BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries in Creating Investor Friendly SEC XBRL Filings (222)

Positive Trend: Public Companies Fixing Long Standing XBRL Issues

There is a very positive trend that is happening. Big and small public companies are correcting long standing issues in their XBRL-based financial reports related to the basic, fundamental accounting concept relations within their financial reports.

One example of this postive trend is General Mills. I will walk you through this issue, how it was fixed, and what it means.

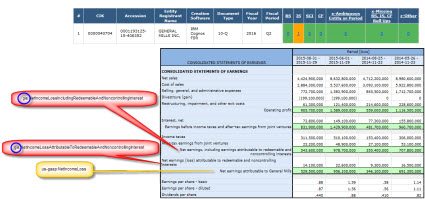

In the screen shot below (click on the image for a larger view) you can see that General Mills used two extension concepts to represent line items of their income statement for Q2 of 2016. The fundamental accounting concept relations consistency checks identifies this issue. On the top of the screen shot you can see the automated validation results with one issue on the income statement (IS) shown in orange. Note the extension concepts shown in red:

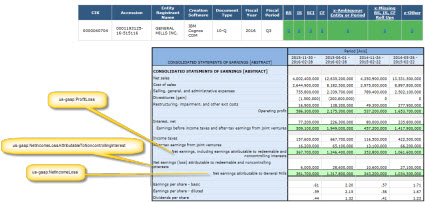

In the very next report for Q3 of 2016, General Mills switches to existing US GAAP Financial Reporting XBRL Taxonomy concepts. You can see that on the top of the screen shot, the validation messages (the ORANGE) went away and the fundamental accounting concept shows General Mills 100% consistent with all of those basic accounting relations:

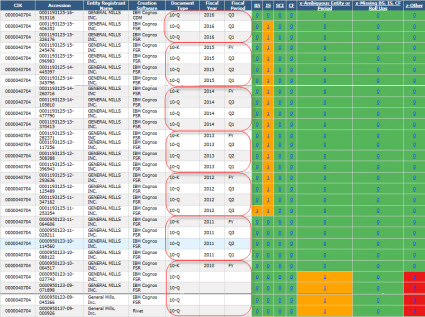

This next screen shot shows a summary of all General Mills XBRL-based financial filings to the SEC. After 18 reporting periods using inappropriate extension concepts, in the latest period (Q3 of 2016) the issue is resolved. In this analysis every General Mills report is evaluated using exactly the same set of rules. In fact, every public company that uses this reporting style uses the same rules.

Thus, General Mills is now consistent with all of the basic, fundamental accounting concept relations just as is approximately 80% of public companies.

Here is a handful of other public companies that have this same positive trend, fixing long standing inconsistencies with the basic, fundamental accounting concept relations:

- General Mills: Discontinued using two inappropriate extension concepts.

- Alaska Airlines: I emailed investor relations, pointed out the inappropriate use of the concept "us-gaap:LiabilitiesNoncurrent", and they fixed the issue. See this balance sheet comparison.

- Boeing: I emailed investor relations. Fixed one of two long standing issues where they were using an inappropriate concept in the statement of comprehensive income. The remaining issue is being worked on. It relates to a unique situation where net income from noncontrolling interest is considered immaterial for the income statement but not for the statement of changes in equity.

- Verizon: Fixed a polarity issue (reversed the value of a number) related to comprehensive income attributable to noncontrolling interest.

- Travelers Companies: Fixed inconsistency between facts reported for net income (loss) and net income available to common shareholders, basic.

- Guess

- Wings & Things

- Jones Financial Companies

- Real Industry

- Tessco Technologies

- Alexandria Real Estate Equities

- Oneok Partners

- Providence Worchester Railroad

- Franklin Resources

- Total System Services

There were more than these fixes, I am only providing supporting evidence for this very positive trend.

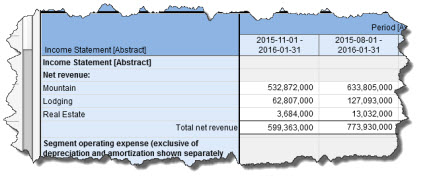

Good Example of Usefulness of Extensions

Too many people say that financial statements need to be forms and that extensions will not work. This is not true. Here is a good job of what extensions offer:

(Click link to go to report income statement)

(Click link to go to report income statement)

If you look at this income statement, the line item "Total net revenue" uses the US GAAP XBRL Taxonomy concept "us-gaap:SalesRevenueNet". The breakdown of revenue into "Mountain" and "Lodging" are extension concepts. "Real Estate" is from the US GAAP XBRL Taxonomy.

So what you get is the ability to compare across economic entities at the "Revenue" level. You get to compare the detail across periods for this specific economic entity. This filer is 100% consistent with the fundamental accounting concept relations.

This same idea can be used for any line item within a financial report. So, there is no need for financial reports to be static forms for the information to be useful.

Further, it is not unreasonable to infer that the extension concepts are some sort of revenue. The XBRL presentation relations infer this as well as the XBRL calculation relations. Sure, the fact that the extension concepts are in fact revenue can be made more clear by using an XBRL "general-special" relationship to show this explicitly.

Imagine Financial Reports as Pivot Tables on Steroids

The most important aspect of XBRL is its ability to structure information. If you don't understand that, please watch the video, How XBRL Works. Before XBRL, information was unstructured; with XBRL, information is structured and the structure can be leveraged.

Imagine financial reports as pivot tables on steroids. Look at the graphics below and think about the relations between the facts reported within an XBRL-based digital financial report. In particular, have a look at the last three graphics. (Another view of the same information below.)

Imagine not only being able to get and pivot information within one financial report, but also being able to query across periods for the same reporting entity or across entities. You can see such queries, although not dynamic, in these examples.

What technology challenges stands between where we are and the pivot tables you might be able to imagine? None really. The only challenge is providing professional accountants that create these reports with appropriate software tools that allow them to create XBRL-based structured financial reports effectively (i.e. no quality issues) and efficiently.

Fundamental Accounting Concepts and Report Frames are Tip of Digital Financial Reporting Iceberg

The basic, common sense fundamental accounting concept relations and the "report frames" or different reporting styles that are used by public companies reporting under US GAAP are the tip of the digital financial reporting iceberg. Below that you have the disclosures which work consistent with the reporting styles/fundamental accounting concept relations. All of this information (the report frames, the fundamental accounting concepts, and the disclosure information) can be represented in machine-readable form using XBRL. Key to this is XBRL definition relations and XBRL Formula.

Already, I have 98.80% consistency with the set of about 22 basic, common sense accounting relations represented. That provides emperical evidence to support these basic accounting relations which are not defined by XBRL; rather they are defined by US GAAP.

Already, I have 80% consistency with a set of approximately 119 different reporting styles used by public companies. Currently, 2,149 public companies report using the exact same reporting style. Of that one report style, 82% of all those public companies are also consistent with all of the basic common sense fundamental accounting concept relations.

I was able to figure this out by essentially reverse engineering the rules from XBRL-based public company financial reports submitted to the SEC. This information is incredibly useful for two reason:

- It provides positive evidence of how to properly represent financial information consistent with US GAAP and consistent with XBRL technical rules.

- It provides contra examples or positive evidence using negative examples of how NOT to use US GAAP or XBRL technical rules.

And the best thing is that 100% of these business rules can be represented using XBRL definition relations and XBRL Formula and are machine-readable.

No one is really arguing against these fundamental accounting concept relations or reporting styles; yet. Why? Because I am focusing on the obvious mistakes that no one really disputes. But what is going to happen is that at a certain point reaching concensus will become harder. For example, one issue pointed out by the fundamental accounting relations is rounding errors. Are rounding errors allowed or are they not allowed? There are two different positions that people have currently. Neither view is "right" or "wrong", they are simply different positions with different sets of "pros" and "cons" when it comes to working with digital financial reports.

These fundamental accounting concept relations and reporting styles will, and are, establishing patterns which can be used to think about other aspects of the US GAAP Financial Reporting XBRL Taxonomy and XBRL-based digital financial reports. These patterns are basically principles of digital financial reporting.

While the fundamental accounting concepts and report frames are not suffecient to make digital financial reporting work correctly; they are necessary. Digital financial reporting cannot be proven to work unless you can prove that the basics work.

Image is from https://ukpr.files.wordpress.com/2015/09/iceberg.jpg

Image is from https://ukpr.files.wordpress.com/2015/09/iceberg.jpg

Digital financial reporting is the future of financial reporting. XBRL-based public company financial reports are defining digital financial reporting.

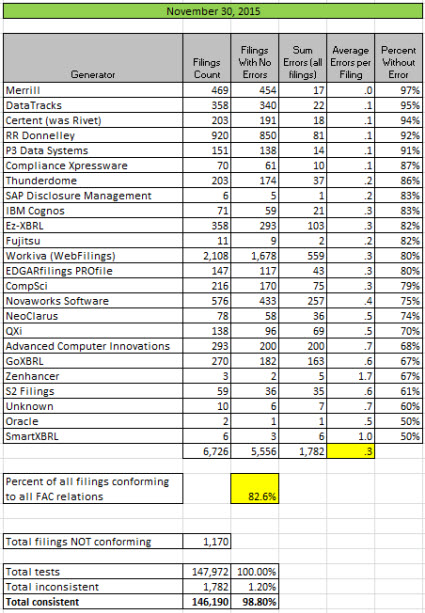

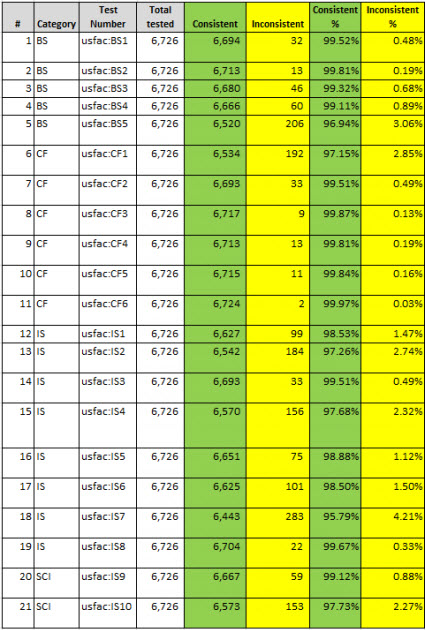

Public Company Quality Continues to Improve, 13 Generators above 80%

The quality of XBRL-based public company digital financial filings to the SEC continued to improve and some important milestones have been reached. As a reminder, this measure compares XBRL-based reports submitted to the SEC with approximately 22 basic, common sense fundamental accounting concept relations using an automated machine-based process. It is expected that 100% of all XBRL-based financial filings to the SEC would be consistent with all 22 basic, common sense accounting relations. Certain specific categories of filers have been removed such as "Funds and trusts" which have unique reporting practices and are not expected to follow these basic relations. The purpose of these tests is to determine the basic abilty of an automated machine-based process to make use of information in XBRL-based public company financial reports. These basic accounting relations consider 100% of the reporting styles of public companies.

There are three possible reasons for an inconsistency with one of the basic, common sense fundamental accounting concept relations:

- Filer error, where the filer represents a relation which is inconsistent with US GAAP. For example, one common error is to use the concept "us-gaap:IncomeLossFromContinuingOperations" to represent the line item "Operating Income (Loss)" in a financial report. The proper concept is "us-gaap:OperatingIncomeLoss".

- US GAAP XBRL Taxonomy error, where a filer cannot possibly represent information consistently because a concept is missing from the taxonomy. For example, the US GAAP XBRL Taxonomy does not have a concept to represent "Operating and nonoperating revenues". Therefore, filers must create an extension concept or use some inappropriate concept and automated processes may misinterpret reported information.

- Test metadata error, where the mapping rules or impute rules used to obtain information and test the relations between reported facts are inconsistent with US GAAP. For example, if a test disallows a relation that is allowed under US GAAP, this is a metadata error.

The column "Percent Without Error" in the table below indicates the percentage of a generaor's (software vendor or filing agent) filings which are completely consistent with expectations represented by the set of approximately 22 relations. For example, the first generator in the list "Merrill" created 469 XBRL-based financial filings which were submitted to the SEC, 454 of those contained no inconsistencies, and therefore 97% of the filings they created were completely consistent with what is expected by the 22 consistency tests.

Other important milestones include:

- 5 software vendors/filing agents have achieved 90% "Percent Without Error" or better.

- 13 software vendors/filing agents have achieved 80% "Percent Without Error" or better.

- 82.6% of all 6,726 XBRL-based financial filings to the SEC were completely consistent with all 22 basic common sense accounting relations.

- Total inconsistencies has dropped below 2,000 for the first time and now stands at 1,782 inconsistencies.

Summary of results by generator (software vendor/filing agent):

Summary of results by test:

(Click image for larger view which includes narrative describing each relation)

(Click image for larger view which includes narrative describing each relation)

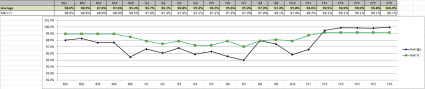

Average consistency with each basic, common sense fundamental accounting concept relation and comparison of software vendor/filing agent with average: (Shows Merrill as compared to average)

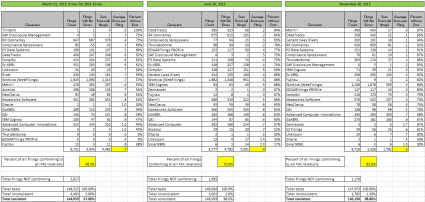

Comparison of information for March 31, 2015 (10-K for 2014), June 30, 2015 and November 30, 2015:

For more information or to obtain a complete set of test results, please contact me. The documents Arriving at 2014 Digital Financial Reporting All Stars: Summary and Understanding Minimum Processing Steps for Effective Use Of SEC XBRL Financial Filing Information, provides helpful information if you want to better understand the tests and testing process.

Again, great work to the software vendors, filing agents, and public companies who are blazing the digital financial reporting trail!

Previous results reported: October 31, 2015; September 30, 2015; August 31, 2015; July 31, 2015; June 30, 2015; May 29, 2015; April 1, 2015; November 29, 2014.