BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries in Creating Investor Friendly SEC XBRL Filings (222)

CFA Institute Calls for Broader and Deeper Use of Structured Data

Note that this paper is now downloadable for free here.

In a paper, Data and Technology: Transforming the Financial Information Landscape, the CFA Institute outlines their vision of a broader and deeper use of structured data in financial reporting. The paper, which looks at what the CFA Instutute calls the "currently inefficient system" of financial reporting from end-to-end.

In the paper, the CFA Institute calls for structuring data earlier:

"Structuring data early in the process would not only benefit companies but would also allow auditors to use audit data analytics to make the audit more efficient and potentially provide users with a better quality and greater granularity of financial information with greater reporting frequency and possibly a higher level of assurance."

The paper can be purchased from Amazon.com for $9.99. It is worth purchasing and reading.

To better understand the efficiencies of structured data of an XBRL-based digital financial report, see my Conceptual Overview of an XBRL-based, Structured Digital Financial Report.

But what about all those quality issues in XBRL-based public company financial filings to the SEC? Employ business rules correctly and not only will the quality problems go away; THAT is how the effeciencies the CFA Institute mentions will be realized. The benefits of structured data are real! When you understand the details, you understand that structured data can work.

Long Standing Errors being Fixed by Public Companies

Long standing errors in the XBRL-based financial reports of public companies are being corrected. Here is a sample of companies where a long standing error has existed but is ultimately corrected:

- Chubb, inappropriate use of concept to represent income from continuing operations on income statement

- Publix, inappropriate extension concept related to their ESOP

- Tesla, concept used in a disclosure which conflicted with what they were saying on the balance sheet

- Violin Memory, Inc, inappropriate use of the concept us-gaap:LiabilitiesNoncurrent

- VERTEX PHARMACEUTICALS INC, inappropriate use of the concept us-gaap:NetCashProvidedByUsedInContinuingOperations in representing cash flow

- Tesla, inappropriate use of concept in cash flow statement

- Wayfair Inc, inappropriate use of concept in cash flow statement

- Wonhe High-Tech International, Inc, inappropriate concept for line item Income (loss) from operations

- Youngevity International, Inc, temporary equity concept used to represent equity on balance sheet

- First Guaranty Bancshares, Inc, error related to provision for loan losses

- First National Corp, error related to provision for loan losses

- First South Bancorp Inc, error related to provision for loan losses

- Form Factor Inc, inappropriate use of concept on cash flow statement

- HIGHLANDS BANKSHARES INC, error related to provision for loan losses

- JAKKS PACIFIC INC, conflicting revenue concepts

Also, many filers have corrected their 10-Q filings but issues persist within the 10-K. Typically these errors relate to conflicting information within a disclosure and within the primary financial statements. Here are samples of filers that have issues in their 10-K, but their 10-Q is correct:

- Diversicare Healthcare Services, Inc, conflicting healthcare revenue concepts

- West Marine Inc, conflicting use of concept us-gaap:IncomeLossFromContinuingOperations

- Westlake Chemical Corp, conflicting revenues concepts on income statement and in disclosure

- Windstream Holdings, conflicting revenues concept on income statement and in disclosure

- CITIZENS FINANCIAL SERVICES INC, error related to provision for loan losses

- Civeo Corp, improper use of concept us-gaap:AssetsNoncurrent in a disclosure

- CUMBERLAND PHARMACEUTICALS INC, conflicting revenues concepts related to disclosure

- Delek US Holdings, Inc, inappropriate use of equity concept

- Enable Midstream Partners, LP, contradictory revenue facts

- FARMERS & MERCHANTS BANCORP, error in provision for loan losses

And just to round this out and to show that it is very possible to get 100% of the information within 100% of all filings correct, here are some examples of public companies that achieve this result. I am showing income statement examples because the income statement is where most errors tend to exist. Here are public companies that have no inconsistencies in their income statements (i.e. this is what all filings SHOULD look like):

- Volt Information Sciences (income statement)

- Tesla (income statement)

- Wayfair Inc (income statement)

- Apple (income statement)

- Cisco Systems (income statement)

- Microsoft (income statement, they do have ONE error)

- Wells Fargo (income statement, interest-based revenues)

- Anchor Bancorp (income statement, interest-based revenues)

- National Security Group (income statement, insurance-based revenues)

- PRUDENTIAL ANNUITIES LIFE ASSURANCE CORP, (income statement, insurance-based revenues)

- Elite Books (income statement)

- Stellar Biotechnologies, Inc, (income statement)

So, it is possible to get 100% of all filings 100% correct. There is plenty of evidence of that.

Normalized and As Reported Comparisons from 28msec

28msec used my fundamental accounting concept relations metadata to implement what I would call normalized comparisons of public company financial information based on those fundamental accounting concept relations. Here is a taste: (there is more to come)

Normalized Information

- Classified balance sheet, entity comparison

- Classified balance sheet, period comparison (you can do cross period comparisons for any entity with these queries also)

- Classified balance sheet, fixed assets reported (alternative), entity comparison

- Unclassified balance sheet, entity comparison

- Income statement, reports gross profit and operating income (loss), entity comparison

- Income statement, reports revenues, operating expenses, and operating income (loss), entity comparison

- Income statement, reports revenues, costs and expenses, and operating income (loss), entity comparison

- Income statement, reports revenues, operating expenses, nonoperating expenese, entity comparison

- Income statement, interest based revenues

- Income statement, insurance based revenues

- Net income (loss) breakdown

- Statement of comprehensive income (loss)

- Cash flow statement

- Cash flow statement (alternative) excludeds exchange gains

- Net cash flow breakdown, continuing/discontinued

- Net cash flow breakdown, continuing/discontinued (alternative, excludes exchange gains)

To understand the difference between the as reported information and the normalized view, please see this resource where that is explained.

Additionally, they implemented an awesome as reported comparison query. You can see that in action here. (I arbitrarily picked Alaska Airlines as the company to provide examples for. You can do these queries for ANY public company, ANY disclosure.)

As Reported Information

- Cash, cash equivalents, and marketable securities

- Deferred tax assets and liabilities

- Components of income tax expense

- Funding status of defined benefit plan details

- Funding status of defined benefit plan details (more)

- Operating segment information (takes a minute, but worth the wait)

- Derivative instruments information (Yes, works with text blocks)

- Significant accounting policies

- Balance sheet (for EVERY QUARTER and FISCAL YEAR)

- Income statement (fiscal years)

- Income statement (fiscal years AND quarterly information)

- Comprehensive income

- Cash flow statement

- Document and entity information

These tools will be very, very helpful getting the quality XBRL-based public company financial reports where it needs to be to make this valuable resource as useful as possible. Also, while I am showing the human-readable version of the query, there is also a machine-readable version of the query (XML , JSON and CSV). Here is an example of that:

- Income statement (machine readable XML)

Thank you to 28msec for implementing these queries; thank you to the SEC for having the foresight to move to structured reporting.

ADDED: Here is documentation that helps you understand how to create the as reported queries.

ADDED: See this working prototype that I created using these queries.

ADDED: This is the metadata that drives the queries.

SEC: Disclosure in the Digital Age: Time for a New Revolution

In a speech, Disclosure in the Digital Age: Time for a New Revolution, SEC commissioner Kara M Stein says that the SEC needs to do more than ask questions in concept releases, it is time for the SEC to lead. Commissioner Stein stated, "It's time to revolutionize our disclosure paradigm. Help us in that endeavor and everyone wins."

The concept release refers to this request for comment by the Securities and Exchange Commission: BUSINESS AND FINANCIAL DISCLOSURE REQUIRED BY REGULATION S-K

SUMMARY: The Commission is publishing this concept release to seek public comment on modernizing certain business and financial disclosure requirements in Regulation S-K. These disclosure requirements serve as the foundation for the business and financial disclosure in registrants' periodic reports. This concept release is part of an initiative by the Division of Corporation Finance to review the disclosure requirements applicable to registrants to consider ways to improve the requirements for the benefit of investors and registrants.

I would encourage you to read commissioner Kara M Stein's speech. Notice her call for a 'revolution' as opposed to an 'evolution'. Commissioner Stein concludes her speech with this call to action:

We need to create a Digital Disclosure Task Force. The Digital Disclosure Task Force should include investors, analysts, academics, companies, and technology experts. Together, we can envision what disclosure should look like in the Digital Age so that we can continue to have the premier capital markets in the world.

Clearly I agree with commissioner Stein. I published my Digital Financial Reporting Manifesto months ago. My document Digital Financial Reporting Principles summarizes five years of poking and prodding XBRL-based public company financial filings to the SEC. I hopes this information can help contribute to making XBRL-based structured digital financial reporting in the US the best in the world.

Don't really understand what structured digital financial reporting is all about? Then read this Conceptual Overview of an XBRL-based, Structured, Digital Financial Report. It will help get you understand what disclosure in the digital age is all about.

Public Company XBRL-based Financial Report Quality Improves Again

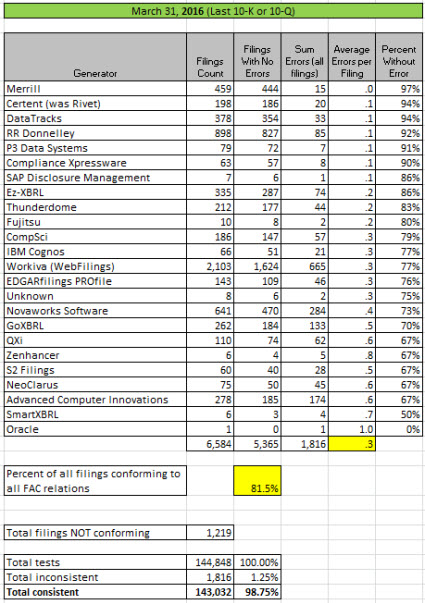

Here is this month's quality report of XBRL-based public company financial filings to the SEC. To remind you, I am measuring these reports against a set of basic, fundamental accounting concept relations. Below is the summary by generator (software vendor/filing agent) and what percentage of their reports are consistent with all of these basic, fundamental accounting concept relations:

(Click image for more information)

(Click image for more information)

This month I added a few new features to this information. This is the summary:

- Dashboard: I provided a dashboard to make it easier to consume the information.

- Three Year Comparison: I have been measuring this information over a three year period. This shows a comparison between each of the last three years.

- Month-to-Month Comparison for the past Year: This shows a comparison for every month of the past year except for April which I guess I did not measure. This is another view of the same information.

- Inconsistencies by Test: This lets you look at the measurement results on a test-by-test basis.

- Summary if Individual Inconsistencies: This provides details of about half of the XBRL-based reports that have inconsistencies and a description of the inconsistency. There is also a link from the inconsistency to the report that contains the inconsistency so you can go look at the report yourself. Here is a stand alone version of that list.

- Download Summary of Individual Inconsistencies: This is an Excel spreadsheet that has the 708 inconsistencies so you can examine the sorts of things that are causing quality issues.

Here is a summary of the inconsistencies by type of inconsistency with the code used for that type of inconsistency and a count of the number of such inconsistencies:

- UseOfIncomeLossFromContinuingOperationsIssue: 100 filers use the concept "us-gaap:IncomeLossFromContinuingOperations incorrectly. Most use this concept incorrectly to represent the line item "Operating Income (Loss)".

- InappropriateExtensionConcept: 93 filers create inappropriate extension concepts.

- NetCashFlowFromConceptIssue: 68 filers use the concept us-gaap:NetCashProvidedByUsedInContinuingOperations inappropriately.

- ContridictoryRevenueFacts: 52 filers report a revenues related fact that contradicts another revenues fact that they reported.

- InappropriateApplicationOfDimensions: 49 filers apply XBRL dimensions inappropriately.

- ReversedPolarityOfFact: 43 filers entered a negative number that should have been positive; or a positive number that should have been negative.

- UseOfOtherCompIncomeConceptCompIncomeIssue: 37 filers used one of the other comprehensive income concepts to represent comprehensive income.

- ReversedEquityConceptsIssue: 37 filers used the parent equity concept to represent total equity and the total equity concept to represent parent equity.

- InappropriateUseOfAssetsNoncurrent: 32 filers use the concept "us-gaap:AssetsNoncurrent" incorrectly and in conflict with the balance sheet. Generally, the majority confuse that concept with the concept "us-gaap:NoncurrentAssets" which is used to represent long-lived assets in the geographic area disclosure.

- InconsistentLoanLossProvision: 30 filers that use interest-based reporting provide contradictory concetps related to their provision for loan losses.

- InappropriateUseOfOperatingExpenses:25 filers are using the concept "us-gaap:OperatingExpenses inappropriately.

- WholePartIssue: 24 filers use a WHOLE and a PART in a way that is inappropriate. For example, a filer might use the concept "us-gaap:Revenue" which is the WHOLE, and then another revenues concept as a sibling to "us-gaap:Revenue".

- NetCashFlowRelatedIssue: 22 filers have a conflict between continuing, discontinued, and continuing plus discontinued operations facts.

- InappropriateUseLiabilitiesNoncurrent: 22 filers use the concept "us-gaap:LiabilitiesNoncurrent" inconsistent with its meaning.

- TemporaryEquityIssue: 19 filers have an issue related to temporary equity.

- ConflictingNetIncomeLossFacts: 12 filers have an inconsistency between the facts Net income (loss) and Net income (loss) attributable to parent.

- ReversedConceptsProfitLossNetIncomeLoss: 12 filers reversed the concepts "us-gaap:ProfitLoss" and "us-gaap:NetIncomeLoss".

- ReportsPreferredStockOutsideEquity: 8 reported preferred stock outside equity (preferred stock is always part of equity).

- SuccessorPredecessorIssue: 6 filers report successor/predecessor information inappropriately.

- MixesPartnershipCorporationNetIncomeConcepts: 6 filers mix the use of partnership and corporation net income concepts.

From that dashboard you can get to the crash course in the fundamental accounting concept relations so that you understand what they are and how they work. Need more details? Check out the updated Digital Financial Reporting Principles document.

* * * PRIOR RESULTS * * *

Previous fundamental accounting concept relations consistency results reported: February 29, 2016; January 31, 2016; December 31, 3015; November 30, 2015; October 31, 2015; September 30, 2015; August 31, 2015; July 31, 2015; June 30, 2015; May 29, 2015; April 1, 2015; November 29, 2014.