BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries in Creating Investor Friendly SEC XBRL Filings (222)

SEC Comments About Our Increasingly Digitally Disrupted World

The U.S. Securities and Exchange Commission (SEC) is one of the very, very few organizations which is showing leadership and vision for the institution of accountancy related to the notion of digital financial reporting.

In a speech Accountants and Capital Markets in an Era of Digital Disruption, SEC commissioner Kara M. Stein made the following comments:

Related to the important role of accountants...

Accountants’ expertise in summarizing and presenting information – that is, data – makes them ideally suited to play a crucial role in ensuring the reliability and accessibility of the data that now drives our capital markets.

Use of common taxonomies...

For example, companies should use common taxonomies to provide up-to-date, accessible, and transparent information to investors. This is where reporting and standards can be reimagined in the new digital world. Let’s think seriously: how should the delivery of information change in the digital age? How should investors access information? Should it be pushed to them every few months, or should it be available on-demand?

Enhancements offered by technology...

Further, technology can enhance both the delivery and usability of financial reports. Most companies keep their financial reporting data in structured databases. However, the data is often presented to investors and financial statement users in an unstructured manner.

Accountants can and should be driving innovation:

A lot has changed since the early 1880s. But just as the industrial revolution drove and accelerated growth, the digital revolution is driving change. Accountants have a unique role to play in our capital markets. With this role comes the responsibility to move forward with strategies to help businesses, investors, and regulators in an increasingly digitally disrupted world. Accountants can and should be driving innovations to enhance transparency, accessibility, accountability, and to promote further trust in the integrity of our capital markets.

Yet, despite all the change, at the end of the day, some things remain constant. This Institute represents a special heritage - a commitment to the public trust that you bring to wherever you work, be it in accounting, management, as investors, or in other capacities.

Others should follow the SEC lead. If the digital financial report is a good thing for public companies, why would it also not be a good thing for financial reporting in general? My personal vision is that of the digital general purpose financial report. Have a look at my personal manifesto. That is where I am going. If anyone has any ideas that would improve my vision, I would love to hear them.

Reimagine financial reporting. Join the 31 others who like this idea! Hard group to sell? Not really. Look at all those who are on the quality band wagon. While digital financial reporting has to earn its right to exist, it is fast proving its worth. Its not about volume of understanding, it is about quality of understanding.

What have you done lately to help move the world closer to digital financial reporting? Or, are you holding onto the practices of the early 1880s?

Getting Data Quality Committee to Leverage Fundamental Accounting Concepts

One of the significant issues with XBRL-based public company financial reports to the SEC is that there is no one set of consistency checks that everyone uses to check their digital financial reports. The SEC has its Edgar Filer Manual (EFM) tests (interactive data public test suite), XBRL-US has their consistency suite, XBRL Cloud has their tests, I have my fundamental accounting concepts and minimum criteria tests, and I suppose that each software vendor has proprietary tests and checks that they do.

What there really needs to be is ONE set of consistency checks that is used by everyone, not different versions of tests and checks which cause different versions of consistent and inconsistent.

I have made available all of my fundamental accounting concepts work free of any restrictions at all to XBRL US or anyone else for that matter. I really hope they take advantage of that work. I would encourage everyone to encourage the XBRL-US Data Quality Committee to consider leveraging this work.

All of this can be downloaded here. Perhaps what I am doing is more sophisticated that what XBRL-US is doing right now or willing to take on. However, the fundamental accounting concepts offers important information about how to best create the US GAAP XBRL Taxonomy and tests which will be important down the road.

I don't know if people remember my state-of-the art example of using XBRL definition relations. These are more along the lines of what is really needed to get XBRL-based digital financial reports dialed in correctly. Those consistency checks will make more sense when software starts guiding professional accontants in the creation of financial reports (i.e. expert systems).

People will eventually figure this out. What about you? Are you going to be proactive and therefore ahead of the curve or are you going to be reactive and therefore behind the curve playing catchup?

Each strategy has it pros and cons. But either way: things are about to change big time.

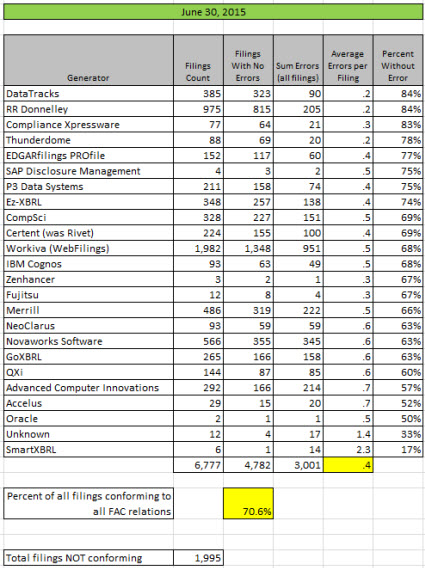

Public Company Quality Improves Yet Again, Three Generators Reach 80%

The quality of public company XBRL-based digital financial reports increased yet again. This month 3 generators (software vendors, filing agents) reached the point where 80% or more of their filings where consistent with a set of fundamental accounting concept relations.

A few data points are worth pointing out. First, the sum of errors in all filings related to these fundamental accounting concept relations is about to drop below 3,000. Right now, the sum of all errors is 3,001. Contrast that to the 12,259 total inconsistencies for the 2013 10-Ks and and 4,463 total inconsistencies for the 2014 10-Ks.

Second, if you look at the graphic on the very bottom you can see that consistency with each test is now above 95% for every test except for one which is at 94.98%. Next month, every test will likely be above 95%.

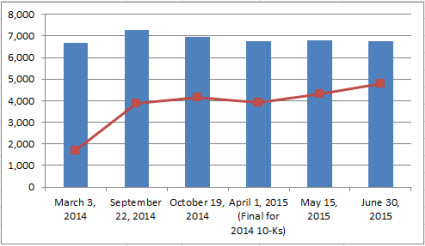

Here is a comparison across time which shows total reports as the blue bar and total number of 100% consistent public company XBRL-based financial reports which is the red line:

Here are the results summarized by generator:

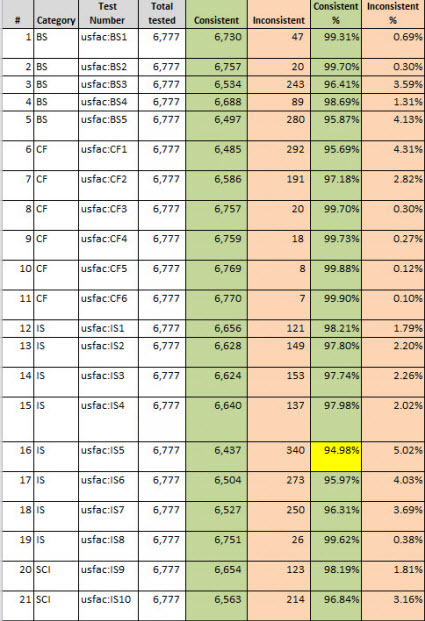

Here are the results summarized for the individual tests:

(Click image for larger view which includes test description)

(Click image for larger view which includes test description)

You can find the human-readable and machine-readable versions of of the consistency checks used to test these fundamental accounting concept relations here.

I am changing the way I evaluate consistency with these fundamental accounting concept relations tests slightly going forward. In the past, I have combined the consistency checks with the machine-readability checks. My rational is as follows. In the past I have had the mantra,

"Prudence dictates that using financial information from a digital financial report not be a guessing game."

There are two parts related to achieving machine-readability of the financial information reported by public companies. The first is the consistency of the fundamental accounting concept relations which are expected. The second is providing adequate information for a machine to be able to decipher the information.

The first, consistency with expected relations, is a US GAAP accounting issue. Basically, using the wrong concepts or mathematical errors are accounting consistency issues.

The second, the ability of a machine to be able to correctly decipher information is not a US GAAP accounting issue. There are plenty of perfectly legal US GAAP ways to report information that my rather unsophisticated algorithms for reading reported information cannot read. If the software algorithms were more sophisticated, I could read the information. Basically, public companies don't have to report so that simple algorithms can read their reported information. In my personal opinion it would be better if algorithms were easy to create, that minimizes the guessing game and increases the probability of software vendors creating software get algorithms right.

And so, I have found a way to distinguish these two different things. I will explain this next month when I roll this new approach out. Also, because the number of inconsistencies is getting so low, I am able to summarize every inconsistency category. This will help understand inconsistencies and tune the US GAAP XBRL Taxonomy. Stay tuned.

XBRL-US and Members Take on Data Quality

XBRL-US and five members including Merrill, RR Donnelley, RDG Filings, Vintage, and Workiva have organized to take on the quality of public company XBRL-based financial filings to the SEC. See this blog post by XBRL-US.

Public Company XBRL-based Digital Financial Report Quality Continues to Improve

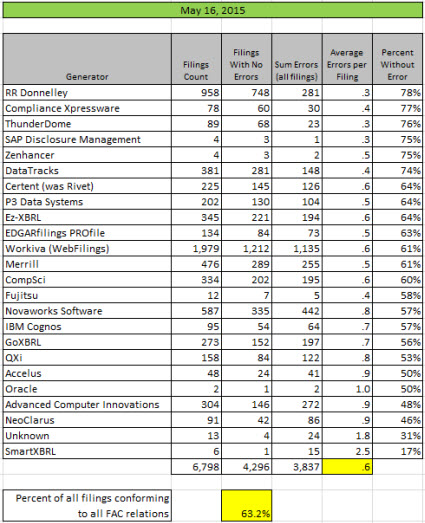

The quality of public company XBRL-based financial reports submitted to the SEC continues to improve. The last measurement of a specific set of fundamental accounting concept relations showed that 58% of all such public company financial reports were consistent with expected basic accounting relations. That consistency rate has increased 5% to 63%. The average number of inconsistencies per financial report (for my set of relations) has decreased from .7 per report to .6. The total number of inconsistencies dropped by 626.

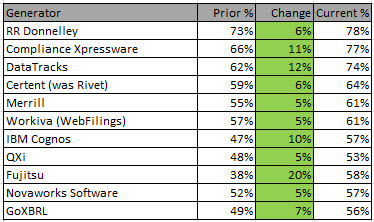

This is the summary of information by software vendor and/or filing agent (generator):

There were 11 software vendors/filing agents that had a 5% increase in quality or greater as compared to my prior analysis in April 2015.

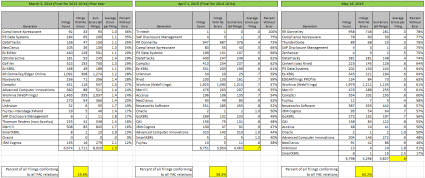

This graphic shows comparison information for the 2013 10-K season, the 2014 10-K season, and this most current analysis:

Competition is a good thing. Public companies have plenty of options when it comes to software vendors and/or filing agents for helping them create their digital financial reports. These choices will help push quality even higher, I believe, and will help the financial reporting supply chain achieve what other domains such as health care and electronic medical records are trying to achieve.

Want to understand how to improve your consistency with these basic fundamental accounting concept relations? This chapter of Digital Financial Reporting provides information about the fundamental accounting concepts. This page on my blog provided very detailed information on these accounting relations. If you want to understand the bigger picture, I suggest these two resources: Digital Financial Reporting Principles and Knowledge Engineering Basics for Professional Accountants.

I will measure quality again in three months. I predict that there will be another healthy increase in quality, that over two thirds of all public company XBRL-based financial filings to the SEC will be consistent with all of these basic accounting relations, and that at least four software vendors/filing agents will have 80% of their financial filings or more completely consistent with these basic accounting relations.