BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from March 27, 2016 - April 2, 2016

Public Company XBRL-based Financial Report Quality Improves Again

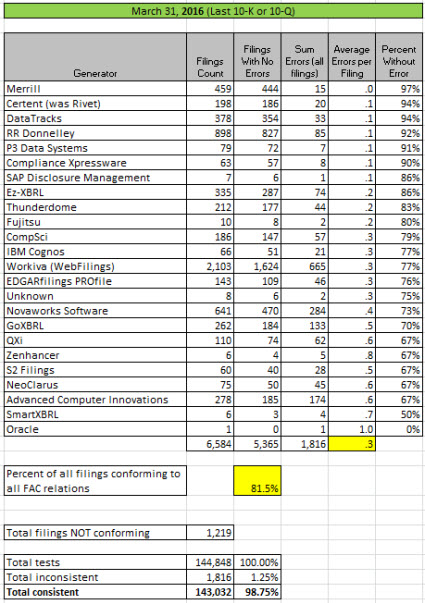

Here is this month's quality report of XBRL-based public company financial filings to the SEC. To remind you, I am measuring these reports against a set of basic, fundamental accounting concept relations. Below is the summary by generator (software vendor/filing agent) and what percentage of their reports are consistent with all of these basic, fundamental accounting concept relations:

(Click image for more information)

(Click image for more information)

This month I added a few new features to this information. This is the summary:

- Dashboard: I provided a dashboard to make it easier to consume the information.

- Three Year Comparison: I have been measuring this information over a three year period. This shows a comparison between each of the last three years.

- Month-to-Month Comparison for the past Year: This shows a comparison for every month of the past year except for April which I guess I did not measure. This is another view of the same information.

- Inconsistencies by Test: This lets you look at the measurement results on a test-by-test basis.

- Summary if Individual Inconsistencies: This provides details of about half of the XBRL-based reports that have inconsistencies and a description of the inconsistency. There is also a link from the inconsistency to the report that contains the inconsistency so you can go look at the report yourself. Here is a stand alone version of that list.

- Download Summary of Individual Inconsistencies: This is an Excel spreadsheet that has the 708 inconsistencies so you can examine the sorts of things that are causing quality issues.

Here is a summary of the inconsistencies by type of inconsistency with the code used for that type of inconsistency and a count of the number of such inconsistencies:

- UseOfIncomeLossFromContinuingOperationsIssue: 100 filers use the concept "us-gaap:IncomeLossFromContinuingOperations incorrectly. Most use this concept incorrectly to represent the line item "Operating Income (Loss)".

- InappropriateExtensionConcept: 93 filers create inappropriate extension concepts.

- NetCashFlowFromConceptIssue: 68 filers use the concept us-gaap:NetCashProvidedByUsedInContinuingOperations inappropriately.

- ContridictoryRevenueFacts: 52 filers report a revenues related fact that contradicts another revenues fact that they reported.

- InappropriateApplicationOfDimensions: 49 filers apply XBRL dimensions inappropriately.

- ReversedPolarityOfFact: 43 filers entered a negative number that should have been positive; or a positive number that should have been negative.

- UseOfOtherCompIncomeConceptCompIncomeIssue: 37 filers used one of the other comprehensive income concepts to represent comprehensive income.

- ReversedEquityConceptsIssue: 37 filers used the parent equity concept to represent total equity and the total equity concept to represent parent equity.

- InappropriateUseOfAssetsNoncurrent: 32 filers use the concept "us-gaap:AssetsNoncurrent" incorrectly and in conflict with the balance sheet. Generally, the majority confuse that concept with the concept "us-gaap:NoncurrentAssets" which is used to represent long-lived assets in the geographic area disclosure.

- InconsistentLoanLossProvision: 30 filers that use interest-based reporting provide contradictory concetps related to their provision for loan losses.

- InappropriateUseOfOperatingExpenses:25 filers are using the concept "us-gaap:OperatingExpenses inappropriately.

- WholePartIssue: 24 filers use a WHOLE and a PART in a way that is inappropriate. For example, a filer might use the concept "us-gaap:Revenue" which is the WHOLE, and then another revenues concept as a sibling to "us-gaap:Revenue".

- NetCashFlowRelatedIssue: 22 filers have a conflict between continuing, discontinued, and continuing plus discontinued operations facts.

- InappropriateUseLiabilitiesNoncurrent: 22 filers use the concept "us-gaap:LiabilitiesNoncurrent" inconsistent with its meaning.

- TemporaryEquityIssue: 19 filers have an issue related to temporary equity.

- ConflictingNetIncomeLossFacts: 12 filers have an inconsistency between the facts Net income (loss) and Net income (loss) attributable to parent.

- ReversedConceptsProfitLossNetIncomeLoss: 12 filers reversed the concepts "us-gaap:ProfitLoss" and "us-gaap:NetIncomeLoss".

- ReportsPreferredStockOutsideEquity: 8 reported preferred stock outside equity (preferred stock is always part of equity).

- SuccessorPredecessorIssue: 6 filers report successor/predecessor information inappropriately.

- MixesPartnershipCorporationNetIncomeConcepts: 6 filers mix the use of partnership and corporation net income concepts.

From that dashboard you can get to the crash course in the fundamental accounting concept relations so that you understand what they are and how they work. Need more details? Check out the updated Digital Financial Reporting Principles document.

* * * PRIOR RESULTS * * *

Previous fundamental accounting concept relations consistency results reported: February 29, 2016; January 31, 2016; December 31, 3015; November 30, 2015; October 31, 2015; September 30, 2015; August 31, 2015; July 31, 2015; June 30, 2015; May 29, 2015; April 1, 2015; November 29, 2014.

Updated Digital Financial Reporting Principles

I have updated the document Digital Financial Reporting Principles. The revisions take into consideration new insights gained over the past year. This document tends to be rather concrete.

Anyone interested in that document would (or should) likely be interested in the Digital Financial Reporting Manifesto also.

Analysis of Fortune 100, See Controversial Issues and How to Resolve Them

The following helps professional accountants understand how to understand and resolve potentially controversial issues related to creating XBRL-based digital financial reports for public companies that are submitted to the SEC.

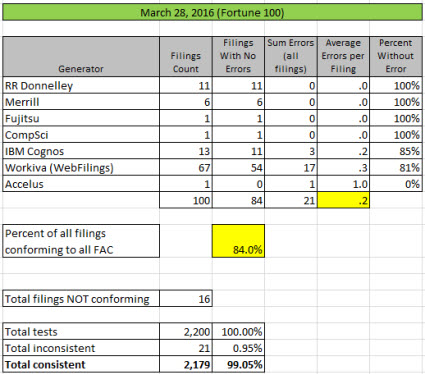

The following is a summary of issues related to representing Fortune 100 company financial reports in the XBRL format. This analysis measures the latest financial report as of March 28 for each of the Fortune 100 public companies against the set of basic, fundamental accounting concept relations that I have been using.

First, here is a summary of all issues by generator (filing agent/software vendor):

On average, the Fortune 100 is 2.6% better in terms of overall quality than the entire population of approximately 6,700 public companies.

Of the total of 21 inconsistencies identified, 9 of those are uncontroversial filer errors. For example, someone entered a value in as a positive that should be negative or they selected an obviously incorrect concept to report a fact.

That leaves 12 issues. Those 12 issues tend to be more controversial in nature, perhaps not as straight-forward to resolve or there is a lack of consensus as to how to resolve the issues.

I want to point out 3 of these issues to make a specific point. Here are the three issues, I will explain the point after I explain the issues.

Potentially controversial issues:

- Possible Missing US GAAP XBRLTaxonomy Concept "Operating and Nonoperating Revenues": Exxon and Marathon Petroleumboth create an extension concept for what amounts to the line item "Operating and Nonoperating Revenues". That concept is not represented within the US GAAP XBRL Taxonomy. About 157 other public companies report relatively similarly to Exxon and Marathon. Some create extension concepts, others use existing US GAAP XBRL Taxonomy concepts. One of two things must be true because an extension concept should not be necessary at this high level:

- #1: Exxon and Marathon have created an inappropriate extension concept and should use some existing US GAAP XBRL Taxonomy concept.

- #2: The US GAAP XBRL Taxonomy is missing the concept Exxon and Marathon felt compelled to extend, "Operating and Nonoperating Revenue".

- Computation of Gross Profit: Philip Morris International does something that is inconsistent with what most public companies do. Most public companies that report gross profit have the following computation: Revenues - Cost of Revenue = Gross Profit. Philip Morris uses this computation: Revenues - Cost of Revenue - Excise Tax = Gross Profit. There are at least four other companies that report that relation in the same manner as Phillip Morris: ALTRIA GROUP, BROWN FORMAN, CONSTELLATION BRANDS (created extension concept for exise tax), MOLSON COORS. One of the following must be true:

- #1: This relation is allowed: Revenues - Cost of Revenue - Excise Tax = Gross Profit

- #2: This relation s NOT allowed, it is always the case that: Revenues - Cost of Revenue = Gross Profit

- Extension of Income (Loss) from Equity Method Investments when Moved: PRUDENTIAL FINANCIAL reports the line item "Income (Loss) from Equity Method Investments" as part of the reconciliation of before and after tax income from continuing operations. They do so using an extension concept. There are 129 public companies that report that line item in exactly that same manner and use the existing US GAAP XBRL Taxonomy concept "us-gaap:IncomeLossFromEquityMethodInvestments". Only one of the following should be true:

- #1: If income (loss) from equity method investments is reported as part of the reconciliation of income from continuing operations before and after tax, DO NOT extend the concept; use the existing US GAAP XBRL Taxonomy concept.

- #2: If income (loss) from equity method investments is reported as part of the reconciliation of income from continuing operations before and after tax, EXTEND the concept. (i.e. DO NOT use the existing US GAAP XBRL Taxonomy concept)

My point is that each of these issues can be resolved by getting clarity on which of the possible alternative resolutions is the appropriate resolution to the specific issue. If I missed an alternative, all one needs to do is simply add that alternative to the list of alternatives being considered. Examining the evidence of how public companies actually report can help resolve these and other issues.

Looking at the issues/inconsistencies related to these 100 companies is very helpful because many of the same sorts of issues/inconsistencies impact the full population of 6,700 public company XBRL-based financial reports.

Further, analyzing issues is not limited to these three specific issues. Other issues exist. I know, I have lists of these issues. Today, I work with filing agents and software vendors to figure out as best as we can how to resolve each specific issue. That works when each filing agent/software vendors arrives at the same decision as to which is the appropriate alternative. When consensus cannot be reached, then different software vendors/filing agents address the specific reporting situations in a different way, causing an inconsistency. Who is right? Who knows. But where consensus is reached, consistency exists. Where consistency exists, what is right is rather obvious.

That will leave the controversial issues unresolved. How many controversial issues are there? I am compiling an inventory of those issues. Stay tuned!

Positive Trend: Public Companies Fixing Long Standing XBRL Issues

There is a very positive trend that is happening. Big and small public companies are correcting long standing issues in their XBRL-based financial reports related to the basic, fundamental accounting concept relations within their financial reports.

One example of this postive trend is General Mills. I will walk you through this issue, how it was fixed, and what it means.

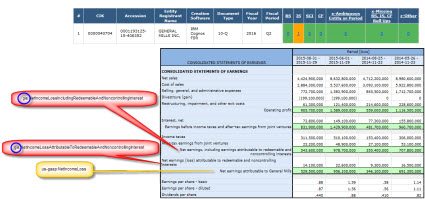

In the screen shot below (click on the image for a larger view) you can see that General Mills used two extension concepts to represent line items of their income statement for Q2 of 2016. The fundamental accounting concept relations consistency checks identifies this issue. On the top of the screen shot you can see the automated validation results with one issue on the income statement (IS) shown in orange. Note the extension concepts shown in red:

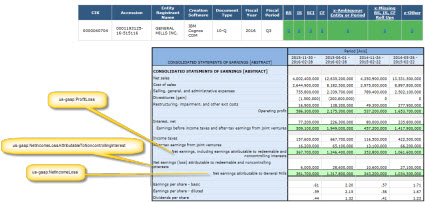

In the very next report for Q3 of 2016, General Mills switches to existing US GAAP Financial Reporting XBRL Taxonomy concepts. You can see that on the top of the screen shot, the validation messages (the ORANGE) went away and the fundamental accounting concept shows General Mills 100% consistent with all of those basic accounting relations:

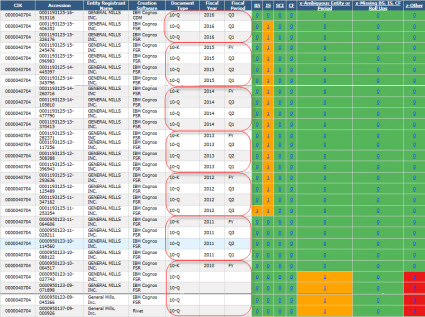

This next screen shot shows a summary of all General Mills XBRL-based financial filings to the SEC. After 18 reporting periods using inappropriate extension concepts, in the latest period (Q3 of 2016) the issue is resolved. In this analysis every General Mills report is evaluated using exactly the same set of rules. In fact, every public company that uses this reporting style uses the same rules.

Thus, General Mills is now consistent with all of the basic, fundamental accounting concept relations just as is approximately 80% of public companies.

Here is a handful of other public companies that have this same positive trend, fixing long standing inconsistencies with the basic, fundamental accounting concept relations:

- General Mills: Discontinued using two inappropriate extension concepts.

- Alaska Airlines: I emailed investor relations, pointed out the inappropriate use of the concept "us-gaap:LiabilitiesNoncurrent", and they fixed the issue. See this balance sheet comparison.

- Boeing: I emailed investor relations. Fixed one of two long standing issues where they were using an inappropriate concept in the statement of comprehensive income. The remaining issue is being worked on. It relates to a unique situation where net income from noncontrolling interest is considered immaterial for the income statement but not for the statement of changes in equity.

- Verizon: Fixed a polarity issue (reversed the value of a number) related to comprehensive income attributable to noncontrolling interest.

- Travelers Companies: Fixed inconsistency between facts reported for net income (loss) and net income available to common shareholders, basic.

- Guess

- Wings & Things

- Jones Financial Companies

- Real Industry

- Tessco Technologies

- Alexandria Real Estate Equities

- Oneok Partners

- Providence Worchester Railroad

- Franklin Resources

- Total System Services

There were more than these fixes, I am only providing supporting evidence for this very positive trend.