BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from October 1, 2012 - October 31, 2012

XBRL for Intellectual Capital Statements

Someone posted a comment on one of the XBRL related groups that I belong to stating that XBRL might be a good tool for articulating intellectual capital statements.

Well, I did not know what an intellectual capital statement was or how to create one. So, in doing some checking these are a few resources that I came up with:

- Intellectual capital statement, a definition

- A Guideline for Intellectual Capital Statements, a key to knowledge management

- Constructing Intellectual Capital Statements

- Intellectual capital (Wikipedia)

- Knowledge management(Wikipedia)

- History of intellectual capital movement

- Reading an intellectual capital statement

- Measuring intellectual capital

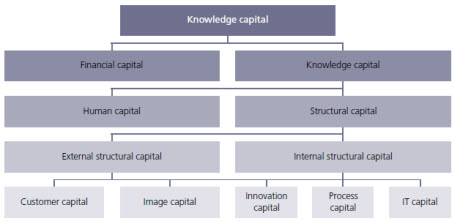

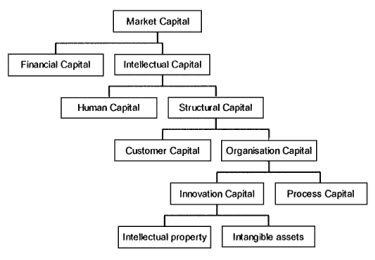

The articles above (#2 and #3) provide different visualizations which help to understand what intellectual capital is or categorizations of intellectual capital:

First:

Second (Edvinsson’s and Sveiby’s models of intellectual capital):

A concise definition of intellectual capital is provided by #2 above as:

The market value of the company (i.e. market capitalisation) minus the book value. In

conjunction with intellectual capital statements, the intellectual capital is often constituted

by the grand total of customers, organisation and individual capital. It is also named

knowledge capital. See also book-to-market value.

Imagine a searchable semantic database of external intellectual capital statements for every company.

Interesting.

General Applicability of XBRL Shown in Ventana Research's Description of Mortgage Market Use of XBRL

Ventana Research's article, Putting XBRL to Work in the Mortgage Market, describes, in detail, how XBRL can be used by all the parties involved in the pieces of the mortgage process (origination, servicing and owning the credit).

This same idea applies to many, many other processes besides securitized mortgages. A sweet spot for XBRL is any process where

- One or more parties are on the other side of your firewall or even internally when different departments have different business systems

- Information transaction are more complex than a basic, simple transaction (i.e. such as a 10 or 100 page regulatory report with perhaps thousands of facts exchanged, as opposed to a small transaction with say 10 data points)

- Information exchanged tend to change a little, requiring more flexibility than that of a form

- Zero tolerance for errors in the information (i.e. everything must tick and tie, cross cast and foot, and if things don't add up, bad things happen)

- Information which needs to be reconfigured by the user of the information (i.e. not a form, although XBRL can be used to expressed what amounts to a form, it excels when that "form" needs some flexibility)

- Business people changing the metadata, no IT involvement required (i.e. XBRL has a good balance between power and ease of use)

Digital Financial Reporting: Using an XBRL-based Model (the Book)

Much of the work I have done over the past 14 or so years working to help create, understand, and effectively use XBRL for financial reporting is now summarized in one resource put together by Rene van Egmond and myself: Digital Financial Reporting: Using an XBRL-based Model.

This non-technical resource is for accountants, auditors, financial analysts, regulators, other business, software engineers, and others who are early adopters, thought leaders, entrepreneurs who desire to understand the moving pieces of digital financial reporting, a forthcoming paradigm which will highly likely replace many current financial reporting practices over the coming years.

Digital Financial Reporting: Using an XBRL-based Model provides a "map" which helps you navigate the many times murky waters which one generally runs across today when trying to make sense of XBRL, a primary enabler of digital financial reporting. It provides information which helps you safely work with this new technology which is still evolving to create new cost effective, easier to use, yet robust, reliable, repeatable, predictable, scalable, secure, auditable, solutions and systems that work. This resource helps you cut through the noise and misinformation to grasp a well-grounded understanding of these new tools.

This resource helps you ask the right questions of software vendors who may, or may not, be taking an approach to implementing digital financial reporting in their products. Following and then abandoning your approach does not have to be a hit or miss game because you did not understand all of the moving pieces of the equation.

Digital financial reporting, using global standard technical specifications such as the Extensible Business Reporting Language (XBRL), is fast becoming the new paradigm for financial reporting. Digital financial reporting is part of a broader trend, digital business reporting in general. While this new digital paradigm has not overtaken the current financial reporting paradigm, chances are that it will. No one knows for sure exactly when, no one knows everything about what this change might mean.

Not understanding change has risk. To remain relevant as this new digital financial reporting paradigm unfolds, CPAs and other accountants need to adjust their thinking about how to appropriately modify financial reporting to keep up with the digital revolution. Gaining a proper understanding of this new tool is key to understand where and how to employ the tool.

Information in this document was accumulated over a period of about 14 years. It represents, arguably, one of the best resources available today to understanding digital financial reporting. The information and knowledge has been accumulated, synthesized, organized, and explained as best as possible given the current point in time of the evolution of XBRL, digital financial reporting, software available to business users, etc.

This is not a resource for the average business user, rather a resource for those putting together the pieces of what will become digital financial reporting. While any business user would benefit from this material, it more for those trying to employ, guide, influence, predict, or otherwise understand how digital financial reporting will unfold.

Rene and I hope you find this resource useful. Comments, suggestions, ideas, or other feedback is welcomed.

FSN White Paper: Restoring Harmony to the ‘Last Mile’ of Finance

An FSN white paper, Restoring harmony to the ‘Last Mile’ of Finance with Cadency Complete, articulates both the problem and the solution of getting financial reports out the door. You can read the entire white paper at the link above. Below is the summary of that white paper:

SUMMARY

Many corporate finance functions are struggling to cope with the unrelenting burden of compliance and regulation coupled with unprecedented market volatility and risk. While there has been significant progress in the collection and consolidation of data, there is rising dissonance and discord in the ‘Last Mile’ of finance. Content management does not sit easily with finance functions more accustomed to working with numbers and spreadsheets. They neither have the enabling technologies nor time to streamline the haphazard processes that characterise the Last Mile.

Numbers, narrative and XBRL all coalesce around the last half of the Record to Report cycle and traditional approaches such as ERP, Microsoft Office and niche products have done little to alleviate the challenges. As a result multiple stakeholders are left to fend for themselves – everyone working to a different beat as they each set about producing reports for different stakeholders more or less independently using outdated technology.

But these reports have much in common and the key to the way forward is to create the conditions in which individuals from different functional areas can collaborate, i.e. to create a ‘many-to-many’ environment in which multiple stakeholders and document authors can work in parallel, sharing content where necessary and re-purposing it for the many delivery channels in which information has to be published.

Cadency Complete is a next generation Disclosure Management product that utilises the ‘Best in Class’ technology (Microsoft, Adobe LiveCycle and Fujitsu respectively) for the three pillars of disclosure management, namely; document authoring, content management and XBRL. These three components work rhythmically to streamline the processes of the Last Mile, complementing legacy investments in ERP and other operational systems.

By joining all stakeholders, whether inside or outside of the corporate firewall, in a single seamless environment Cadency Complete is able to restore harmony to the Last Mile, providing complete visibility of the process, while enabling a higher level control, accuracy and productivity – giving the CFO peace of mind and confidence in the integrity of any reports and disclosures.

Updated Reference Implementation and Comprehensive Example

The 9 metapatterns are distilled from the 30 business use cases. These are great examples of the pieces which work together to construct a digital financial report.

The comprehensive example takes each of the 30 business use cases, models them within one XBRL instance and XBRL taxonomy "system" to be sure the pieces of the system work together properly.

The reference implementation is similar to the comprehensive example except that the reference implementation is intended to comply with the SEC Edgar Filer Manual (EFM) and tests to be sure the inner workings of an SEC XBRL financial report are correct. The 75 disclosure templates are similar to the business use cases.

So now my complete set of samples/examples have been updated to correct for all errors and other issues, adjust to the more precise terminology of the Financial Report Semantics and Dynamics Theory terminology, and all have been made available with XBRL Formula examples to both verify the modeling of the information and provide a base set of XBRL Formula examples.

All of these samples/examples are helpful to accountants in understanding how to make use of XBRL for financial reporting. These samples/examples don't provide all the answers, but they certainly raise important questions as to what financial reporting use cases need to be addressed by any system endeavoring to employ XBRL.

I hope this information is helpful to others. If you have ideas on how to make it more helpful, please send me your ideas. Or even better, help create the future of financial reporting by contributing to the Digital Financial Reporting Wiki.