BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from June 1, 2017 - June 30, 2017

Accounting and Auditing in the Digital Age

In the document Accounting and Auditing in the Digital Age, I try and explain, as succinctly as I possibly can, how three primary enabling technologies will help the medieval tradition of accounting evolve to meet the new operating needs of businesses large and small. Here is the executive summary:

- The fourth industrial revolution is occurring which is enabling businesses to operate in significantly different ways; enabling technologies include artificial intelligence, internetworked physical devices, cyber-physical systems, nanotechnology, and biotechnology.

- Professional accountants and accounting practices, procedures, and processes will need to adapt. Education and training of professional accountants also needs to adapt.

- Humans augmented by machine capabilities, much like an electronic calculator enabling a human to do math quicker, will empower knowledge workers who know how to leverage the use of those machines.

- Three primary enabling technological innovations are driving this significant change to the current accounting practices, processes, and methods: XBRL-based structured digital financial reports, knowledge-based systems and other application of artificial intelligence, and blockchain-based distributed ledgers.

- While it is difficult to precisely predict the productivity gains which will be realized, initial information is showing the productivity gains will be very, very significant.

Please let me know how I did or if you have ideas for improving this document.

Commentary Linkbase for IFRS-FULL

I created a commentary linkbase for US GAAP a while back. I started a similar commentary linkbase resource for IFRS-FULL (2016). Here is the 2017 IFRS-FULL taxonomy commentary. (This is the IFRSBOX commentary linkbase prototype.)

(I am doing that as part of my template creation exercise for IFRS which will expand my expert system to that reporting scheme.)

What something like the commentary linkbase does is allow you to add helpful commentary or other guidance or explanations to an XBRL taxonomy. It is just a label linkbase that uses a specific label role. You can see how the commentary shows up in a software tool in this graphic.

How much coding was required to get software to support this feature? Zero. Comes with XBRL; if software developers created their software correctly.

This XBRL instance makes use of the commentary linkbase. It also has a bunch of different labels, another very useful feature of XBRL. (Here is a screenshot of that.)

Imagine all the other documentation you could provide to make taxonomies even more useful! Got any ideas? Let me know.

What the future of artificial intelligence in government?

An article, What the future of artificial intelligence in government?, which is based on a study by Dr. Peter Viechnicki, William D. Eggers states the following:

At the high end, we estimate within the next 5-7 years, as many as 1.1 billion working hours could be freed up in the federal government every year, saving a whopping $37 billion annually. Ultimately, AI could potentially free up 30 percent of federal employees' time. State government savings in time and money could be similar percentages.

The study, How much time and money can AI save government?, is worth reading. The study measured what government employees do at a task level. One of the more interesting things is information about the US Geological Survey, the folks that make maps. Here is that section:

How cartography went digital

The US Geological Survey (USGS) began producing topographic maps of the nation in 1879 and for most of its history, it printed its maps on paper. If you were an active hiker or camper in the 1980s, you’ll likely remember shelves and shelves of USGS topo maps at outdoor stores, but over the following decade, USGS transformed its mapmaking techniques by embracing digital map production. This transformation, which relied on a major Reagan-era investment in geospatial information systems technology, was disruptive and productive. It significantly improved the efficiency of production—and completely changed the nature of cartographers’ jobs.

Before the transformation, USGS cartographers worked as skilled craftsmen, performing painstaking tasks such as drawing elevation contours on acetate sheets. Today, their duties primarily involve collecting and disseminating digital cartographic data through the National Map program.

Today, USGS officials recall a bumpy transformation. Veteran cartographer Laurence Moore says, “We were slow to appreciate how fundamentally GPS and digital map data would change the world, and tended to think of these technologies as just tools to produce traditional maps faster and cheaper.”

Today, the agency employs only a tenth of the cartographers working there at the peak of the paper-map production era. But paradoxically, the total number of cartographers and photogrammetrists employed by federal, state, and local governments has risen by 84 percent since 1999. And the Bureau of Labor Statistics forecasts a 29 percent growth in employment for cartographers and photogrammetrists through 2024, largely due to “increasing use of maps for government planning.”

The article and the study help professional accountants wrap their heads around what is about to happen to them.

Public Company Quality Continues to Improve, Trend is Good

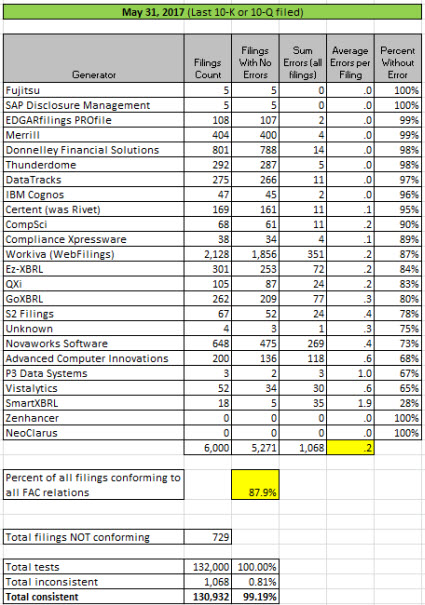

The quality improvement trend continues. There are currently 10 software generators and filing agents that have 90% or more of their XBRL-based public company financial reports consistent with all of the fundamental accounting concept relations continuity cross-checks. Average is 87.9%. On a per test basis, 99.19% of all relations are consistent with expectation.

Here are the current results of my measurements:

The biggest notable item is that Workiva went from 84% consistency to 87% consistency, fixing about 114 specific errors.

**********************PRIOR RESULTS**********************

Previous fundamental accounting concept relations consistency results reported: March 31, 2017; November 28, 2016; August 31, 2016; June 30, 2016; March 31, 2016; February 29, 2016; January 31, 2016; December 31, 3015; November 30, 2015; October 31, 2015; September 30, 2015; August 31, 2015; July 31, 2015; June 30, 2015; May 29, 2015; April 1, 2015; November 29, 2014.