BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from March 1, 2016 - March 31, 2016

Analysis of Fortune 100, See Controversial Issues and How to Resolve Them

The following helps professional accountants understand how to understand and resolve potentially controversial issues related to creating XBRL-based digital financial reports for public companies that are submitted to the SEC.

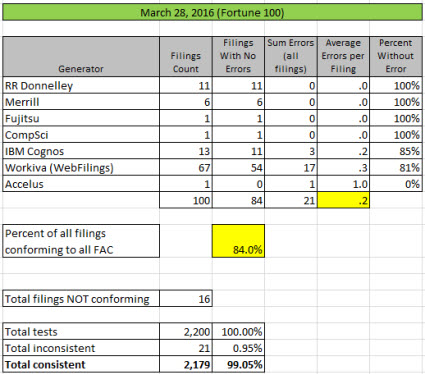

The following is a summary of issues related to representing Fortune 100 company financial reports in the XBRL format. This analysis measures the latest financial report as of March 28 for each of the Fortune 100 public companies against the set of basic, fundamental accounting concept relations that I have been using.

First, here is a summary of all issues by generator (filing agent/software vendor):

On average, the Fortune 100 is 2.6% better in terms of overall quality than the entire population of approximately 6,700 public companies.

Of the total of 21 inconsistencies identified, 9 of those are uncontroversial filer errors. For example, someone entered a value in as a positive that should be negative or they selected an obviously incorrect concept to report a fact.

That leaves 12 issues. Those 12 issues tend to be more controversial in nature, perhaps not as straight-forward to resolve or there is a lack of consensus as to how to resolve the issues.

I want to point out 3 of these issues to make a specific point. Here are the three issues, I will explain the point after I explain the issues.

Potentially controversial issues:

- Possible Missing US GAAP XBRLTaxonomy Concept "Operating and Nonoperating Revenues": Exxon and Marathon Petroleumboth create an extension concept for what amounts to the line item "Operating and Nonoperating Revenues". That concept is not represented within the US GAAP XBRL Taxonomy. About 157 other public companies report relatively similarly to Exxon and Marathon. Some create extension concepts, others use existing US GAAP XBRL Taxonomy concepts. One of two things must be true because an extension concept should not be necessary at this high level:

- #1: Exxon and Marathon have created an inappropriate extension concept and should use some existing US GAAP XBRL Taxonomy concept.

- #2: The US GAAP XBRL Taxonomy is missing the concept Exxon and Marathon felt compelled to extend, "Operating and Nonoperating Revenue".

- Computation of Gross Profit: Philip Morris International does something that is inconsistent with what most public companies do. Most public companies that report gross profit have the following computation: Revenues - Cost of Revenue = Gross Profit. Philip Morris uses this computation: Revenues - Cost of Revenue - Excise Tax = Gross Profit. There are at least four other companies that report that relation in the same manner as Phillip Morris: ALTRIA GROUP, BROWN FORMAN, CONSTELLATION BRANDS (created extension concept for exise tax), MOLSON COORS. One of the following must be true:

- #1: This relation is allowed: Revenues - Cost of Revenue - Excise Tax = Gross Profit

- #2: This relation s NOT allowed, it is always the case that: Revenues - Cost of Revenue = Gross Profit

- Extension of Income (Loss) from Equity Method Investments when Moved: PRUDENTIAL FINANCIAL reports the line item "Income (Loss) from Equity Method Investments" as part of the reconciliation of before and after tax income from continuing operations. They do so using an extension concept. There are 129 public companies that report that line item in exactly that same manner and use the existing US GAAP XBRL Taxonomy concept "us-gaap:IncomeLossFromEquityMethodInvestments". Only one of the following should be true:

- #1: If income (loss) from equity method investments is reported as part of the reconciliation of income from continuing operations before and after tax, DO NOT extend the concept; use the existing US GAAP XBRL Taxonomy concept.

- #2: If income (loss) from equity method investments is reported as part of the reconciliation of income from continuing operations before and after tax, EXTEND the concept. (i.e. DO NOT use the existing US GAAP XBRL Taxonomy concept)

My point is that each of these issues can be resolved by getting clarity on which of the possible alternative resolutions is the appropriate resolution to the specific issue. If I missed an alternative, all one needs to do is simply add that alternative to the list of alternatives being considered. Examining the evidence of how public companies actually report can help resolve these and other issues.

Looking at the issues/inconsistencies related to these 100 companies is very helpful because many of the same sorts of issues/inconsistencies impact the full population of 6,700 public company XBRL-based financial reports.

Further, analyzing issues is not limited to these three specific issues. Other issues exist. I know, I have lists of these issues. Today, I work with filing agents and software vendors to figure out as best as we can how to resolve each specific issue. That works when each filing agent/software vendors arrives at the same decision as to which is the appropriate alternative. When consensus cannot be reached, then different software vendors/filing agents address the specific reporting situations in a different way, causing an inconsistency. Who is right? Who knows. But where consensus is reached, consistency exists. Where consistency exists, what is right is rather obvious.

That will leave the controversial issues unresolved. How many controversial issues are there? I am compiling an inventory of those issues. Stay tuned!

Positive Trend: Public Companies Fixing Long Standing XBRL Issues

There is a very positive trend that is happening. Big and small public companies are correcting long standing issues in their XBRL-based financial reports related to the basic, fundamental accounting concept relations within their financial reports.

One example of this postive trend is General Mills. I will walk you through this issue, how it was fixed, and what it means.

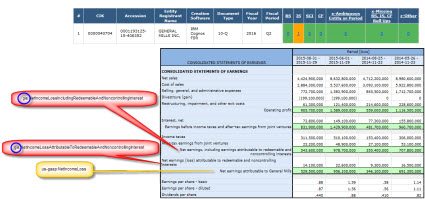

In the screen shot below (click on the image for a larger view) you can see that General Mills used two extension concepts to represent line items of their income statement for Q2 of 2016. The fundamental accounting concept relations consistency checks identifies this issue. On the top of the screen shot you can see the automated validation results with one issue on the income statement (IS) shown in orange. Note the extension concepts shown in red:

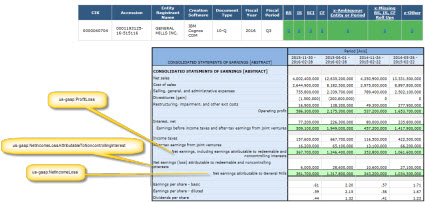

In the very next report for Q3 of 2016, General Mills switches to existing US GAAP Financial Reporting XBRL Taxonomy concepts. You can see that on the top of the screen shot, the validation messages (the ORANGE) went away and the fundamental accounting concept shows General Mills 100% consistent with all of those basic accounting relations:

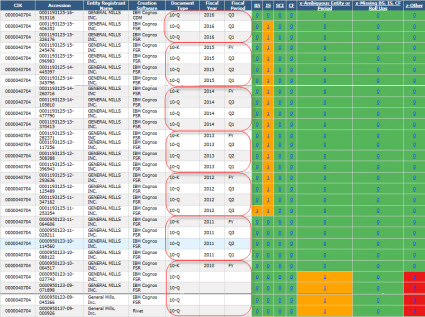

This next screen shot shows a summary of all General Mills XBRL-based financial filings to the SEC. After 18 reporting periods using inappropriate extension concepts, in the latest period (Q3 of 2016) the issue is resolved. In this analysis every General Mills report is evaluated using exactly the same set of rules. In fact, every public company that uses this reporting style uses the same rules.

Thus, General Mills is now consistent with all of the basic, fundamental accounting concept relations just as is approximately 80% of public companies.

Here is a handful of other public companies that have this same positive trend, fixing long standing inconsistencies with the basic, fundamental accounting concept relations:

- General Mills: Discontinued using two inappropriate extension concepts.

- Alaska Airlines: I emailed investor relations, pointed out the inappropriate use of the concept "us-gaap:LiabilitiesNoncurrent", and they fixed the issue. See this balance sheet comparison.

- Boeing: I emailed investor relations. Fixed one of two long standing issues where they were using an inappropriate concept in the statement of comprehensive income. The remaining issue is being worked on. It relates to a unique situation where net income from noncontrolling interest is considered immaterial for the income statement but not for the statement of changes in equity.

- Verizon: Fixed a polarity issue (reversed the value of a number) related to comprehensive income attributable to noncontrolling interest.

- Travelers Companies: Fixed inconsistency between facts reported for net income (loss) and net income available to common shareholders, basic.

- Guess

- Wings & Things

- Jones Financial Companies

- Real Industry

- Tessco Technologies

- Alexandria Real Estate Equities

- Oneok Partners

- Providence Worchester Railroad

- Franklin Resources

- Total System Services

There were more than these fixes, I am only providing supporting evidence for this very positive trend.

Good Example of Usefulness of Extensions

Too many people say that financial statements need to be forms and that extensions will not work. This is not true. Here is a good job of what extensions offer:

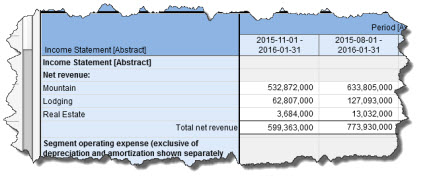

(Click link to go to report income statement)

(Click link to go to report income statement)

If you look at this income statement, the line item "Total net revenue" uses the US GAAP XBRL Taxonomy concept "us-gaap:SalesRevenueNet". The breakdown of revenue into "Mountain" and "Lodging" are extension concepts. "Real Estate" is from the US GAAP XBRL Taxonomy.

So what you get is the ability to compare across economic entities at the "Revenue" level. You get to compare the detail across periods for this specific economic entity. This filer is 100% consistent with the fundamental accounting concept relations.

This same idea can be used for any line item within a financial report. So, there is no need for financial reports to be static forms for the information to be useful.

Further, it is not unreasonable to infer that the extension concepts are some sort of revenue. The XBRL presentation relations infer this as well as the XBRL calculation relations. Sure, the fact that the extension concepts are in fact revenue can be made more clear by using an XBRL "general-special" relationship to show this explicitly.

Introduction to the Multidimensional Model for Professional Accountants

The law of conservation of complexity states:

"Every application has an inherent amount of irreducible complexity. The only question is: Who will have to deal with it-the user, the application developer, or the platform developer?"

I put together a video and a slide deck that helps professional accountants understand the multidimensional model. Understanding the multidimensional model is important if you want to correctly understand digital financial reports. Understanding the model also helps you understand how to look at software to see if the creators of that software chose to have you deal with complexity of if they dealt with complexity for you.

Just like an electronic spreadsheet has a model (workbook, spreadsheet, row, column, cell); a digital financial report has a model. Here are the high-level pieces of a digital financial report:

- Fact: A fact defines a single, observable, reportable piece of information contained within a financial report, or fact value, contextualized for unambiguous interpretation or analysis by one or more distinguishing characteristics. Facts can be numbers, text, or prose.

- Characteristic: A characteristic describes a fact (a characteristic is a property of a fact). A characteristic provides information necessary to describe a fact and distinguish one fact from another fact. A fact may have one or many distinguishing characteristics.

- Fact Table: A fact table is a set of facts which go together for some specific reason. All the facts in a fact table share the same characteristics.

- Relation: A relation is how one thing in a business report is or can be related to some other thing in a business report. These relations are often called business rules. There are three primary types of relations (others can exist):

- Whole-part: something composed exactly of their parts and nothing else; the sum of the parts is equal to the whole (roll up).

- Is-a: descriptive and differentiates one type or class of thing from some different type or class of thing; but the things do not add up to a whole.

- Computational business rule: Other types of computational business rules can exist such as “Beginning balance + changes = Ending Balance” (roll forward) or “Net income (loss) / Weighted average shares = Earnings per share”.

- Grain: Grain is the level of depth of information or granularity. The lowest level of granularity is the actual transaction, event, circumstance, or other phenomenon represented in a financial report.

Believe it or not, but 100% of XBRL-based public company financial reports fit into that rather simple model. A handful of software vendors have implemented that model. It is very easy to create something that is complicated. It is a lot harder to create something that is simple.

I will continue to improve and otherwise tune this model. If you have feedback or suggestions, please send them along. The next step is for me to improve the document Understanding Blocks, Slots, Templates, and Examplars. That explains the next layer of the model.

Understanding Important Connection Between Global LEI, XBRL Taxonomies, Conceptual Frameworks

There is an effort to create a global legal entity identifier. There are very important connections between all of the following things and it is important to understand that interconnectedness:

- Global Legal Entity Identifier, Parts of a Legal Entity

- XBRL Financial Reporting Taxonomies

- Financial Reporting Conceptual Frameworks

I mentioned the paper, An analysis of fundamental concepts in the conceptual framework using ontology technologies, written by Marthinus Cornelius Gerber, Aurona Jacoba Gerber, Alta van der Merwe; in a prior blog post. The paper points out then when textual manuscripts are used to describe things in a conceptual framework the descriptions can be vague, inconsistent or ambiguous. Machine-readable ontologies offer better percision. The paper states the following in the conclusion:

"From the first version of the artefact construction of an ontology-based formal language for the Conceptual Framework, there is evidence that the construction of a formal language using ontology technologies could play a substantial role to enhance the quality, clarity and re-usability of the Conceptual Framework definitions. Ontology statements are explicit and precise, and consequences of assertions can be exposed using reasoning technologies."

Here is an example of where ontologies can help. In another blog post and in a document I wrote, Differentiating Alternatives from Ambiguity, I pointed out specific inconsistencies that exist in US GAAP which were pointed out by the Wiley GAAP 2011 (page 46 to 48). In that resource, the authors make the following statement:

"Since these requirements do not utilize a common taxonomy, the following explanation will be referenced throughout Wiley GAAP."

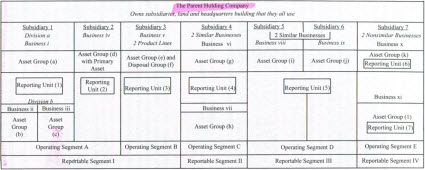

And then, they provide this graphic below that shows their resolution to the inconsistencies in US GAAP:

In today's digital world, we need this type of information in machine-readable form and we need this information to be represented correctly and precisely for machines such as computers to help us perform tasks we need them to perform.

To achieve this end, professional accountants need to learn a few things about knowledge engineering basics. This will enable professional accountants to both understand why we need this information in machine-readable form, enable them to work with knowledge engineers and information technology professionals to express this information correctly, and enable professional accountants to both maintain this information and add even more information to the base machine-readable representations.

Digital financial reporting is coming. Public companies, software vendors, and the U.S. Securities and Exchange Commission are perfecting digital financial reporting. Getting important standard identifiers like the global legal entity identifier right, getting the breakdown of entities right, and getting other such machine-readable information right is important.

(The link to LEI.INFO is https://lei.info)