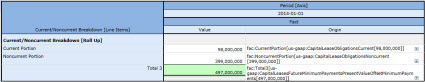

Notice that the numbers in the detail match the numbers in the text block. But that is not all of the numbers. Notice that at the bottom of the Level 3 text block there is a current/noncurrent breakdown of the total capital lease obligation. I show that separately, here is that part of the disclosure:

The reason I separate this is that personally, I consider this two disclosures. The first disclosure is the future minimum payments under capital leases. The second disclosure is the breakdown of the current and noncurrent portions of the total capital lease obligation. Sometimes the current/noncurrent breakdown ties to the balance sheet line items. Sometimes, as in Delta's case, it does not. Other times this can tie to other things.

This new tool provide by XBRL Cloud can help you visualize these pieces. It is worth checking out.

If you work through that analysis document (this PDF), you can see that comparing and contrasting how different reporting entities represent the same information and you can learn lots of useful things. Here are some things that seem straight forward to me:

- While there are 6 entities which use the prescribed concept, 24 entities combine the operating and capital lease disclosure and create an extension concept, 4 other combined operating and capital lease disclosures and us an OPERATING LEASE related text block, and a handful of others combined the capital lease disclosure with something else. What does that mean? Should all these permutations and combinations be added to the US GAAP XBRL Taxonomy? Or, alternatively, should the text block always be provided separately? Or, is there some other solution to this situation?

- The concepts us-gaap:CapitalLeaseObligations (which 12 filers use) and us-gaap:CapitalLeasesFutureMinimumPaymentsPresentValueOfNetMinimumPayments(which 19 filers use) appear to be representing exactly the same thing. Seems to me that one of these concepts should be removed from the US GAAP XBRL Taxonomy.

- It seems to me that US GAAP requires the disclosure of the current and noncurrent portions of the total capital lease obligation. Most filers provide this, 18 of the 35. A handful are not required to report the breakdown because they provide an unclassified balance sheet. You can sometimes sort this out by subtracting the long term debt portion from the long term debt and capital lease obligation portion to arrive at the capital lease obligation portion. But sometimes you cannot.

- The US GAAP XBRL Taxonomy provides concepts for the executory costs and interest portions which are used to arrive at total future net minimum payments. One filer includes the line item "unamortized fair value adjustment" in computation of net minimum payments. If that is correct, then there is a concept missing from the US GAAP XBRL Taxonomy. If it is not correct, then that is a reporting error. Two filers combined executory costs and interest. Is that correct? If so, that combined concept is missing from the US GAAP XBRL Taxonomy.

There is a lot more that can be gleaned from the analysis. There are also a lot of other documents which analyze disclosures here, see the section "Disclosures". Of particular interest are property, plant, and equipment components by type; property, plant, and equipment estimated useful lives; and long term debt maturities.

Those will set you on the right course for becoming a master of XBRL-based digital financial report disclosures. While I walked you through one disclosure, these same ideas apply to other disclosures also.

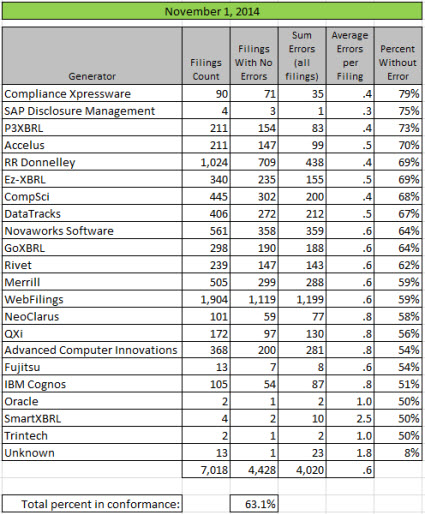

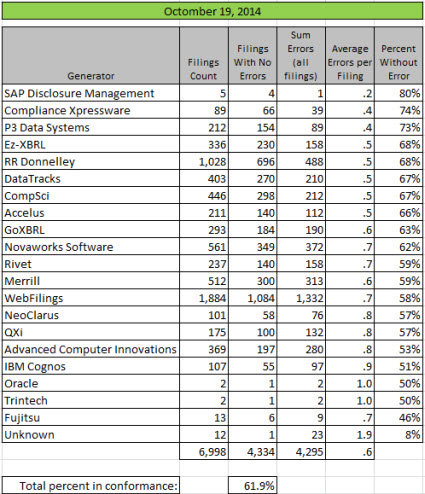

Public Company Conformance to Fundamental Relations Grows to 63.1 Percent

Because it is so easy now and because a fair amount of filings are submitted at the end of October, I re-ran my analysis of fundamental accounting concept conformance. The percentage of public companies who conform to all of these relations is up to 63.1%. This graphic shows breakdown by software vendor/filing agent:

Ask yourself a question: Why exactly would conformance to accounting relations differ by software vendor or filing agent? Think about that.

Not a big percentage change, but not bad either for just about two weeks. The graphic below shows a comparison of analysis results for: March, September, October, and November. (Click the image to get a larger readable view)

My testing tools continue to improve. One of the leaps that I will start making is from using one set of fundamental accounting concept relations that all filers fit into, to multiple hierarchies of relations. I have always known that there is not one set of fundamental accounting concepts, there are many sets. The data shows that about 90% of public companies all into about 10 to maybe 15 groups. I may, or may not, be able to then reconcile all of these groups together into a "super" set of fundamental accounting concepts which allows comparison across groups.

The exact number of groups will become clearer and clear as the public companies are put into groups. These are the primary groups that I have thus far. You can look at this as "industry sectors" or "accounting activities" or "industry audit guides". The point is, there are groups:

- commercial and industrial companies (most public companies, about 85% of all companies)

- interest based revenues (about 610 public companies identified so far such as banks)

- insurance based revenues (about 50 public companies identified so far, insurance companies)

- securities based revenues (about 100 public companies identified so far such as brokers/dealers in securities

- real estate investment trusts (about 130 public companies identified so far, all REITs)

- funds and trusts (about 375 public companies, no interest in these)

Each of these different types of reporting entities, or industry types or types of accounting activities, report in specific ways. From what I am seeing thus far, the most consistent and correct right not is interest based reporting. About 70% of all banks follow one consistent pattern and have complete conformance to that specific/specialized set of fundamental accounting concepts.

I am going to publish these specific/specialized sets of fundamental accounting concepts here with the rest of the information I am publishing on this topic.

One of the most interesting things that this exercise will provide is an "inventory" of the reporting flexibility which is employed by public companies. For example, see this analysis of all the places public companies report income (loss) from equity method investments.

Professional accountants, ask yourself a question. Where you aware that there were so many different places you could put that line item? Personally, I had no idea this level of flexibility existed and pretty much every accountant I have talked to was a little surprised. Was this flexibility an intended, conscious choice by those writing the accounting standards or was it caused by poor attention to detail in writing the standards? I don't know, I am simply asking the question. If you know or have an opinion, leave me a comment.

What if you could see all of this flexibility, organized by industry activity grouping? I think that is a useful tool. What do you think?

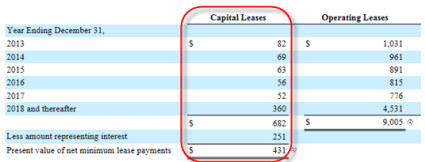

Public Company Conformance to Fundamental Relations Grows to 61.9 Percent

Back in April 2014 as part of the minimum criteria testing I was doing, I observed that the percentage of public company filings which conformed to all of the fundamental accounting concept relations was 25.6% (1711 filers).

Last month I pointed out that the percentage of public companies which conformed to all of these relations was 53.1% (3863 filers).

I ran the same test for the last filing of every public company which reports to the SEC today and the percentage that conform to all of the fundamental accounting concept relations is now at 61.9% (4334 filers). You can see the graphic below which breaks this information out by generator (filing agent or software used).

This rapid growth rate is expected to continue for three reasons:

- These relations between fundamental accounting concept relations is not really controversial and it is increasingly easy to understand and correct the errors.

- I have provided a substantial amount of information here which helps those who want to correct these issues. This recently added analysis shows that each of these tests can precisely detect not only nonconformance to these relations, but also generally the reason for nonconformance.

- I know of at least one commercial implementation of software which can be used to detect and therefore correct these issues, XBRL Cloud. This testing will appear on XBRL Cloud's Edgar Dashboard at some point.

If you look at the numbers below and compare them to the prior results you will see that pretty much every generator is improving. I pester software vendors to include this testing in their products to help them understand that their software can help external financial reporting managers avoid errors like these. But more importantly, I am trying to get software vendors to realize that this is only the tip of a much, much bigger iceberg. This is a digital disclosure checklist summary which I created several months ago. This shows you where things are headed.

These rules may seem annoying to software vendors. I can tell you two things. First, external financial reporting managers already have to comply with these rules. They are just doing so using time consuming and expensive manual processes. Second, automate these tasks by leveraging the XBRL-based structured information and you will provide something very useful: reducing the risk of noncompliance.

It is these rules which will make the quality of public company financial information submitted to the SEC to be at a level to make it safely, reliably, predictably usable by machine-based automated processes. If you don't understand digital financial reporting, the risk of becoming a relic of the past is increasing every day.

(Click image for larger view)If you don't want to become a relic of the past era of paper-based financial reporting, understand how digital financial reporting really works. Digital financial reporting is not only inevitable, it is imminent.

(Click image for larger view)If you don't want to become a relic of the past era of paper-based financial reporting, understand how digital financial reporting really works. Digital financial reporting is not only inevitable, it is imminent.

If you want to understand the moving parts and you can walk through an Excel macro, the prototype Excel application on a link at the bottom of this page can help you understand the important moving pieces.

Compliance Week: Even With SEC XBRL Guidance, Problems Persist

A Compliance Week, Even With SEC XBRL Guidance, Problems Persist, has some pretty strong statements:

“XBRL has been a failure since the beginning,” says Dave Frankel, an independent consultant with SlingStone Group, formerly with EDGAR Online. “The SEC had the right idea but didn’t commit to it fully. This latest guidance is kind of a weak attempt to get things moving in the right direction. Most in the industry are skeptical whether it will have any effect.”

“The way data quality is being managed around this whole initiative has been terrible,” he [Campbell Pryde] says. “I don’t think it could be any worse. There’s been very little communication from the SEC, so there hasn’t been a strong incentive for folks to get it correct. It’s a cycle, and hopefully the SEC attention to this should start to break the cycle.”

“I think the data is pretty useful even as it is,” Ghai says [Pranav Ghai, co-founder of Calcbench]. “Obviously changes need to be made, but we can make great use of the data, and we do.”

While the data quality situation is certainly not great, it is far, far from a failure. Currently 19% of all SEC XBRL financial filings I analyzed satisfy a set of 7 minimum criteria for making basic use of the information and 95% of all filers are 5 or fewer errors from meeting that criteria.

It will be interesting to see how many "All stars" I find for the 2014 SEC XBRL financial filings.